Pitney Bowes 2010 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

85

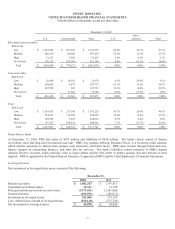

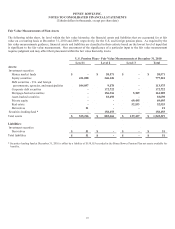

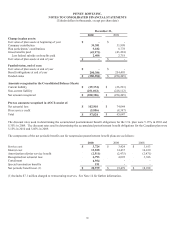

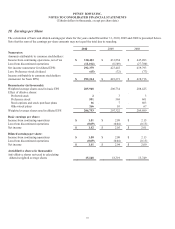

Fair Value Measurements of Plan Assets

The following tables show, by level within the fair value hierarchy, the financial assets and liabilities that are accounted for at fair

value on a recurring basis at December 31, 2010 and 2009, respectively, for the U.S. and foreign pension plans. As required by the

fair value measurements guidance, financial assets and liabilities are classified in their entirety based on the lowest level of input that

is significant to the fair value measurement. Our assessment of the significance of a particular input to the fair value measurement

requires judgment and may affect their placement within the fair value hierarchy levels.

U.S. Pension Plans - Fair Value Measurements at December 31, 2010

Level 1 Level 2 Level 3 Total

Assets:

Investment securities

Money market funds $- $ 20,571 $ - $ 20,571

Equity securities 431,098 346,126 - 777,224

Debt securities - U.S. and foreign

governments, agencies, and municipalities 104,097 9,878 - 113,975

Corporate debt securities - 172,722 - 172,722

Mortgage-backed securities - 156,516 5,389 161,905

Asset-backed securities - 18,698 - 18,698

Private equity - - 69,495 69,495

Real estate - - 52,553 52,553

Derivatives 21 - - 21

Securities lending fund * - 158,155 - 158,155

Total assets $ 535,216 $ 882,666 $ 127,437 $ 1,545,319

Liabilities:

Investment securities

Derivatives $ 51 $ - $ - $ 51

Total liabilities $ 51 $ - $ - $ 51

* Securities lending fund at December 31, 2010 is offset by a liability of $158,155 recorded in the Pitney Bowes Pension Plan net assets available for

benefits.