Nokia 2005 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

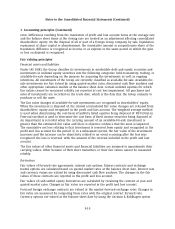

1. Accounting principles (Continued)

the related liabilities. Actuarial gains and losses outside the corridor are recognized over the

average remaining service lives of employees.

Property, plant and equipment

Property, plant and equipment are stated at cost less accumulated depreciation. Depreciation is

recorded on a straight-line basis over the expected useful lives of the assets as follows:

Buildings and constructions ................................ 20–33 years

Production machinery, measuring and test equipment ........... 1–3 years

Other machinery and equipment ............................ 3–10 years

Land and water areas are not depreciated.

Maintenance, repairs and renewals are generally charged to expense during the financial period in

which they are incurred. However, major renovations are capitalized and included in the carrying

amount of the asset when it is probable that future economic benefits in excess of the originally

assessed standard of performance of the existing asset will flow to the Group. Major renovations

are depreciated over the remaining useful life of the related asset. Leasehold improvements are

depreciated over the lease term or useful life, whatever is shorter.

Gains and losses on the disposal of fixed assets are included in operating profit/loss.

Leases

The Group has entered into various operating leases, the payments under which are treated as

rentals and charged to the profit and loss account on a straight-line basis over the lease terms.

Inventories

Inventories are stated at the lower of cost or net realizable value. Cost is determined using

standard cost, which approximates actual cost, on a first in first out (FIFO) basis. Net realizable

value is the amount that can be realized from the sale of the inventory in the normal course of

business after allowing for the costs of realization.

In addition to the cost of materials and direct labor, an appropriate proportion of production

overheads are included in the inventory values.

An allowance is recorded for excess inventory and obsolescence.

Accounts receivable

Accounts receivable are carried at the original invoice amount to customers less an estimate made

for doubtful receivables based on a periodic review of all outstanding amounts, which includes an

analysis of historical bad debt, customer concentrations, customer creditworthiness, current

economic trends and changes in our customer payment terms. Bad debts are written off when

identified.

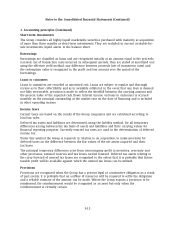

Cash and cash equivalents

Bank and cash consist of cash at bank and in hand. Cash equivalents consist of highly liquid

available-for-sale investments purchased with remaining maturities at the date of acquisition of

three months or less.

F-14