Nokia 2005 Annual Report Download - page 209

Download and view the complete annual report

Please find page 209 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

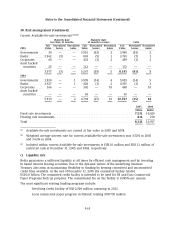

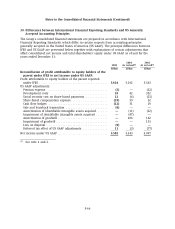

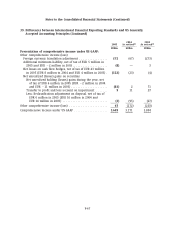

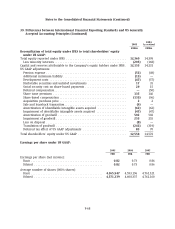

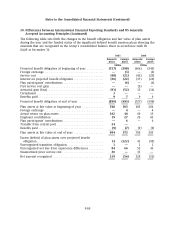

39. Differences between International Financial Reporting Standards and US Generally

Accepted Accounting Principles (Continued)

performance shares was recorded as deferred compensation within shareholders’ equity and

recognized in the profit and loss account over the vesting period of the underlying equity

instruments.

Effective January 1, 2005, the Group adopted the Statement of Financial Accounting Standards

No. 123 (R), Share Based Payment (FAS 123R), using the modified prospective method. Under the

modified prospective method, all new equity-based compensation awards granted to employees

and existing awards modified on or after January 1, 2005, are measured based on the fair value of

the award and are recognized in the statement of income over the required service period. Prior

periods have not been revised.

The retrospective transition provision of IFRS 2 and the modified prospective transition provision

of FAS 123(R) give rise to differences in the historical income statement for share-based

compensation. Further, associated differences surrounding the effective date of application of the

standards to unvested shares give rise to both current and historical income statement differences

in share-based compensation. Share issue premium reflects the cumulative difference between the

amount of share based compensation recorded under US GAAP and IFRS and the amount of

deferred compensation previously recorded in accordance with APB 25.

Total share-based compensation expense under US GAAP was EUR 134 million in 2005. Total

share-based compensation expense in 2005 would have been EUR 110 million under APB 25. The

increase in share-based compensation expense resulting from the adoption of FAS 123R reduced

basic and diluted earnings per share under US GAAP by 0.01 EUR in 2005.

Cash flow hedges

Under IFRS, the Group adopted IAS 39(R) as of January 1, 2005, which supersedes IAS 39 (revised

2000). The changes, which are retrospective, under IAS 39(R) are that hedge accounting is no

longer allowed under Treasury Center foreign exchange netting.

Under US GAAP, the Group applies FAS 133, Accounting for Derivative Instruments and Hedging

Activities.

The US GAAP difference arises when a subsidiary’s reporting currency is different from Treasury

Center’s reporting currency and external and internal hedge maturities are different more than

31 days. For those hedges not qualifying under US GAAP, the unrealized spot foreign exchange

gains and losses from those hedges are released to the income statement. The US GAAP adjustment

for prior years has been adjusted for the adoption for IAS 39(R).

Sale and leaseback transaction

In 2005, the Group entered into a sale and leaseback transaction. Under the agreement, the Group

has a potential liability related to a pending zoning change scheduled to be final in 2006. Under

IFRS, the transaction qualified as a sale and leaseback as the potential liability related to the

zoning change is considered to be remote. Accordingly, the Group recorded a gain on the sale of

the property and rental expense associated with the subsequent leaseback.

Under US GAAP, the transaction did not qualify for sale and leaseback accounting as the clause is

deemed to create continuing involvement by the Group. Accordingly, the transaction is accounted

F-71