Nokia 2005 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

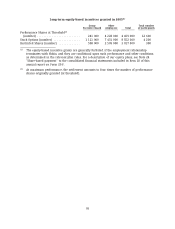

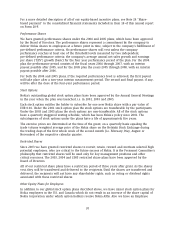

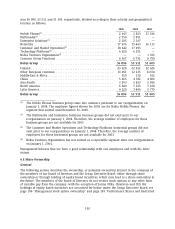

Summary Compensation Table 2005

The annual compensation of our five most highly paid executive officers for 2005 is detailed in the following table. The sums include

cash incentive payments awarded for the fiscal year 2005 although they will be partially paid in 2006.

Cash Compensation Long-term Equity-based Incentives Granted(1)

Cash Other Performance Performance

Base Incentive Annual All Other Shares at Shares at Fair Value Stock Fair Value Restricted Fair Value

Name and Principal Position in 2005 Year salary payments(2) Compensation Compensation Threshold(3) Maximum(3) at grant(4) Options at grant(5) Shares at grant(5)

EUR EUR EUR EUR number number EUR number EUR number EUR

Jorma Ollila 2005 1 500 000 3 212 037 * 165 000(6) 100 000 400 000 2 370 000 400 000 982 675 100 000 1 205 000

Chairman and CEO 2004 1 475 238 1 936 221 * 150 000 100 000 400 000 2 116 000 400 000 1 035 775 100 000 1 570 000

2003 1 400 000 2 253 192 * 150 000 — — — 800 000 2 773 442 — —

Pekka Ala-Pietil¨

a(7) 2005 717 000 946 332 * — 15 000 60 000 355 500 60 000 147 401 35 000 421 750

Until October 1, 2005, President of Nokia 2004 717 000 479 509 * — 20 000 80 000 423 200 80 000 207 155 35 000 549 500

Corporation and Head of Customer and 2003 711 279 520 143 * — — — — 170 000 589 356 — —

Market Operations

Olli-Pekka Kallasvuo 2005 623 524 947 742 * — 15 000 60 000 355 500 160 000 407 197 70 000 932 050

As of October 1, 2005, President and COO 2004 584 000 454 150 * — 15 000 60 000 317 400 60 000 155 366 35 000 549 500

Until September 30, 2005, EVP and General 2003 575 083 505 724 * — — — — 120 000 416 016 — —

Manager of Mobile Phones

Anssi Vanjoki 2005 476 000 718 896 * — 15 000 60 000 355 500 60 000 147 401 35 000 421 750

EVP and General Manager of Multimedia

Richard Simonson 2005 461 526 634 516 * 358 786(8) 15 000 60 000 355 500 60 000 147 401 35 000 421 750

EVP, Chief Financial Officer

(1) The equity-based incentive grants are generally forfeited, if the employment relationship terminates with Nokia, and they are conditional upon such performance and other conditions, as

determined in the relevant plan rules. For a description of our equity plans, see Note 24 ‘‘Share-based payment’’ to the consolidated financial statements included in Item 18 of this

annual report on Form 20-F.

(2) Cash incentive payments are based on the performance of Nokia and the individual for the fiscal year 2005, and were paid under Nokia’s short-term incentive plan.

(3) For the performance share plans 2004 and 2005, the number of performance shares at threshold represents the number of performance shares granted. This number shall vest as shares,

should the pre-determined threshold performance levels of the company be met. The maximum number of performance shares shall vest as shares, should the predetermined maximum

performance levels be met. The maximum number of performance shares equals four times the number originally granted.

(4) The fair value of performance shares equals the estimated fair value on the grant date. The estimated fair value is based on the grant date market price of the company’s share less

expected dividends. The value is presented for the target number of shares which is two times the number at threshold. The target number is used for expensing the instruments in the

company’s accounting.

(5) The fair values of stock options and restricted shares equal the estimated fair value on the grant date. For stock options it is calculated using the Black Scholes model. For restricted

shares it is based on the grant date market price of the company’s share less expected dividends.

(6) The amount includes EUR 165 000 for his services as Chairman of the Board, of which EUR 99 005 was paid in cash and the balance paid in 5 011 Nokia shares.

(7) Pekka Ala-Pietil¨

a served as the President of the company and member of the Group Executive Board until he resigned from these positions effective October 1, 2005. As of this date

Mr. Ala-Pietil¨

a held the role of Executive Advisor until January 31, 2006, when he ceased employment with us. For 2006, based on these advisory services, Mr. Ala-Pietil¨

a received a total

payment of EUR 101 717. Based on the service contract, Mr. Ala-Pietil¨

a is entitled to receive a payment of EUR 956 000 in 2006 for his commitments during 2006.

(8) The amount includes EUR 9 646 company contribution to 401(k), EUR 4 816 company contribution to Restoration and Deferral Plan and EUR 344 324 provided as benefits under Nokia

relocation policy.

*Each executive listed received benefits and perquisites in 2005 not exceeding the lesser of EUR 50 000 or 10% of the executives total compensation.