Nokia 2005 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

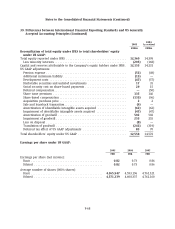

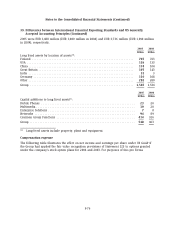

39. Differences between International Financial Reporting Standards and US Generally

Accepted Accounting Principles (Continued)

under IFRS and US GAAP for the determination of the recoverable amount and net realizable value

of software related development costs.

Marketable securities and unlisted investments

Under IFRS, all available-for-sale investments, which includes all publicly listed and non-listed

marketable securities, are measured at fair value and gains and losses are recognized within

shareholders’ equity until realized in the profit and loss account upon sale or disposal.

Under US GAAP, the Group’s listed marketable securities are classified as available-for-sale and

carried at aggregate fair value with gross unrealized holding gains and losses reported as a

component of other comprehensive income (loss). Investments in equity securities that are not

traded on a public market are carried at historical cost, giving rise to an adjustment between IFRS

and US GAAP.

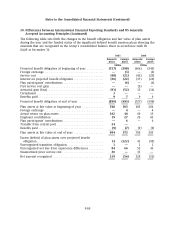

Social security cost on share-based payments

Under IFRS, the Group recognizes a provision for social security costs on unvested equity

instruments based upon local statutory law, net of deferred compensation, which is recorded as a

component of total equity. The provision is considered as a cash-settled share-based payment and

is measured by reference to the fair value of the equity benefits provided and the amount of the

provision is adjusted to reflect the changes in Nokia’s share price.

Under US GAAP, a liability for social security costs on unvested equity instruments is recognized on

the date of the event triggering the measurement and payment of the tax to the taxing authority.

Accordingly, no expense is recorded until stock options are exercised or nonvested shares are fully

vested.

The US GAAP social security costs adjustment reflects the reversal of social security costs recorded

under IFRS for outstanding options and unvested performance and restricted shares.

Share-based compensation

The Group maintains several share-based employee compensation plans, which are described

more fully in Note 24. As of January 1, 2005 the Group adopted IFRS 2. Prior to the adoption of

IFRS 2, the Group did not recognize the financial effect of share-based payments until such

payments were settled. In accordance with the transitional provisions of IFRS 2, the Standard has

been applied retrospectively to all grants of shares, share options or other equity instruments that

were granted after November 7, 2002 and that were not yet vested at the effective date of the

standard.

Through December 31, 2004, the Group accounted for its employee share-based compensation

programs under US GAAP using the intrinsic value method in accordance with Accounting

Principles Board Opinion No. 25, Accounting for Stock Issued to Employees (APB 25) and related

interpretations to measure employee stock compensation. Under APB 25, compensation expense

was recognized under the Group’s option programs when options were awarded at an exercise

price below the market price of the Group’s shares on the grant date and under the Group’s

performance and restricted share programs as they were accounted for as variable award plans.

Under APB 25, compensation arising from stock option programs, restricted shares and

F-70