Pitney Bowes 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

71

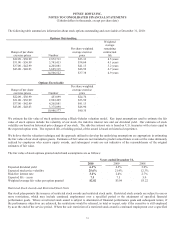

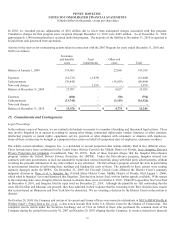

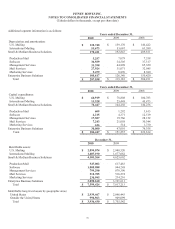

17. Finance Assets

Finance Receivables

Finance receivables are comprised of sales-type lease receivables and unsecured revolving loan receivables. Sales-type leases are

generally due in monthly, quarterly or semi-annual installments over periods ranging from three to five years. Loan receivables arise

primarily from financing services offered to our customers for postage and related supplies. Loan receivables are generally due each

month; however, customers may rollover outstanding balances. The components of sales-type lease and loan receivables at December

31, 2010 and 2009 were as follows:

U.S. International Total

December 31, 2010

Sales-type lease receivables

Gross finance receivables $ 1,669,963 $ 745,765 $ 2,415,728

Unguaranteed residual values 217,394 38,331 255,725

Unearned income (357,970) (165,513) (523,483)

Allowance for credit losses (24,261) (16,849) (41,110)

Net investment in sales-type lease receivables 1,505,126 601,734 2,106,860

Loan receivables

Loan receivables 432,137 55,418 487,555

Allowance for credit losses (25,552) (2,768) (28,320)

Net investment in loan receivables 406,585 52,650 459,235

Net investment in finance receivables $ 1,911,711 $ 654,384 $ 2,566,095

December 31, 2009

Sales-type lease receivables

Gross finance receivables $ 1,836,899 $ 774,971 $ 2,611,870

Unguaranteed residual values 245,086 37,122 282,208

Unearned income (423,290) (178,141) (601,431)

Allowance for credit losses (26,629) (17,453) (44,082)

Net investment in sales-type lease receivables 1,632,066 616,499 2,248,565

Loan receivables

Loan receivables 456,308 49,563 505,871

Allowance for credit losses (25,889) (2,187) (28,076)

Net investment in loan receivables 430,419 47,376 477,795

Net investment in finance receivables $ 2,062,485 $ 663,875 $ 2,726,360