Pitney Bowes 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.27

completed within the next year and the examination of years 2005-2008 within the next two years. In connection with the 2001-2004

exam, we have received notices of proposed adjustments to our filed returns and the IRS has withdrawn a civil summons to provide

certain company workpapers. Tax reserves have been established which we believe to be appropriate given the possibility of tax

adjustments. A variety of post-2000 tax years remain subject to examination by other tax authorities, including the U.K., Canada,

France, Germany and various U.S. states. Tax reserves have been established which we believe to be appropriate given the possibility

of tax adjustments. However, the resolution of such matters could have a material impact on our results of operations, financial

position and cash flows. See Note 9 to the Consolidated Financial Statements.

We are currently undergoing unclaimed property audits, which are being conducted by several states.

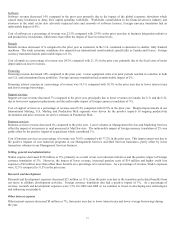

Effects of Inflation and Foreign Exchange

Inflation

Inflation, although minimal in recent years, continues to affect worldwide economies and the way companies operate. It increases

labor costs and operating expenses, and raises costs associated with replacement of fixed assets such as rental equipment. Despite

these growing costs, we have generally been able to maintain profit margins through productivity and efficiency improvements,

introduction of new products and expense reductions.

Foreign Exchange

During 2010, approximately 30% of our revenue and 35% of pre-tax income from continuing operations were derived from operations

outside of the U.S. Currency translation increased our 2010 revenue and pre-tax income from continuing operations by less than 1%.

Based on the current contribution from our international operations, a 1% increase in the value of the U.S. dollar would result in a

decline in revenue of approximately $16 million and a decline in pre-tax income from continuing operations of approximately $2

million.

Assets and liabilities of subsidiaries operating outside the U.S. are translated at rates in effect at the end of the period and revenue and

expenses are translated at average monthly rates during the period. Net deferred translation gains and losses are included in

accumulated other comprehensive loss in stockholders’ deficit in the Consolidated Balance Sheets. Changes in the value of the U.S.

dollar relative to the currencies of countries in which we operate impact our reported assets, liabilities, revenue and expenses.

Exchange rate fluctuations can also impact the settlement of intercompany receivables and payables from the transfer of finished

goods inventories between our affiliates in different countries, and intercompany loans.

To mitigate the risk of foreign currency exchange rate fluctuations, we enter into foreign exchange contracts. These derivative

contracts expose us to counterparty credit risk. To mitigate this risk, we enter into contracts with only those financial institutions that

meet stringent credit requirements as set forth in our derivative policy. We regularly review our credit exposure balances as well as

the creditworthiness of our counterparties. Maximum risk of loss on these contracts is limited to the amount of the difference between

the spot rate at the date of the contract delivery and the contracted rate. At December 31, 2010, the fair value of our outstanding

foreign exchange contracts was a net liability of $4 million.

During 2010, deferred translation losses of $16 million were recorded primarily resulting from the strengthening of the U.S. dollar as

compared to the British pound and Euro, partially offset by a weakening of the U.S. dollar as compared to the Canadian dollar. In

2009, deferred translation gains of $120 million were recorded as the U.S. dollar weakened against the British pound, Euro and

Canadian dollar. Deferred translation gains and losses are recorded as a component of accumulated other comprehensive income and

do not affect earnings.

Dividends

It is a general practice of our Board of Directors to pay a cash dividend on common stock each quarter. In setting dividend payments,

our board considers the dividend rate in relation to our recent and projected earnings and our capital investment opportunities and

requirements. We have paid a dividend each year since 1934.