Nokia 2005 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227

|

|

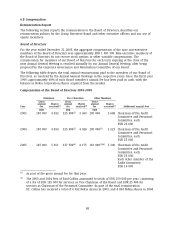

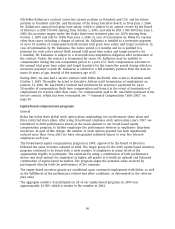

three and five year period. In the case of the CEO, the annual incentive award is also partly

based on his performance compared against strategic leadership objectives.

Incentive as a % of Annual Base Salary

Minimum Target Maximum

Position Performance Performance Performance Measurement criteria

Chairman and CEO 0 100% 225% Financial Objectives

(Includes targets for net

sales, operating profit and

net working capital

measures)

0 25% 37.50% Total Shareholder Return

(comparison made with key

comparators in the high

technology and

telecommunications

industries over a one, three

and five year period)

0 25% 37.50% Strategic Objectives

Total 0 150% 300%

President and COO 0 100% 225% Financial & Strategic

Objectives

0 25% 37.50% Total Shareholder Return

Total 0 125% 262.5%

Group Executive Board 0 75% 168.75% Financial & Strategic

Objectives

0 25% 37.50% Total Shareholder Return(1)

Total 0 100% 206.25%

(1) Only some of the Group Executive Board Members are eligible for the additional 25%

total Shareholder Return element.

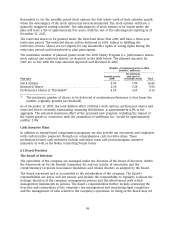

More information on the actual cash compensation paid in 2005 to our executive officers is in the

‘‘Summary Compensation Table 2005’’ on page 94.

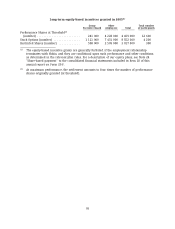

Long-term equity-based incentives

•Long-term equity-based incentive awards in the form of stock options, performance shares

and restricted shares are used to align the executives’ interests with shareholders’ interests,

reward performance, and encourage retention. These awards are determined on the basis of

several factors, including a comparison of that executive’s overall compensation with the

relevant market. Stock options will only have value for the executive if the share price is

higher than the exercise price of the option established at grant, before the term of the

option expires. This aligns the interests of the executives with those of the shareholders. In

addition, performance shares only vest as shares when the pre-determined threshold

performance level, tied to the company’s financial performance, is achieved by the end of

the performance period. Restricted shares, used primarily for retention reasons, are vested

91