Pitney Bowes 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

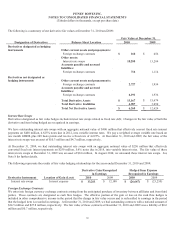

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

57

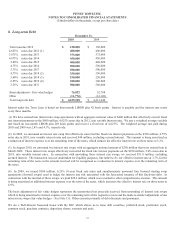

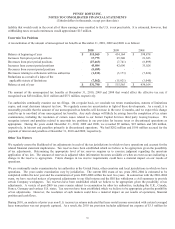

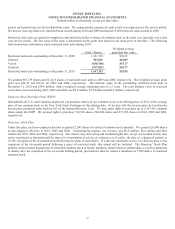

the periods 2007 through 2009. A $14.4 million adjustment was also made to opening retained earnings to establish the related tax

liabilities for earlier years. The impact of the adjustments was not material to any previously reported period.

At December 31, 2010, our current tax accounts included a $36 million tax receivable for uncertain tax positions, which was received

in February 2011.

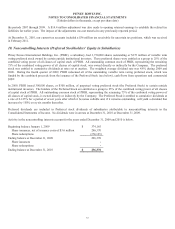

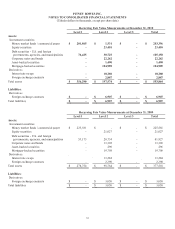

10. Noncontrolling Interests (Preferred Stockholders’ Equity in Subsidiaries)

Pitney Bowes International Holdings, Inc. (PBIH), a subsidiary, had 3,750,000 shares outstanding or $375 million of variable term

voting preferred stock owned by certain outside institutional investors. These preferred shares were entitled as a group to 25% of the

combined voting power of all classes of capital stock of PBIH. All outstanding common stock of PBIH, representing the remaining

75% of the combined voting power of all classes of capital stock, was owned directly or indirectly by the Company. The preferred

stock was entitled to cumulative dividends at rates set at auction. The weighted average dividend rate was 4.8% during 2009 and

2008. During the fourth quarter of 2009, PBIH redeemed all of the outstanding variable term voting preferred stock, which was

funded by the combined proceeds from the issuance of the Preferred Stock (see below), cash flows from operations and commercial

paper.

In 2009, PBIH issued 300,000 shares, or $300 million, of perpetual voting preferred stock (the Preferred Stock) to certain outside

institutional investors. The holders of the Preferred Stock are entitled as a group to 25% of the combined voting power of all classes

of capital stock of PBIH. All outstanding common stock of PBIH, representing the remaining 75% of the combined voting power of

all classes of capital stock, is owned directly or indirectly by the Company. The Preferred Stock is entitled to cumulative dividends at

a rate of 6.125% for a period of seven years after which it becomes callable and, if it remains outstanding, will yield a dividend that

increases by 150% every six months thereafter.

Preferred dividends are included in Preferred stock dividends of subsidiaries attributable to noncontrolling interests in the

Consolidated Statements of Income. No dividends were in arrears at December 31, 2010 or December 31, 2009.

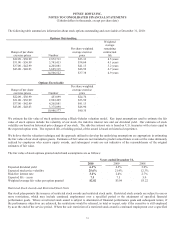

Activity in the noncontrolling interests account for the years ended December 31, 2009 and 2010 is below.

Beginning balance January 1, 2009 $ 374,165

Share issuances, net of issuance costs of $3.6 million 296,370

Share redemptions (374,165)

Ending balance at December 31, 2009 296,370

Share issuances -

Share redemptions -

Ending balance at December 31, 2010 $ 296,370