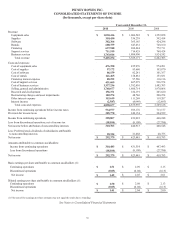

Pitney Bowes 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

42

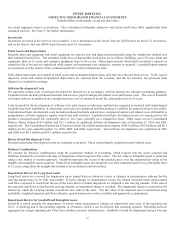

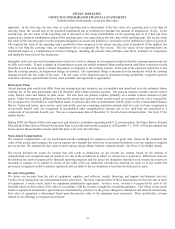

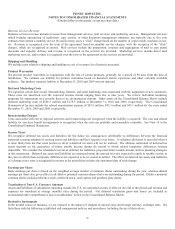

1. Description of Business and Summary of Significant Accounting Policies

Description of Business

We are a provider of mail processing equipment and integrated mail solutions to organizations of all sizes. We offer a full suite of

equipment, supplies, software, services and solutions for managing and integrating physical and digital communication channels. We

conduct our business activities in seven reporting segments within two business groups: Small & Medium Business Solutions and

Enterprise Business Solutions. See Note 18 for information regarding our reportable segments.

Basis of Presentation and Consolidation

The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United

States of America (GAAP). Operating results of acquired companies are included in the consolidated financial statements from the

date of acquisition. Intercompany transactions and balances have been eliminated.

Reclassification

Certain prior year amounts have been reclassified to conform to the current year presentation.

Use of Estimates

The preparation of the consolidated financial statements in conformity with GAAP requires us to make estimates and assumptions that

affect the amounts of assets, liabilities, revenues and expenses that are reported in the consolidated financial statements and

accompanying disclosures, including the disclosure of contingent assets and liabilities. These estimates are based on our best

knowledge of current events, historical experience, actions that we may undertake in the future, and on various other assumptions that

are believed to be reasonable under the circumstances. These estimates include, but are not limited to, allowance for doubtful

accounts and credit losses, inventory obsolescence, residual values of leased assets, useful lives of long-lived assets and intangible

assets, impairment of goodwill, allocation of purchase price to tangible and intangible assets acquired in business combinations,

warranty obligations, restructuring costs, pensions and other postretirement benefits and loss contingencies. As a result, actual results

could differ from those estimates and assumptions.

Cash Equivalents and Investments

Cash equivalents include short-term, highly liquid investments with maturities of three months or less at the date of purchase. Short-

term investments include highly liquid investments with maturities greater than three months but less than one year from the reporting

date. Investments with maturities greater than one year from the reporting date are recorded as Other assets. Our investments are

predominantly classified as available-for-sale.

Accounts Receivable and Allowance for Doubtful Accounts

We estimate our accounts receivable risks and provide allowances for doubtful accounts accordingly. We believe that our credit risk

for accounts receivable is limited because of our large number of customers, small account balances for most of our customers and

customer geographic and industry diversification. We evaluate the adequacy of the allowance for doubtful accounts based on our

historical loss experience, length of time receivables are past due, adverse situations that may affect a customer’s ability to pay and

prevailing economic conditions, and make adjustments to our actual aggregate reserve as necessary. This evaluation is inherently

subjective and actual results may differ significantly from estimated reserves.

Finance Receivables and Allowance for Credit Losses

Finance receivables are predominantly from the sales of products and are composed of sales-type lease receivables and unsecured

revolving loan receivables. We estimate our finance receivables risks and provide allowances for credit losses accordingly. We

establish credit approval limits based on the credit quality of the customer and the type of equipment financed. Finance receivables

are written-off against the allowance for credit losses after collection efforts are exhausted and we deem the account uncollectible.

We believe that our concentration of credit risk for finance receivables is limited because of our large number of customers, small

account balances and customer geographic and industry diversification.

Our general policy is to discontinue revenue recognition for lease receivables that are delinquent more than 120 days, and to

discontinue revenue recognition on unsecured loan receivables that are delinquent for more than 90 days. We resume revenue

recognition when customer payments reduce the account balance aging to 60 days or less past due.

We evaluate the adequacy of the allowance for credit losses based on our historical loss experience, the nature and volume of the

portfolios, adverse situations that may affect a customer’s ability to pay and prevailing economic conditions, and make adjustments to