Nokia 2005 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

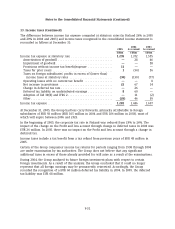

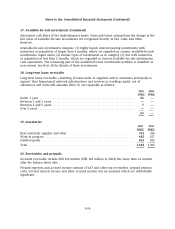

22. Fair value and other reserves (Continued)

In order to ensure that amounts deferred in the cash flow hedging reserve represent only the

effective portion of gains and losses on properly designated hedges of future transactions that

remain highly probable at the balance sheet date, Nokia has adopted a process under which all

derivative gains and losses are initially recognized in the profit and loss account. The appropriate

reserve balance is calculated at the end of each period and posted to the Hedging Reserve.

The Group continuously reviews the underlying cash flows and the hedges allocated thereto, to

ensure that the amounts transferred to the Hedging Reserve during the year ended December 31,

2005 and 2004 do not include gains/losses on forward exchange contracts that have been

designated to hedge forecasted sales or purchases that are no longer expected to occur. Because of

the number of transactions undertaken during each period and the process used to calculate the

reserve balance, separate disclosure of the transfers of gains and losses to and from the reserve

would be impractical.

All of the net fair value gains or losses recorded in the Fair value and other reserve at

December 31, 2005 on open forward foreign exchange contracts which hedge anticipated future

foreign currency sales or purchases are transferred from the Hedging Reserve to the profit and

loss account when the forecasted foreign currency cash flows occur, at various dates up to 1 year

from the balance sheet date.

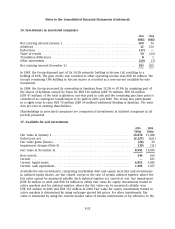

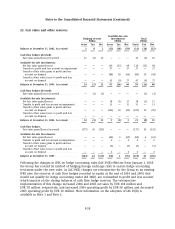

23. The shares of the Parent Company

Nokia shares and shareholders

Shares and share capital

Nokia has one class of shares. Each Nokia share entitles the holder to one (1) vote at General

Meetings of Nokia. The par value of the share is EUR 0.06.

The minimum share capital stipulated in the Articles of Association is EUR 170 million and the

maximum share capital EUR 680 million. The share capital may be increased or reduced within

these limits without amending the Articles of Association.

On December 31, 2005, the share capital of Nokia Corporation was EUR 266,033,192.40 and the

total number of shares was 4,433,886,540.

On December 31, 2005, the total number of shares included 261,511,283 shares owned by the

Group companies with an aggregate par value of EUR 15,690,676.98 representing approximately

5.9% of the share capital and the total voting rights.

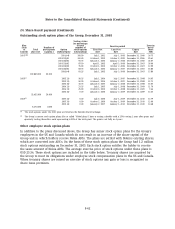

Authorizations

Authorization to increase the share capital

The Board of Directors had been authorized by Nokia shareholders at the Annual General Meeting

held on March 25, 2004 to decide on an increase of the share capital by a maximum of

EUR 55,500,000 offering a maximum of 925,000,000 new shares. In 2005, the Board of Directors did

not increase the share capital on the basis of this authorization. The authorization expired on

March 25, 2005.

At the Annual General Meeting held on April 7, 2005 Nokia shareholders authorized the Board of

Directors to decide on an increase of the share capital by a maximum of EUR 53,160,000 within

F-39