Nokia 2005 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

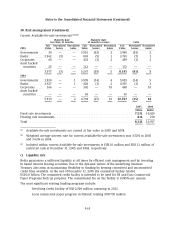

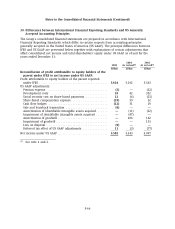

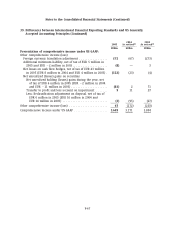

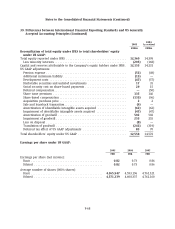

Notes to the Consolidated Financial Statements (Continued)

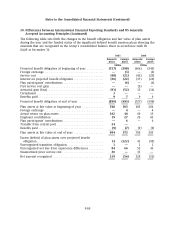

39. Differences between International Financial Reporting Standards and US Generally

Accepted Accounting Principles (Continued)

expense under US GAAP of other intangible assets as of December 31, 2005, is expected to be as

follows:

EURm

2006 ...................................................................... 164

2007 ...................................................................... 79

2008 ...................................................................... 27

2009 ...................................................................... 13

2010 ...................................................................... 6

Thereafter .................................................................. 136

425

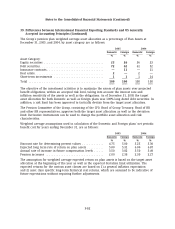

Amortization of goodwill

Under IFRS, the Group adopted the provisions of IFRS 3 on January 1, 2005. As a result, goodwill

recognized relating to purchase acquisitions and acquisitions of associated companies is no longer

subject to amortization. Under the transitional provisions of IFRS 3, this change in accounting

policy was effective immediately for acquisitions made after March 31, 2004.

Under US GAAP, the Group records goodwill in accordance with FAS 142, Goodwill and Other

Intangible Assets, (FAS 142). The Group adopted the provisions of FAS 142 on January 1, 2002 and

as a result, goodwill relating to purchase acquisitions and acquisitions of associated companies is

no longer subject to amortization subsequent to the date of adoption.

The US GAAP adjustment reverses amortization expense and the associated movement in

accumulated amortization recorded under IFRS prior to the adoption of IFRS 3.

Impairment of goodwill

Under IFRS, goodwill is allocated to ‘‘cash generating units’’, which are the smallest group of

identifiable assets that include the goodwill under review for impairment and generate cash

inflows from continuing use that are largely independent of the cash inflows from other assets.

Under IFRS, the Group recorded an impairment of goodwill of EUR 151 million related to Amber

Networks in 2003 as the carrying amount of the cash generating unit exceeded the recoverable

amount of the unit.

Under US GAAP, goodwill is allocated to ‘‘reporting units’’, which are operating segments or one

level below an operating segment (as defined in FAS 131, Disclosures about Segments of an

Enterprise and Related Information). The goodwill impairment test under FAS 142 compares the

carrying value for each reporting unit to its fair value based on discounted cash flows.

The US GAAP impairment of goodwill adjustment reflects the cumulative reversal of impairments

recorded under IFRS that do not qualify as impairments under US GAAP.

Upon completion of the 2003 annual impairment test, the Group determined that the impairment

recorded for Amber Networks should be reversed under US GAAP as the fair value of the reporting

unit in which Amber Networks resides exceeded the book value of the reporting unit. The annual

impairment tests performed subsequent to 2003 continue to support the reversal of this

impairment.

F-73