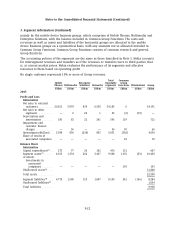

Nokia 2005 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

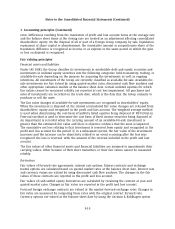

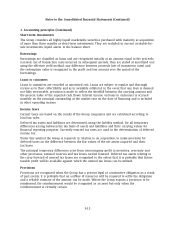

1. Accounting principles (Continued)

Foreign currency hedging of net investments

The Group also applies hedge accounting for its foreign currency hedging on net investments.

Qualifying hedges are those properly documented hedges of the foreign exchange rate risk of

foreign currency-denominated net investments that meet the requirements set out in IAS 39(R).

The hedge must be effective both prospectively and retrospectively.

The Group claims hedge accounting in respect of forward foreign exchange contracts, foreign

currency-denominated loans, and options, or option strategies, which have zero net premium or a

net premium paid, and where the terms of the bought and sold options within a collar or zero

premium structure are the same.

For qualifying foreign exchange forwards the change in fair value that reflects the change in spot

exchange rates is deferred in shareholders’ equity. The change in fair value that reflects the

change in forward exchange rates less the change in spot exchange rates is recognized in the

profit and loss account within financial income and expenses. For qualifying foreign exchange

options the change in intrinsic value is deferred in shareholders’ equity. Changes in the time value

are at all times taken directly to the profit and loss account within financial income and expenses.

If a foreign currency-denominated loan is used as a hedge, all foreign exchange gains and losses

arising from the transaction are recognized in shareholders’ equity.

Accumulated fair value changes from qualifying hedges are released from shareholders’ equity

into the profit and loss account only if the legal entity in the given country is sold, liquidated,

repays its share capital or is abandoned.

Revenue recognition

Sales from the majority of the Group are recognized when persuasive evidence of an arrangement

exists, delivery has occurred, the fee is fixed or determinable and collectibility is probable. An

immaterial part of the revenue from products sold through distribution channels is recognized

when the reseller or distributor sells the products to the end users. The Group records reductions

to revenue for special pricing agreements, price protection and other volume based discounts.

In addition, sales and cost of sales from contracts involving solutions achieved through

modification of complex telecommunications equipment are recognized on the percentage of

completion method when the outcome of the contract can be estimated reliably. This occurs when

total contract revenue and the costs to complete the contract can be estimated reliably, it is

probable that the economic benefits associated with the contract will flow to the Group and the

stage of contract completion can be measured. When the Group is not able to meet those

conditions, the policy is to recognize revenues only equal to costs incurred to date, to the extent

that such costs are expected to be recovered.

Completion is measured by reference to cost incurred to date as a percentage of estimated total

project costs, the cost-to-cost method.

The percentage of completion method relies on estimates of total expected contract revenue and

costs, as well as dependable measurement of the progress made towards completing a particular

project. Recognized revenues and profits are subject to revisions during the project in the event

that the assumptions regarding the overall project outcome are revised. The cumulative impact of

a revision in estimates is recorded in the period such revisions become likely and estimable.

Losses on projects in progress are recognized in the period they become likely and estimable.

F-12