Nokia 2005 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227

|

|

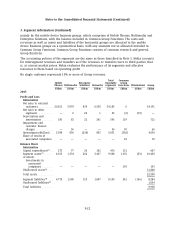

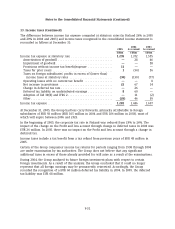

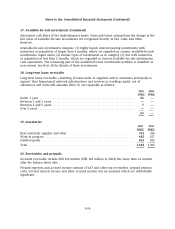

Notes to the Consolidated Financial Statements (Continued)

9. Impairment (Continued)

estimated discounted future cash flows, using a 15% discount rate for WCDMA and FlexiGateway

and 12% discount rate for Metrosite, expected to arise from the continuing use of the asset and

from its disposal at the end of its useful life.

The impairment charge recorded in 2002 relating to Mobilcom was substantially reversed in 2003

by EUR 226 million as a result of the company receiving repayment of the Mobilcom loans

receivables in the form of subordinated convertible perpetual bonds of France Telecom. See

Notes 12, 17 and 22.

The Group has evaluated the carrying value of goodwill arising from certain acquisitions by

determining if the carrying values of the net assets of the cash generating unit to which the

goodwill belongs exceeds the recoverable amounts of that unit. In 2003, in the Networks business,

the Group recorded an impairment charge of EUR 151 million on goodwill related to the

acquisition of Amber Networks. The recoverable amount for Amber Networks was derived from

the value in use discounted cash flow projections, which cover the estimated life of the Amber

platform technology, using a discount rate of 15%. The impairment was a result of significant

declines in the market outlook for products under development.

During 2005 the Group’s investment in certain equity securities suffered a permanent decline in

fair value resulting in an impairment charge of EUR 30 million relating to non-current available-

for-sale investments (EUR 11 million in 2004 and EUR 27 million in 2003).

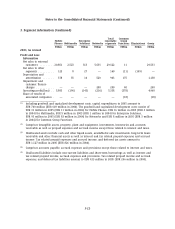

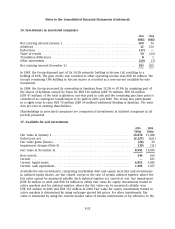

10. Acquisitions

In 2003, the Group made three minor purchase acquisitions for a total consideration of EUR 38

million, of which EUR 20 million was in cash and EUR 18 million in non-cash consideration.

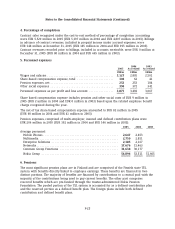

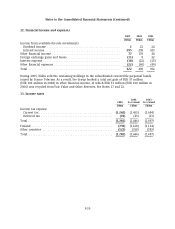

11. Depreciation and amortization

Depreciation and amortization by function

Cost of sales ...................................................... 242 196 214

Research and development .......................................... 349 431 537

Selling and marketing .............................................. 914 23

Administrative and general .......................................... 99 123 162

Other operating expenses ........................................... 13 843

Amortization of goodwill ............................................ —96 159

Total ............................................................ 712 868 1,138

F-29