Pitney Bowes 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

58

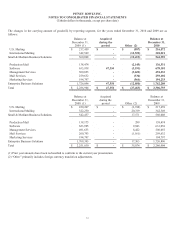

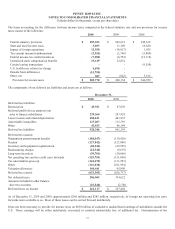

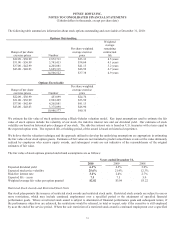

11. Stockholders’ Deficit

At December 31, 2010, 480,000,000 shares of common stock, 600,000 shares of cumulative preferred stock, and 5,000,000 shares of

preference stock were authorized. The following table summarizes the preferred, preference and common stock, net of treasury

shares, outstanding.

Common Stock

Preferred

Stock Preference

Stock Issued Treasury Outstanding

Balance, December 31, 2007 135 37,069 323,337,912 (108,822,953) 214,514,959

Repurchase of common stock - - - (9,246,535)

Issuances of common stock - - - 896,030

Conversions to common stock - (1,013) - 16,739

Balance, December 31, 2008 135 36,056 323,337,912 (117,156,719) 206,181,193

Repurchase of common stock - - - -

Issuances of common stock - - - 949,689

Conversions to common stock (50) (3,977) - 66,946

Balance, December 31, 2009 85 32,079 323,337,912 (116,140,084) 207,197,828

Repurchase of common stock - - - (4,687,304)

Issuances of common stock - - - 876,794

Conversions to common stock - (4,296) - 43,684

Balance, December 31, 2010 85 27,783 323,337,912 (119,906,910) 203,431,002

Unissued and unreserved shares

at December 31, 2010 599,915 4,972,217 116,473,634

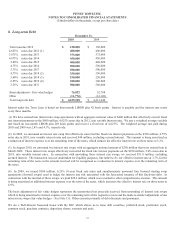

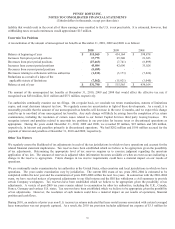

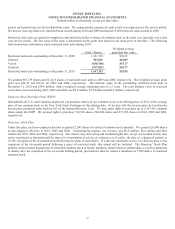

At December 31, 2010, preferred stock (4% preferred stock) outstanding was entitled to cumulative dividends at a rate of $2 per year.

The preferred stock is redeemable at our option, in whole or in part at any time, at a price of $50 per share, plus dividends accrued to

the redemption date. Each share of the 4% preferred stock can be converted into 24.24 shares of common stock, subject to adjustment

in certain events.

At December 31, 2010, preference stock ($2.12 preference stock) was entitled to cumulative dividends at a rate of $2.12 per year. The

preference stock is redeemable at our option at the rate of $28 per share. Each share of the $2.12 preference stock can be converted

into 16.53 shares of common stock, subject to adjustment in certain events.

The Board of Directors will determine the dividend rate, terms of redemption, terms of conversion (if any) and other pertinent features

of future issuances of preferred stock or preference stock.

Cash dividends paid on common stock were $1.46 per share, $1.44 per share and $1.40 per share for 2010, 2009, and 2008,

respectively.

At December 31, 2010, 2,060 shares of common stock were reserved for issuance upon conversion of the 4% preferred stock and

459,253 shares of common stock were reserved for issuance upon conversion of the $2.12 preference stock. In addition, 39,727,141

shares of common stock were reserved for issuance under our dividend reinvestment and other corporate plans.