Pitney Bowes 2010 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

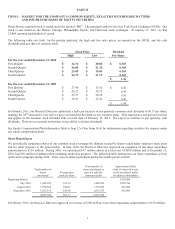

PART II

ITEM 5. – MARKET FOR THE COMPANY’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS

AND ISSUER PURCHASES OF EQUITY SECURITIES

Pitney Bowes common stock is traded under the symbol “PBI”. The principal market is the New York Stock Exchange (NYSE). Our

stock is also traded on the Boston, Chicago, Philadelphia, Pacific and Cincinnati stock exchanges. At January 31, 2011, we had

21,844 common stockholders of record.

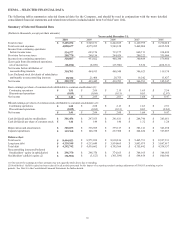

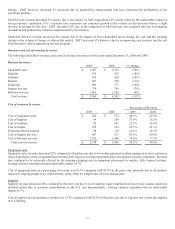

The following table sets forth, for the periods indicated, the high and low sales prices, as reported on the NYSE, and the cash

dividends paid per share of common stock.

Stock Price Dividend

High Low Per Share

For the year ended December 31, 2010

First Quarter $ 24.76 $20.80 $0.365

Second Quarter $ 26.00 $21.28 0.365

Third Quarter $ 25.00 $19.06 0.365

Fourth Quarter $ 24.79 $21.19 0.365

$1.46

For the year ended December 31, 2009

First Quarter $ 27.46 $ 17.62 $0.36

Second Quarter $ 26.25 $ 20.71 0.36

Third Quarter $ 25.57 $ 20.38 0.36

Fourth Quarter $ 26.41 $ 22.44 0.36

$ 1.44

In February 2011, our Board of Directors authorized a half-cent increase in our quarterly common stock dividend to $0.37 per share,

marking the 29th consecutive year that we have increased the dividend on our common stock. This represents a one percent increase

and applies to the common stock dividend with a record date of February 18, 2011. We expect to continue to pay quarterly cash

dividends. There are no material restrictions on our ability to declare dividends.

See Equity Compensation Plan Information Table in Item 12 of this Form 10-K for information regarding securities for issuance under

our equity compensation plans.

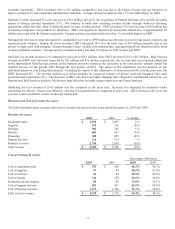

Share Repurchases

We periodically repurchase shares of our common stock to manage the dilution created by shares issued under employee stock plans

and for other purposes in the open market. In May 2010, the Board of Directors approved an expansion of our share repurchase

authorization to $150 million. During 2010, we repurchased 4.7 million shares at a total cost of $100 million and at December 31,

2010, had $50 million of authorization remaining under this program. The following table summarizes our share repurchase activity

under active programs during 2010. There were no share repurchases during the fourth quarter of 2010.

Total number of

shares

purchased

Average price

paid per share

Total number of

shares purchased as

part of a publicly

announced plan

Approximate dollar

value of shares that may

yet be purchased under

the plan (in thousands)

Beginning balance $150,000

July 2010 1,248,943 $23.39 1,248,943 $120,786

August 2010 1,770,826 $20.21 1,770,826 $85,000

September 2010 1,667,535 $20.99 1,667,535 $50,000

4,687,304 $21.33 4,687,304

In February 2011, our Board of Directors approved an increase of $100 million in our share repurchase authorization to $150 million.