Pitney Bowes 2010 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

Our expected return on plan assets is determined based on historical portfolio results, the plan’s asset mix and future expectations of

market rates of return on the types of assets in the plan.

Sensitivity to changes in assumptions:

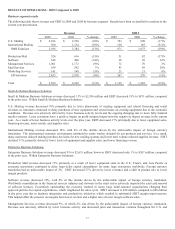

U.S. Pension Plan

• Discount rate – a 0.25% increase in the discount rate would decrease annual pension expense by approximately $3.0 million

and would lower the projected benefit obligation by $43.5 million.

• Rate of compensation increase – a 0.25% increase in the rate of compensation increase would increase annual pension

expense by approximately $0.1 million.

• Expected return on plan assets – a 0.25% increase in the expected return on assets of our principal plans would decrease

annual pension expense by approximately $3.7 million.

U.K. Pension Plan

• Discount rate – a 0.25% increase in the discount rate would decrease annual pension expense by approximately $1.4 million

and would lower the projected benefit obligation by $16.0 million.

• Rate of compensation increase – a 0.25% increase in the rate of compensation increase would increase annual pension

expense by approximately $0.5 million.

• Expected return on plan assets – a 0.25% increase in the expected return on assets of our principal plans would decrease

annual pension expense by approximately $0.8 million.

Delayed recognition principles

Actual pension plan results that differ from our assumptions and estimates are accumulated and amortized over the estimated future

working life of the plan participants and will therefore affect future pension expense. We also base our net pension expense primarily

on a market related valuation of plan assets. Under this approach, differences between the actual and expected return on plan assets

are recognized over a five-year period and will also impact future pension expense.

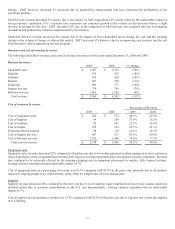

Investment related risks and uncertainties

We invest our pension plan assets in a variety of investment securities in accordance with our strategic asset allocation policy. The

composition of our U.S. pension plan assets at December 31, 2010 was approximately 57% equity securities, 34% fixed income

securities and 9% real estate and private equity investments. The composition of our U.K. pension plan assets at December 31, 2010

was approximately 68% equity securities, 29% fixed income securities and 3% cash. Investment securities are exposed to various

risks such as interest rate, market and credit risks. In particular, due to the level of risk associated with investment securities, it is

reasonably possible that change in the value of such investment securities will occur and that such changes could materially affect our

future results.

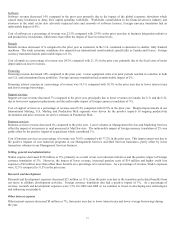

New Accounting Pronouncements

In 2010, we adopted guidance that increases disclosures regarding the credit quality of an entity’s financing receivables and its

allowance for credit losses. The guidance also requires an entity to disclose credit quality indicators, past due information, and

modifications of its financing receivables. The adoption of this guidance resulted in additional disclosures but did not have an impact

on our consolidated financial statements. See Note 17 to the Consolidated Financial Statements.

In September 2009, new guidance was introduced addressing the accounting for revenue arrangements with multiple elements and

certain revenue arrangements that include software. The guidance allows companies to allocate consideration in a multiple element

arrangement in a way that better reflects the economics of the transaction and eliminates the residual method. In addition, tangible

products that have software components that are “essential to the functionality” of the tangible product will be scoped out of the

software revenue guidance. The new guidance will also result in more expansive disclosures. The new guidance became effective on

January 1, 2011 and is not expected to have a material impact on our financial position, results of operations or cash flows.

Legal and Regulatory Matters

Legal

See Legal Proceedings in Item 3 of this Form 10-K for information regarding our legal proceedings.

Other regulatory matters

We are continually under examination by tax authorities in the United States, other countries and local jurisdictions in which we have

operations. The years under examination vary by jurisdiction. The current IRS exam of tax years 2001-2004 is estimated to be