Pitney Bowes 2010 Annual Report Download - page 107

Download and view the complete annual report

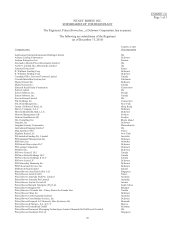

Please find page 107 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

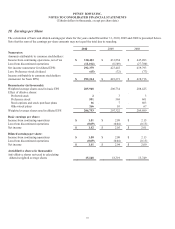

(Tabular dollars in thousands, except per share data)

88

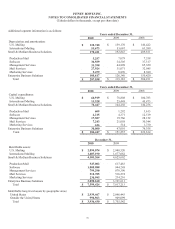

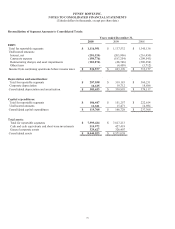

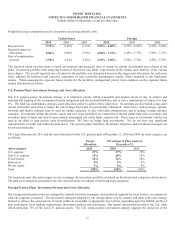

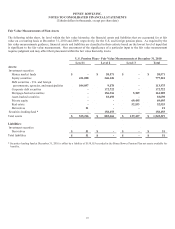

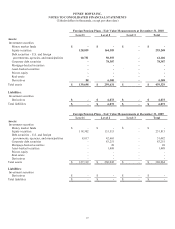

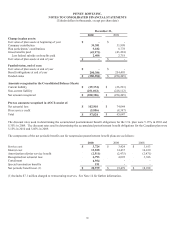

The following information relates to our classification of investments into the fair value hierarchy:

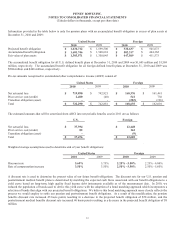

• Money Market Funds: Money market funds typically invest in government securities, certificates of deposit, commercial paper of

companies and other highly liquid and low-risk securities. Money market funds are principally used for overnight deposits. The

money market funds are classified as Level 2 since they are not actively traded on an exchange.

• Equity Securities: Equity securities include U.S. and foreign common stock, American Depository Receipts, preferred stock and

commingled funds. Equity securities classified as Level 1 are valued using active, high volume trades for identical securities.

Equity securities classified as Level 2 represent those not listed on an exchange in an active market. These securities are valued

based on quoted market prices of similar securities.

• Debt Securities - U.S. and Foreign Governments and its Agencies and Municipalities: Government securities include treasury

notes and bonds, foreign government issues, U.S. government sponsored agency debt and commingled funds. Municipal debt

securities include general obligation securities and revenue-backed securities. Debt securities classified as Level 1 are valued

using active, high volume trades for identical securities. Debt securities classified as Level 2 are valued through benchmarking

model derived prices to quoted market prices and trade data for identical or comparable securities.

• Corporate Debt Securities: Investments are comprised of both investment grade debt (≥BBB-) and high-yield debt (≤BBB-). The

fair value of corporate debt securities is valued using recently executed transactions, market price quotations where observable, or

bond spreads. The spread data used are for the same maturity as the security. These securities are classified as Level 2.

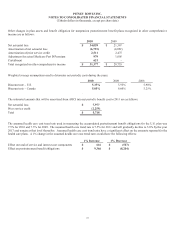

• Mortgage-Backed Securities (MBS): Investments are comprised of agency-backed MBS, non-agency MBS, collateralized

mortgage obligations, commercial MBS, and commingled funds. These securities are valued based on external pricing indices.

When external index pricing is not observable, MBS are valued based on external price/spread data. If neither pricing method is

available, broker quotes are utilized. When inputs are observable and supported by an active market, MBS are classified as Level

2 and when inputs are unobservable, MBS are classified as Level 3.

• Asset-Backed Securities (ABS): Investments are primarily comprised of credit card receivables, auto loan receivables, student

loan receivables, and Small Business Administration loans. These securities are valued based on external pricing indices or

external price/spread data and are classified as Level 2.

• Private Equity: Investments are comprised of units in fund-of-fund investment vehicles. Fund-of-funds consist of various private

equity investments and are used in an effort to gain greater diversification. The investments are valued in accordance with the

most appropriate valuation techniques, and are classified as Level 3 due to the unobservable inputs used to determine a fair value.

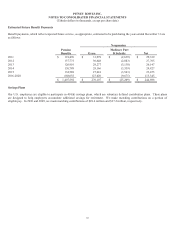

• Real Estate: Investments include units in open-ended commingled real estate funds. Properties that comprise these funds are

valued in accordance with the most appropriate valuation techniques, and are classified as Level 3 due to the unobservable inputs

used to determine a fair value.

• Derivatives: Instruments are comprised of futures, forwards, options and warrants and are used to gain exposure to a desired

investment as well as for defensive hedging purposes against currency and interest rate fluctuations. Derivative instruments

classified as Level 1 are valued through a readily available exchange listed price. Derivative instruments classified as Level 2 are

valued using observable inputs but are not listed or traded on an exchange.

• Securities Lending Fund: Investment represents a commingled fund through our custodian’s securities lending program. The U.S.

pension plan lends securities that are held within the plan to other banks and/or brokers, for which we receive collateral. This

collateral is invested in the commingled fund, which invests in short-term fixed income securities such as commercial paper,

short-term ABS and other short-term issues. Since the commingled fund is not listed or traded on an exchange, the investment is

classified as Level 2. The investment is offset by a liability of an equal amount representing assets that participate in securities

lending program, which is reflected in the Pitney Bowes Pension Plan’s net assets available for benefits.