Pitney Bowes 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

76

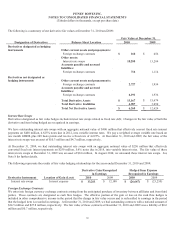

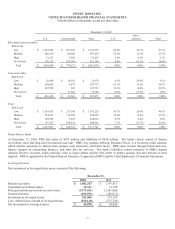

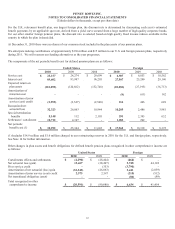

The following is a summary of the components of income from leveraged leases:

December 31,

2010 2009 2008

Pre-tax leveraged lease income $ 8,334 $ 918 $ 316

Income tax effect (863) 6,676 7,063

Income from leveraged leases $ 7,471 $ 7,594 $ 7,379

Income from leveraged leases was positively impacted by $2.2 million, $2.8 million and $2.6 million in 2010, 2009 and 2008,

respectively, due to changes in statutory tax rates.

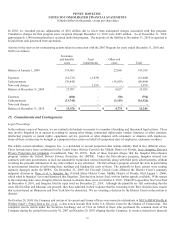

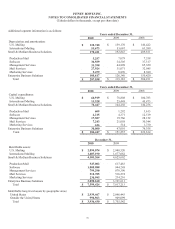

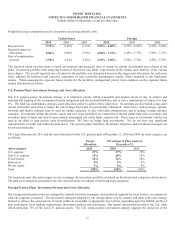

18. Business Segment Information

We conduct our business activities in seven reporting segments within two business groups, Small & Medium Business Solutions and

Enterprise Business Solutions. The principal products and services of each of our reporting segments are as follows:

Small & Medium Business Solutions:

U.S. Mailing: Includes the U.S. revenue and related expenses from the sale, rental and financing of our mail finishing, mail

creation, shipping equipment and software; supplies; support and other professional services; and payment solutions.

International Mailing: Includes the non-U.S. revenue and related expenses from the sale, rental and financing of our mail

finishing, mail creation, shipping equipment and software; supplies; support and other professional services; and payment

solutions.

Enterprise Business Solutions:

Production Mail: Includes the worldwide revenue and related expenses from the sale, support and other professional services

of our high-speed, production mail systems, sorting and production print equipment.

Software: Includes the worldwide revenue and related expenses from the sale and support services of non-equipment-based

mailing, customer relationship and communication and location intelligence software.

Management Services: Includes worldwide revenue and related expenses from facilities management services; secure mail

services; reprographic, document management services; and litigation support and eDiscovery services.

Mail Services: Includes worldwide revenue and related expenses from presort mail services and cross-border mail services.

Marketing Services: Includes revenue and related expenses from direct marketing services for targeted customers.

The accounting policies of the segments are the same as those described in the summary of significant accounting policies.

Earnings before interest and taxes (EBIT), a non-GAAP measure, is useful to management in demonstrating the operational

profitability of the segments by excluding interest and taxes, which are generally managed across the entire company on a

consolidated basis. EBIT is determined by deducting from revenue the related costs and expenses attributable to the segment.

Segment EBIT also excludes general corporate expenses, restructuring charges and asset impairments. Identifiable assets are those

used in our operations and exclude cash and cash equivalents, short-term investments and general corporate assets. Long-lived assets

exclude finance receivables and investment in leveraged leases.