Pitney Bowes 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

47

We use derivative instruments to manage the related cost of debt and to limit the effects of foreign exchange rate fluctuations on

financial results. Derivative instruments typically consist of forward contracts, interest rate swaps, and currency swaps depending

upon the underlying exposure. We do not use derivatives for trading or speculative purposes. We record our derivative instruments at

fair value, and the accounting for changes in the fair value of the derivatives depends on the intended use of the derivative, the

resulting designation, and the effectiveness of the instrument in offsetting the risk exposure it is designed to hedge.

To qualify as a hedge, a derivative must be highly effective in offsetting the risk designated for hedging purposes. The hedge

relationship must be formally documented at inception, detailing the particular risk management objective and strategy for the hedge.

The effectiveness of the hedge relationship is evaluated on a retrospective and prospective basis.

The use of derivative instruments exposes us to counterparty credit risk. To mitigate such risks, we enter into contracts with only

those financial institutions that meet stringent credit requirements as set forth in our derivative policy. We regularly review our credit

exposure balances as well as the creditworthiness of our counterparties. See Note 13 for additional disclosures on derivative

instruments.

New Accounting Pronouncements

In 2010, we adopted guidance that increases disclosures regarding the credit quality of an entity’s financing receivables and its

allowance for credit losses. The guidance also requires an entity to disclose credit quality indicators, past due information, and

modifications of its financing receivables. The adoption of this guidance resulted in additional disclosures (see Note 17) but did not

have an impact on our consolidated financial statements.

In September 2009, new guidance was introduced addressing the accounting for revenue arrangements with multiple elements and

certain revenue arrangements that include software. The guidance allows companies to allocate consideration in a multiple element

arrangement in a way that better reflects the economics of the transaction and eliminates the residual method. In addition, tangible

products that have software components that are “essential to the functionality” of the tangible product will be scoped out of the

software revenue guidance. The new guidance will also result in more expansive disclosures. The new guidance became effective on

January 1, 2011 and is not expected to have a material impact on our financial position, results of operations or cash flows.

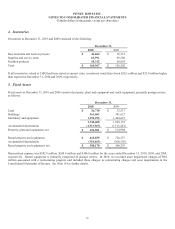

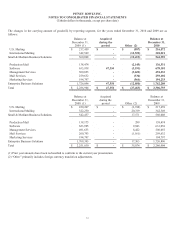

2. Discontinued Operations

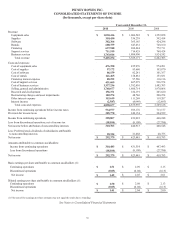

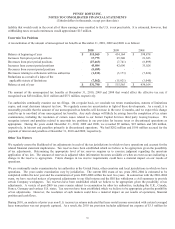

The following table shows selected financial information included in discontinued operations for the years ended December 31, 2010,

2009 and 2008:

2010 2009 2008

Pre-tax income $ 754 $ 20,624 $ -

Tax provision (18,858) (28,733) (27,700)

Loss from discontinued operations, net of tax $ (18,104) $ (8,109) $ (27,700)

The net loss in 2010 primarily relates to the accrual of interest on uncertain tax positions and additional tax associated with the

discontinued operations. The net loss in 2009 includes $9.8 million of pre-tax income ($6.0 million net of tax) for a bankruptcy

settlement and $10.9 million of pre-tax income ($6.7 million net of tax) related to the expiration of an indemnity agreement associated

with the sale of a former subsidiary. This income was more than offset by the accrual of interest on uncertain tax positions. The net

loss in 2008 includes an accrual of tax and interest on uncertain tax positions.