Pitney Bowes 2010 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

92

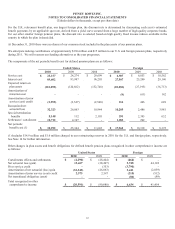

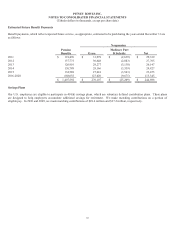

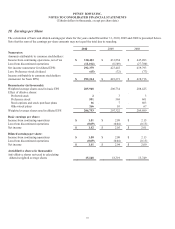

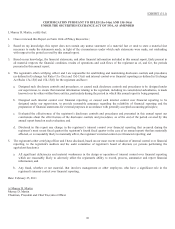

Estimated Future Benefit Payments

Benefit payments, which reflect expected future service, as appropriate, estimated to be paid during the years ended December 31 are

as follows:

Nonpension

Pension

Benefits

Gross

Medicare Part

D Subsidy Net

2011 $ 191,476 $ 31,978 $ (2,639) $ 29,339

2012 137,775 30,648 (2,883) 27,765

2013 126,910 29,277 (3,130) 26,147

2014 130,788 28,166 (3,339) 24,827

2015 132,588 27,018 (3,543) 23,475

2016-2020 688,055 123,020 (9,675) 113,345

$ 1,407,592 $ 270,107 $ (25,209) $ 244,898

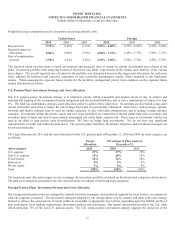

Savings Plans

Our U.S. employees are eligible to participate in 401(k) savings plans, which are voluntary defined contribution plans. These plans

are designed to help employees accumulate additional savings for retirement. We make matching contributions on a portion of

eligible pay. In 2010 and 2009, we made matching contributions of $28.6 million and $27.2 million, respectively.