Pitney Bowes 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

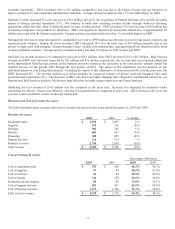

Equipment sales

Equipment sales revenue increased 2% to $1,030 million compared to the prior year. Foreign currency translation had a positive

impact of 1%. The growth was primarily driven by higher sales of production mail equipment in the U.S. and higher equipment sales

in Canada and parts of Europe. Period revenue was adversely affected by lease extensions.

Cost of equipment sales as a percentage of revenue was 46.2% compared with 45.3% in the prior year, primarily due to the higher mix

of lower margin production mail equipment sales, which more than offset the positive impacts of higher levels of lease extensions and

ongoing productivity improvements.

Supplies

Supplies revenue decreased 5% to $318 million compared to the prior year due to lower supplies usage resulting from lower mail

volumes and fewer installed meters due to customer consolidations worldwide. Foreign currency translation had less than a 1%

favorable impact.

Cost of supplies as a percentage of revenue was 30.5% compared with 27.9% in the prior year primarily due to the increasing mix of

lower margin non-compatible supplies sales worldwide.

Software

Software revenue increased 5% to $382 million compared to the prior year. The acquisition of Portrait accounted for 4% of the

increase and foreign currency translation accounted for 1% of the increase. Period revenue growth was also negatively impacted by

the shift to recurring revenue streams through multi-year licensing agreements.

Cost of software as a percentage of revenue was 22.5%, unchanged from the prior year.

Rentals

Rentals revenue decreased 7% to $601 million compared to the prior year as customers in the U.S. continue to downsize to smaller,

fully featured machines. The weak economic conditions have also impacted our international rental markets, specifically in France.

Foreign currency translation had less than a 1% positive impact.

Cost of rentals as a percentage of revenue was 23.6% compared with 24.5% in the prior year. Rental margins have been positively

impacted by lower depreciation associated with higher levels of lease extensions.

Financing

Financing revenue decreased 8% to $638 million compared to the prior year as lower equipment sales in previous years have resulted

in a net decline in both our U.S. and international lease portfolios. Foreign currency translation had a 1% positive impact.

Financing interest expense as a percentage of revenue was 13.8% compared with 14.1% in the prior year due to lower interest rates

and lower average borrowings. In computing financing interest expense, which represents the cost of borrowing associated with the

generation of financing revenues, we assume a 10:1 leveraging ratio of debt to equity and apply our overall effective interest rate to

the average outstanding finance receivables.

Support Services

Support services revenue of $712 million was flat compared to the prior year. Growth has been negatively impacted by lower

placements of mailing equipment, primarily in the U.S., U.K. and France. Foreign currency translation had a positive impact of 1%.

Cost of support services as a percentage of revenue improved to 63.5% compared with 65.4% in the prior year due to margin

improvements from our ongoing productivity investments in the U.S. and International Mailing and Production Mail businesses.

Business Services

Business services revenue decreased 3% to $1,744 million compared to the prior year primarily due to the loss of several large postal

contracts and print volumes at Management Services. Foreign currency translation had less than a 1% negative impact.

Cost of business services as a percentage of revenue was 76.7% compared with 76.6% in the prior year. Positive impacts of cost

reduction programs at our Management Services and Presort businesses were offset by higher shipping costs in International Mail

Services.