Nokia 2005 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227

|

|

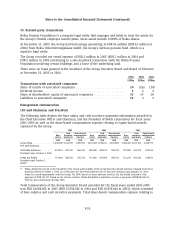

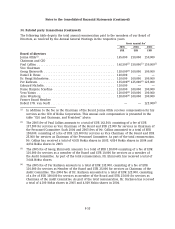

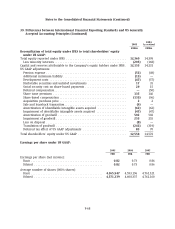

Notes to the Consolidated Financial Statements (Continued)

36. Subsequent events (unaudited) (Continued)

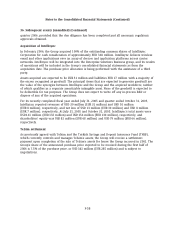

quarter 2006, provided that the due diligence has been completed and all necessary regulatory

approvals obtained.

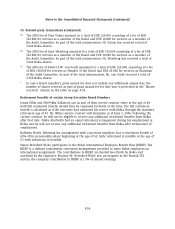

Acquisition of Intellisync

In February 2006, the Group acquired 100% of the outstanding common shares of Intellisync

Corporation for cash consideration of approximately EUR 368 million. Intellisync delivers wireless

email and other applications over an array of devices and application platforms across carrier

networks. Intellisync will be integrated into the Enterprise Solutions business group, and its results

of operations will be included in the Group’s consolidated financial statements as from the

acquisition date. The purchase price allocation is being performed with the assistance of a third

party.

Assets acquired are expected to be EUR 51 million and liabilities EUR 17 million with a majority of

the excess recognised as goodwill. The principal items that are expected to generate goodwill are

the value of the synergies between Intellisync and the Group and the acquired workforce, neither

of which qualifies as a separate amortizable intangible asset. None of the goodwill is expected to

be deductible for tax purposes. The Group does not expect to write off any in-process R&D or

dispose of any of the acquired operations.

For its recently completed fiscal year ended July 31, 2005 and quarter ended October 31, 2005,

Intellisync reported revenues of USD 39 million (EUR 31 million) and USD 10 million

(EUR 8 million), respectively, and net loss of USD 13 million (EUR 10 million) and USD 8 million

(EUR 7 million), respectively. At July 31, 2005 and October 31, 2005, Intellisync’s total assets were

USD 161 million (EUR 133 million) and USD 156 million (EUR 130 million), respectively, and

shareholders’ equity was USD 82 million (EUR 68 million) and USD 79 million (EUR 66 million),

respectively.

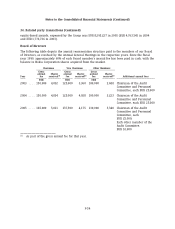

Telsim settlement

As previously agreed with Telsim and the Turkish Savings and Deposit Insurance Fund (TMSF),

which currently controls and manages Telsim’s assets, the Group will receive a settlement

payment upon completion of the sale of Telsim’s assets for losses the Group incurred in 2001. The

Group’s share of the announced purchase price expected to be received during the first half of

2006 is 7.5% of the purchase price, or USD 341 million (EUR 285 million) and is subject to

negotiations.

F-58