Pitney Bowes 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

Europe. EBIT however, increased 3% primarily due to productivity enhancements that have improved the profitability of the

operations globally.

Mail Services revenue increased 3% mostly due to the impact of 2008 acquisitions (4%) partly offset by the unfavorable impact of

foreign currency translation (1%). Customer base expansion and continued growth in the volume of mail processed drove a slight

increase in revenue for the year. EBIT increased 20% due to the integration of Mail Services sites acquired last year and ongoing

automation and productivity initiatives implemented by the business.

Marketing Services revenue decreased 5%, mostly due to the impact of fewer household moves during the year and the resulting

decline in the volume of change of address kits mailed. EBIT increased 8% however, due to an improving cost structure and the exit

from the motor vehicle registration services program.

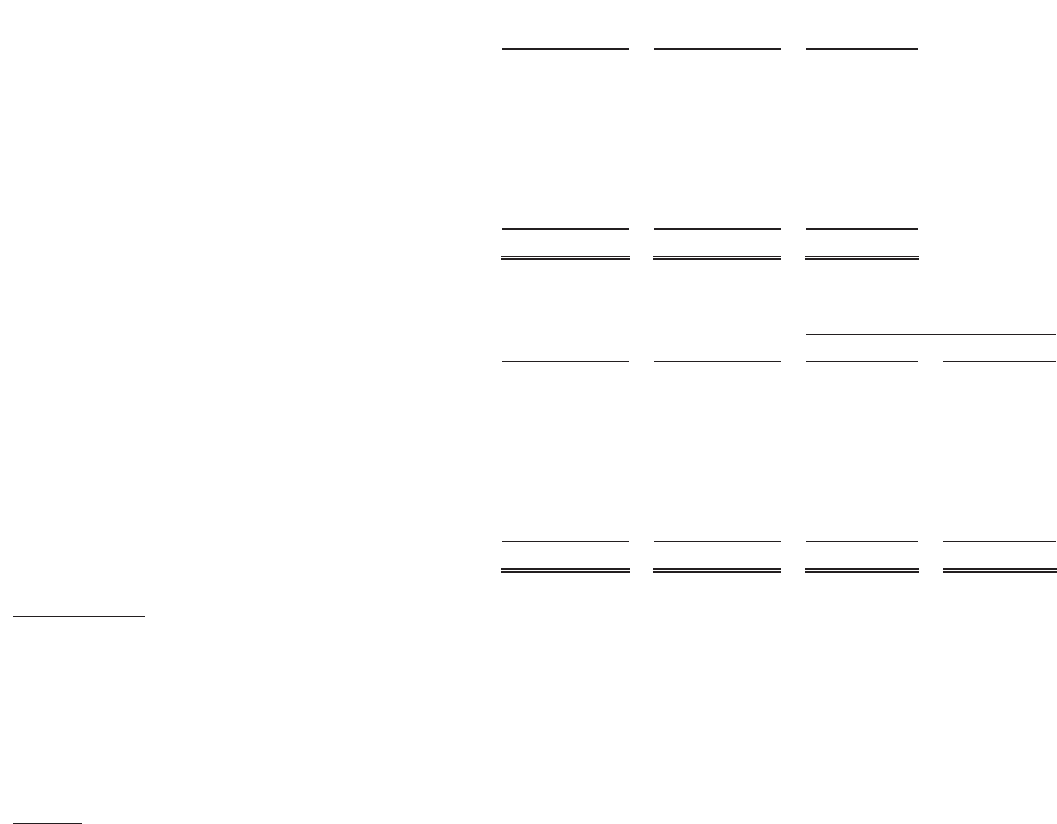

Revenues and cost of revenues by source

The following tables show revenues and costs of revenues by source for the years ended December 31, 2009 and 2008:

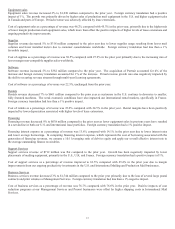

Revenue by source

2009 2008 % change

Equipment sales $ 1,007 $ 1,252 (20)%

Supplies 336 392 (14)%

Software 365 424 (14)%

Rentals 647 728 (11)%

Financing 695 773 (10)%

Support services 714 769 (7)%

Business services 1,805 1,924 (6)%

Total revenue $ 5,569 $ 6,262 (11)%

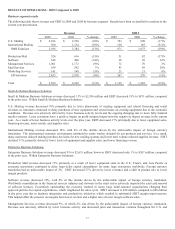

Cost of revenues by source

Percentage of Revenue

2009 2008 2009 2008

Cost of equipment sales $456 $ 574 45.3% 45.9%

Cost of supplies 94 104 27.9% 26.5%

Cost of software 82 101 22.5% 23.9%

Cost of rentals 159 154 24.5% 21.1%

Financing interest expense 98 110 14.1% 14.3%

Cost of support services 467 537 65.4% 69.9%

Cost of business services 1,382 1,486 76.6% 77.2%

Total cost of revenues $2,738 $ 3,066 49.2% 49.0%

Equipment sales

Equipment sales revenue decreased 20% compared to the prior year due to lower placements of mailing equipment as more customers

delayed purchases of new equipment and extended their leases on existing equipment due to the global economic conditions. Revenue

also continued to be adversely affected by the ongoing changing mix in equipment placements to smaller, fully featured systems.

Foreign currency translation had an unfavorable impact of 3%.

Cost of equipment sales as a percentage of revenue was 45.3% compared with 45.9% in the prior year, primarily due to the positive

impacts of ongoing productivity improvements, partly offset by a higher mix of lower margin sales.

Supplies

Supplies revenue decreased 14% compared to the prior year due to lower supplies usage resulting from lower mail volumes and fewer

installed meters due to customer consolidations in the U.S. and internationally. Foreign currency translation had an unfavorable

impact of 3%.

Cost of supplies as a percentage of revenue was 27.9% compared with 26.5% in the prior year due to a greater mix of non-ink supplies

in U.S Mailing.