Pitney Bowes 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

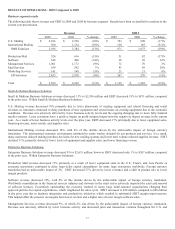

Software

Software revenue decreased 14% compared to the prior year primarily due to the impact of the global economic slowdown which

caused many businesses to delay their capital spending worldwide. Worldwide consolidation in the financial services industry and

slowness in the retail sector also adversely impacted sales and renewals of software licenses. Foreign currency translation had an

unfavorable impact of 4%.

Cost of software as a percentage of revenue was 22.5% compared with 23.9% in the prior year due to business integration initiatives

and productivity investments, which more than offset the impact of lower revenue levels.

Rentals

Rentals revenue decreased 11% compared to the prior year as customers in the U.S. continued to downsize to smaller, fully featured

machines. The weak economic conditions also impacted our international rental markets, specifically in Canada and France. Foreign

currency translation had an unfavorable impact of 1%.

Cost of rentals as a percentage of revenue was 24.5% compared with 21.1% in the prior year primarily due to the fixed costs of meter

depreciation on lower revenues.

Financing

Financing revenue decreased 10% compared to the prior year. Lower equipment sales over prior periods resulted in a decline in both

our U.S. and international lease portfolios. Foreign currency translation had an unfavorable impact of 2%.

Financing interest expense as a percentage of revenue was 14.1% compared with 14.3% in the prior year due to lower interest rates

and lower average borrowings.

Support services

Support services revenue decreased 7% compared to the prior year, principally due to lower revenues in Canada, the U.S. and the U.K.

due to lower new equipment placements and the unfavorable impact of foreign currency translation of 3%.

Cost of support services as a percentage of revenue was 65.4% compared with 69.9% in the prior year. Margin improvements in our

International Mailing, U.S. Mailing and Production Mail segments were driven by the positive impacts of ongoing productivity

investments and price increases on service contracts in Production Mail.

Business services

Business services revenue decreased 6% compared to the prior year. Lower volumes at Management Services and Marketing Services

offset the impact of an increase in mail processed at Mail Services. The unfavorable impact of foreign currency translation of 2% was

partly offset by the positive impact of acquisitions which contributed 1%.

Cost of business services as a percentage of revenue was 76.6% compared with 77.2% in the prior year. This improvement was due to

the positive impacts of cost reduction programs at our Management Services and Mail Services businesses, partly offset by lower

transaction volumes in our Management Services business.

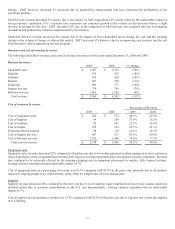

Selling, general and administrative

SG&A expense decreased $170 million or 9%, primarily as a result of our cost reduction initiatives and the positive impact of foreign

currency translation of 3%. However, the impact of lower revenue, increased pension costs of $14 million and higher credit loss

expenses of $9 million more than offset these benefits on a percentage of revenue basis. As a percentage of revenue, SG&A expenses

were 32.3% compared to 31.5% in the prior year.

Research and development

Research and development expenses decreased $23 million or 11%, from the prior year due to the transition and related benefits from

our move to offshore development activities. Foreign currency translation also had a positive impact of 3%. As a percentage of

revenue, research and development expenses were 3.3% for 2009 and 2008 as we continue to invest in developing new technologies

and enhancing our products.

Other interest expense

Other interest expense decreased $8 million or 7%, from prior year due to lower interest rates and lower average borrowings during

the year.