Nokia 2005 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

6. Pensions (Continued)

Effective on January 1, 2005, the Finnish TEL system was reformed. The most significant change

that has an impact on the Group’s future financial statements is that pensions accumulated after

2005 are calculated on the earnings during the entire working career, not only on the basis of the

last few years of employment as provided by the old rules. An increase to the rate at which

pensions accrue led to a past service cost of EUR 5 million in 2004, which will be recognized over

employees’ future working life.

As a result of the changes in the TEL system, which increased the Group’s obligation in respect of

ex employees and reduced the obligation in respect of recent recruits, a change in the liability has

been recognised to cover future disability pensions. In 2005, to compensate the Group for the

additional liability in respect of ex-employees assets of EUR 24 million were transferred from the

pooled part of the pension system to cover future disability pensions inside Nokia Pension

Foundation. As this transfer of assets is effectively a reduction of the obligation to the pooled

premium, it has been accounted for as a credit to the profit and loss account during 2005.

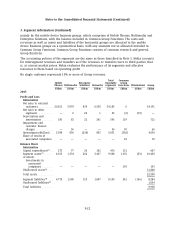

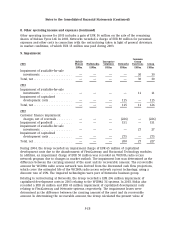

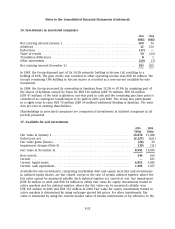

The amounts recognized in the balance sheet relating to single employer defined benefit schemes

are as follows:

2005 2004

Domestic Foreign Domestic Foreign

Plans Plans Plans Plans

EURm EURm EURm EURm

Fair value of plan assets .............................. 904 372 768 303

Present value of obligations ........................... (890) (495) (727) (398)

Surplus/(Deficit) ..................................... 14 (123) 41 (95)

Unrecognized net actuarial losses ....................... 128 105 93 82

Unrecognized past service cost ......................... 3— 5—

Prepaid/(Accrued) pension cost in balance sheet ........... 145 (18) 139 (13)

Present value of obligations include EUR 35 million (EUR 36 million in 2004) of unfunded

obligations.

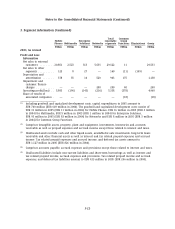

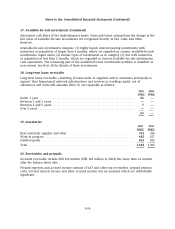

The amounts recognized in the profit and loss account are as follows:

2005 2004 2003

EURm EURm EURm

Current service cost .............................................. 69 62 54

Interest cost .................................................... 58 56 46

Expected return on plan assets ..................................... (64) (56) (55)

Net actuarial losses recognized in year ............................... 9—3

Past service cost gain (-) loss (+) .................................... 1(1) —

Transfer from central pool ........................................ (24) ——

Curtailment .................................................... (3) — (10)

Total, included in personnel expenses ................................ 46 61 38

F-26