Nokia 2005 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

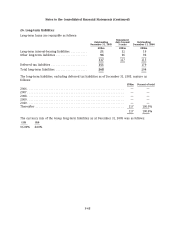

Notes to the Consolidated Financial Statements (Continued)

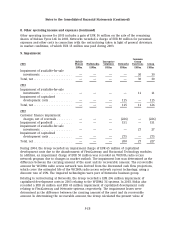

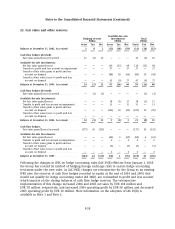

22. Fair value and other reserves

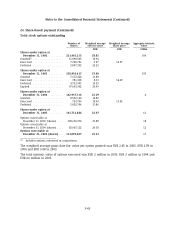

Available-for-sale

Hedging reserve investments Total

EURm EURm EURm

Gross Tax Net Gross Tax Net Gross Tax Net

Balance at December 31, 2002, As revised ...... 2 0 2 (13) (16) (29) (11) (16) (27)

Cash flow hedges (Revised):

Fair value gains/(losses) in period ............ 12 (2) 10 — — — 12 (2) 10

Available-for-sale Investments:

Net fair value gains/(losses) ................ — — — 110 (12) 98 110 (12) 98

Transfer to profit and loss account on impairment — — — 27 — 27 27 — 27

Transfer of fair value gains to profit and loss

account on disposal .................... — — — (84) 20 (64) (84) 20 (64)

Transfer of fair value losses to profit and loss

account on disposal .................... — — — 43 (6) 37 43 (6) 37

Balance at December 31, 2003, As revised ...... 14 (2) 12 83 (14) 69 97 (16) 80

Cash flow hedges (Revised):

Fair value gains/(losses) in period ............ — (1) (1) — — — — (1) (1)

Available-for-sale Investments:

Net fair value gains/(losses) ................ — — — 18 (1) 17 18 (1) 17

Transfer to profit and loss account on impairment . . — — — 11 — 11 11 — 11

Transfer of fair value gains to profit and loss

account on disposal .................... — — — (105) 10 (95) (105) 10 (95)

Transfer of fair value losses to profit and loss

account on disposal .................... — — — — — — — — —

Balance at December 31, 2004, As revised ...... 14 (3) 11 7 (5) 2 21 (8) 13

Cash flow hedges:

Fair value gains/(losses) in period ............ (177) 45 (132) — — — (177) 45 (132)

Available-for-sale Investments:

Net fair value gains/(losses) ................ — — — (69) 6 (63) (69) 6 (63)

Transfer to profit and loss account on impairment . . — — — 9 — 9 9 — 9

Transfer of fair value gains to profit and loss

account on disposal .................... — — — (5) — (5) (5) — (5)

Transfer of fair value losses to profit and loss

account on disposal .................... — — — 2 — 2 2 — 2

Balance at December 31, 2005 ............... (163) 42 (121) (56) 1 (55) (219) 43 (176)

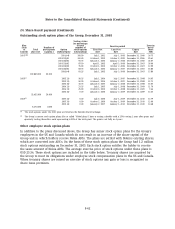

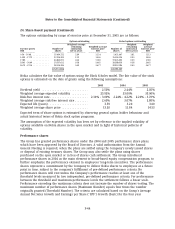

Following the changes in IFRS on hedge accounting rules (IAS 39(R) effective from January 1, 2005,

the Group has revised its method of hedging foreign exchange risks to ensure hedge accounting

treatment under the new rules. As IAS 39(R) changes are retrospective for the Group as an existing

IFRS user, the reserves of cash flow hedges recorded in equity at the end of 2003 and 2004, that

would not qualify for hedge accounting under IAS 39(R), are reclassified to profit and loss account,

which impacts on the closing balances of cash flow hedge reserves. The retrospective

implementation of this change increased 2004 and 2003 net sales by EUR 104 million and

EUR 78 million, respectively, and increased 2004 operating profit by EUR 58 million and decreased

2003 operating profit by EUR 10 million. More information on the adoption of IAS 39(R) is

available in Note 1 and Note 2.

F-38