Pitney Bowes 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.20

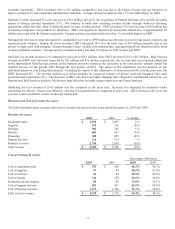

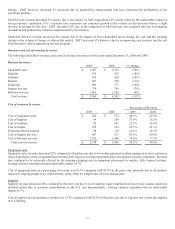

Income taxes / effective tax rate

The effective tax rate for 2009 and 2008 was 34.6% and 34.3%, respectively. The effective tax rate for 2009 included $13 million of

charges related to the write-off of deferred tax assets associated with the expiration of out-of-the-money vested stock options and the

vesting of restricted stock, offset by $13 million of tax benefits from retirement of inter-company obligations and the repricing of

leveraged lease transactions. The effective tax rate for 2008 included $12 million of tax increases related to the low tax benefit

associated with restructuring expenses recorded during 2008, offset by adjustments of $10 million related to deferred tax assets

associated with certain U.S. leasing transactions.

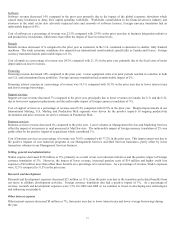

Discontinued operations

The net loss from discontinued operations was $8 million and $28 million for 2009 and 2008, respectively. The 2009 net loss from

discontinued operations included $6 million, net of tax, for a bankruptcy settlement received and $7 million, net of tax, related to the

expiration of an indemnity agreement associated with the sale of a former subsidiary. This income was more than offset by the

accrual of interest on uncertain tax positions. The 2008 net loss from discontinued operations is comprised of an accrual of tax and

interest on uncertain tax positions.

Preferred stock dividends of subsidiaries attributable to noncontrolling interests

Preferred stock dividends to stockholders of subsidiary companies were $21 million in 2009 and 2008. The 2009 amount also

included $3 million associated with the redemption of $375 million of variable term voting preferred stock during the year. The 2008

amount included $2 million associated with the redemption of $10 million of 9.11% Cumulative Preferred Stock.

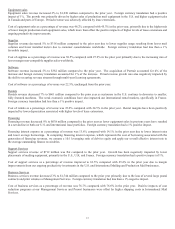

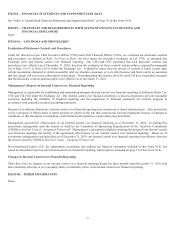

Restructuring Charges and Asset Impairments

In 2009, we announced that we were undertaking a series of initiatives designed to transform and enhance the way we operate as a

global company (the 2009 Program). In order to enhance our responsiveness to changing market conditions, we executed a strategic

transformation program designed to create improved processes and systems to further enable us to invest in future growth in areas

such as our global customer interactions and product development processes.

During 2010, we accelerated several of our initiatives to streamline processes and make our cost structure more variable to better

leverage changing business conditions. Due to the acceleration of these initiatives and pension and retiree medical related non-cash

charges of $24 million, pre-tax restructuring charges and asset impairments for the 2009 Program were $183 million in 2010.

Accordingly, we expect our cost range to be $300 million to $350 million. Additionally, we expect that total net annualized run rate

benefits from the 2009 Program to be in the range of $250 million to $300 million by 2012. This represents a $100 million increase in

our projected benefits resulting from process automation, channel alignment, reduced infrastructure costs and streamlined product

development. See Note 14 to the Consolidated Financial Statements for further discussion.

Acquisitions

On July 5, 2010, we acquired Portrait Software plc (Portrait) for $65 million in cash, net of cash acquired. Portrait provides software

to enhance existing customer relationship management systems, enabling clients to achieve improved customer retention and

profitability. The acquired goodwill was assigned to the Software segment. We also completed smaller acquisitions during 2010 for

an aggregate cost of $12 million.

There were no acquisitions during 2009.

In 2008, we acquired Zipsort, Inc. for $40 million in cash, net of cash acquired. Zipsort, Inc. acts as an intermediary between

customers and the U.S. Postal Service. Zipsort, Inc. offers mailing services that include presorting of first class, standard class, flats,

permit and international mail as well as metering services. We assigned the goodwill to the Mail Services segment. We also

completed several smaller acquisitions for an aggregate cost of $30 million.

The operating results of these acquisitions have been included in our consolidated financial statements since the date of acquisition.

See Note 1 to the Consolidated Financial Statements for our business combination accounting policy and Note 3 for further information

regarding these acquisitions.