Pitney Bowes 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

53

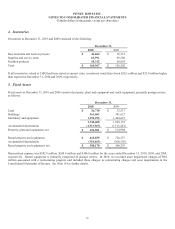

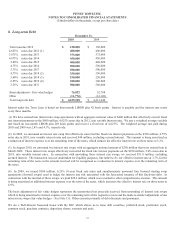

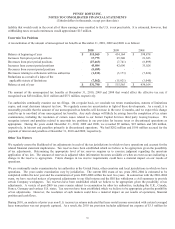

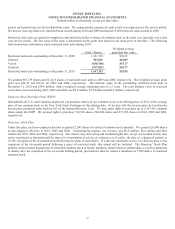

8. Long-term Debt

December 31,

2010 2009

Term loan due 2012 $ 150,000 $ 150,000

4.625% notes due 2012 (1) 400,000 400,000

3.875% notes due 2013 375,000 375,000

4.875% notes due 2014 450,000 450,000

5.00% notes due 2015 400,000 400,000

4.75% notes due 2016 500,000 500,000

5.75% notes due 2017 500,000 500,000

4.75% notes due 2018 (2) 350,000 350,000

5.60% notes due 2018 (3) 250,000 250,000

6.25% notes due 2019 (4) 300,000 300,000

5.25% notes due 2037 500,000 500,000

Basis adjustment - Fair value hedges 76,022 52,788

Other (11,774) (14,148)

Total long-term debt $ 4,239,248 $ 4,213,640

Interest under the Term Loan is based on three-month LIBOR plus 42 basis points. Interest is payable and the interest rate resets

every three months.

(1) We have entered into interest rate swap agreements with an aggregate notional value of $400 million that effectively convert fixed

rate interest payments on the $400 million, 4.625% notes due in 2012, into variable interest rates. We pay a weighted average variable

rate based on one-month LIBOR plus 249 basis points and receive a fixed rate of 4.625%. The weighted average rate paid during

2010 and 2009 was 2.8% and 4.3%, respectively.

(2) In 2008, we unwound an interest rate swap that effectively converted the fixed rate interest payments on the $350 million, 4.75%

notes due in 2018, into variable interest rates and received $44 million, excluding accrued interest. This amount is being amortized as

a reduction of interest expense over the remaining term of the notes, which reduces the effective interest rate on these notes to 3.2%.

(3) In August 2010, we unwound two interest rate swaps with an aggregate notional amount of $250 million that were entered into in

March 2008. These interest rate swaps effectively converted the fixed rate interest payments on the $250 million, 5.6% notes due in

2018, into variable interest rates. In connection with unwinding these interest rate swaps, we received $31.8 million, excluding

accrued interest. The transaction was not undertaken for liquidity purposes, but rather to fix our effective interest rate at 3.7% for the

remaining term of the notes as the amount received will be recognized as a reduction in interest expense over the remaining term of

the notes.

(4) In 2009, we issued $300 million, 6.25% 10-year fixed rate notes and simultaneously unwound four forward starting swap

agreements (forward swaps) used to hedge the interest rate risk associated with the forecasted issuance of this fixed-rate debt. In

connection with the unwind of these swaps, we paid $20.3 million, which was recorded to other comprehensive income. This amount

is being amortized as additional interest expense over the term of the notes, which increases the effective interest rate on these notes to

6.9%.

The basis adjustment of fair value hedges represents the unamortized net proceeds received from unwinding of interest rate swaps

which is being amortized to interest expense over the remaining term of the respective notes and the mark-to-market adjustment of our

interest rate swaps (fair value hedges – See Note 13). Other consists primarily of debt discounts and premiums.

We are a Well-Known Seasoned Issuer with the SEC which allows us to issue debt securities, preferred stock, preference stock,

common stock, purchase contracts, depositary shares, warrants and units.