Pitney Bowes 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

46

Business Services Revenue

Business services revenue includes revenue from management services, mail services, and marketing services. Management services,

which includes outsourcing of mailrooms, copy centers, or other document management functions, are typically one to five year

contracts that contain a monthly service fee and in many cases a “click” charge based on the number of copies made, machines in use,

etc. Revenue is recognized over the term of the agreement based on monthly service charges, with the exception of the “click”

charges, which are recognized as earned. Mail services include the preparation, sortation and aggregation of mail to earn postal

discounts and expedite delivery and revenue is recognized as the services are provided. Marketing services include direct mail

marketing services, and revenue is recognized over the term of the agreement as the services are provided.

Shipping and Handling

We include costs related to shipping and handling in cost of revenues for all periods presented.

Product Warranties

We provide product warranties in conjunction with the sale of certain products, generally for a period of 90 days from the date of

installation. We estimate our liability for product warranties based on historical claims experience and other currently available

evidence. Our product warranty liability at December 31, 2010 and 2009 was not material.

Deferred Marketing Costs

We capitalize certain direct mail, telemarketing, Internet, and retail marketing costs associated with the acquisition of new customers.

These costs are amortized over the expected revenue stream ranging from five to nine years. We review individual marketing

programs for impairment on a periodic basis or as circumstances warrant. Other assets on the Consolidated Balance Sheets include

deferred marketing costs of $106.3 million and $119.5 million at December 31, 2010 and 2009, respectively. The Consolidated

Statements of Income include the related amortization expense of $38.5 million, $43.5 million and $43.1 million for the years ended

December 31, 2010, 2009 and 2008, respectively.

Restructuring Charges

Costs associated with exit or disposal activities and restructurings are recognized when the liability is incurred. The cost and related

liability for one-time benefit arrangements is recognized when the costs are probable and reasonably estimable. See Note 14 to the

Consolidated Financial Statements.

Income Taxes

We recognize deferred tax assets and liabilities for the future tax consequences attributable to differences between the financial

statement carrying amounts of existing assets and liabilities and their respective tax bases. A valuation allowance is provided when it

is more likely than not that some portion or all of a deferred tax asset will not be realized. The ultimate realization of deferred tax

assets depends on the generation of future taxable income during the period in which related temporary differences become

deductible. We consider the scheduled reversal of deferred tax liabilities, projected future taxable income and tax planning strategies

in this assessment. Deferred tax assets and liabilities are measured using the enacted tax rates expected to apply to taxable income in

the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities

of a change in tax rates is recognized in income in the period that includes the enactment date of such change.

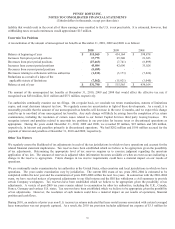

Earnings per Share

Basic earnings per share is based on the weighted average number of common shares outstanding during the year, whereas diluted

earnings per share also gives effect to all dilutive potential common shares that were outstanding during the period. Dilutive potential

common shares include preference stock, preferred stock, stock option and purchase plan shares.

Translation of Non-U.S. Currency Amounts

Assets and liabilities of subsidiaries operating outside the U.S. are translated at rates in effect at the end of the period and revenue and

expenses are translated at average monthly rates during the period. Net deferred translation gains and losses are included in

accumulated other comprehensive loss in stockholders’ deficit in the Consolidated Balance Sheets.

Derivative Instruments

In the normal course of business, we are exposed to the impact of changes in interest rates and foreign currency exchange rates. We

limit these risks by following established risk management policies and procedures, including the use of derivatives.