Nokia 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Non-market vesting conditions attached to the performance shares are included in assumptions

about the number of shares that the employee will ultimately receive relating to projections of

sales and earnings per share. On a regular basis we review the assumptions made and revise the

estimates of the number of performance shares that are expected to be settled, where necessary.

At the date of grant the number of performance shares granted to employees that are expected to

be settled is assumed to be the target amount. Any subsequent revisions to the estimates of the

number of performance shares expected to be settled may increase or decrease total compensation

expense. Such increase or decrease adjusts the prior period compensation expense in the period of

the review on a cumulative basis for unvested performance shares for which compensation

expense has already been recognized in the profit and loss account, and in subsequent periods for

unvested performance shares for which the expense has not yet been recognized in the profit and

loss account. Significant differences in employee option activity, equity market performance and

our projected and actual sales and earnings per share performance, may materially affect future

expense. In addition, the value, if any, an employee ultimately receives from share-based payment

awards may not correspond to the expense amounts recorded by the Group.

Results of Operations

2005 compared with 2004

Nokia Group

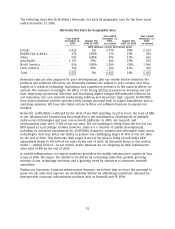

The following table sets forth selective line items and the percentage of net sales that they

represent for Nokia for the fiscal years 2005 and 2004.

Year ended

Year ended December 31, Percentage

December 31, Percentage of 2004 Percentage of Increase/

2005 Net Sales As revised Net Sales (decrease)

(EUR millions, except percentage data)

Net sales .................. 34 191 100.0% 29 371 100.0% 16%

Cost of sales ................ (22 209) (65.0)% (18 179) (61.9)% 22%

Gross profit ................ 11 982 35.0% 11 192 38.1% 7%

Research and development

expenses ................. (3 825) (11.2)% (3 776) (12.9)% 1%

Selling and marketing expenses (2 961) (8.7)% (2 564) (8.7)% 15%

Administrative and general

expenses ................. (609) (1.8)% (611) (2.1)% —

Other operating income and

expenses ................. 52 0.2% 181 0.6% (71)%

Amortization of goodwill ..... — — (96) (0.3)% (100)%

Operating profit ............. 4 639 13.6% 4 326 14.7% 7%

For 2005, Nokia’s net sales increased 16% to EUR 34.2 billion compared with EUR 29.4 billion in

2004. At constant currency, group net sales would have grown 20% in 2005. Our gross margin in

2005 was 35.0% compared with 38.1% in 2004. This reflected the higher proportion of entry level

devices in our product mix in 2005 due to strong volume growth in emerging markets, which

have the industry’s lowest ASPs. Our gross margin in 2005 was also affected by intense price

competition in both the device and infrastructure markets, as well as by the lower margin

services business and emerging markets representing an increased share of Networks sales.

Research and development, or R&D, expenses were EUR 3.8 billion in both 2005 and 2004.

Research and development expenses represented 11.2% of net sales in 2005, down from 12.9% in

59