Pitney Bowes 2010 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

Financings and Capitalization

We are a Well-Known Seasoned Issuer with the SEC, which allows us to issue debt securities, preferred stock, preference stock,

common stock, purchase contracts, depositary shares, warrants and units in an expedited fashion. We have a commercial paper

program that is a significant source of liquidity for us and a committed line of credit of $1.25 billion which supports our commercial

paper issuance. The line of credit expires in 2013. We have not experienced any problems to date in accessing the commercial paper

market. As of December 31, 2010, the line of credit had not been drawn upon.

At December 31, 2010, we had $50 million of outstanding commercial paper with a weighted average interest rate of 0.32%. During

2010, borrowings under our commercial paper program averaged $347 million at a weighted average interest rate of 0.23%. The

maximum amount of commercial paper issued at any point in time during 2010 was $552 million.

At December 31, 2009, we had $221 million of outstanding commercial paper with a weighted average interest rate of 0.09%. During

2009, borrowings under our commercial paper program averaged $430 million at a weighted average interest rate of 0.18%. The

maximum amount of commercial paper issued at any point in time during 2009 was $848 million.

In August 2010, we unwound two interest rate swaps with an aggregate notional amount of $250 million. These interest rate swaps

effectively converted the fixed rate of 5.6% on $250 million of notes, due 2018, into variable interest rates. In connection with

unwinding these interest rate swaps, we received $32 million, excluding accrued interest. The transaction was not undertaken for

liquidity purposes, but rather to fix our effective interest rate at 3.7% for the remaining term of the notes as the amount received will

be recognized as a reduction in interest expense over the remaining term of the notes.

There were no other significant changes to long-term debt during 2010. No long-term notes will mature in 2011.

We anticipate making contributions of approximately $130 million and $15 million to our U.S. and foreign pension plans, respectively

during 2011. We will reassess our funding alternatives as the year progresses.

We believe our financing needs in the short and long-term can be met from cash generated internally, the issuance of commercial

paper, debt issuance under our effective shelf registration statement and borrowing capacity under our existing credit agreements.

Contractual Obligations and Off-Balance Sheet Arrangements

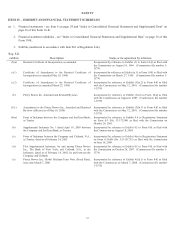

The following summarizes our known contractual obligations and off-balance sheet arrangements at December 31, 2010 and the effect

that such obligations are expected to have on our liquidity and cash flow in future periods:

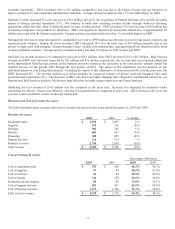

Payments due by period

(Dollars in millions)

Total Less than

1 year 1-3 years 3-5 years More than

5 years

Commercial paper borrowings $ 50 $ 50 $ - $ - $ -

Long-term debt and current portion of

long-term debt 4,175 - 925 850 2,400

Non-cancelable operating lease obligations 289 99 119 45 26

Interest payments on debt 1,681 197 374 308 802

Capital lease obligations 10 4 5 1 -

Purchase obligations (1) 276 205 56 15 -

Other non-current liabilities (2) 649 - 121 48 480

Total $ 7,130 $ 555 $ 1,600 $ 1,267 $ 3,708

(1) Purchase obligations include unrecorded agreements to purchase goods or services that are enforceable and legally binding upon

us and that specify all significant terms, including: fixed or minimum quantities to be purchased; fixed, minimum or variable

price provisions; and the approximate timing of the transaction. Purchase obligations exclude agreements that are cancelable

without penalty.

(2) Other non-current liabilities relate primarily to our postretirement benefits. See Note 19 to the Consolidated Financial

Statements.

The amount and period of future payments related to our income tax uncertainties cannot be reliably estimated and, therefore, is not

included in the above table. See Note 9 to the Consolidated Financial Statements for further details.