Nokia 2005 Annual Report Download - page 178

Download and view the complete annual report

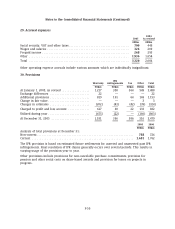

Please find page 178 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

23. The shares of the Parent Company (Continued)

one year from the resolution of the Annual General Meeting. The increase of the share capital may

consist of one or more issues offering a maximum of 886,000,000 new shares with a par value of

EUR 0.06 each. The share capital may be increased in deviation from the shareholders’ pre-emptive

rights for share subscription provided that from the company’s perspective important financial

grounds exist such as financing or carrying out of an acquisition or another arrangement or

granting incentives to selected members of the personnel. In 2005, the Board of Directors did not

increase the share capital on the basis of this authorization. The authorization is effective until

April 7, 2006.

At the end of 2005, the Board of Directors had no other authorizations to issue shares, convertible

bonds, warrants or stock options.

The Board of Directors will propose to the Annual General Meeting convening on March 30, 2006

that the Board of Directors be authorized to resolve to increase the share capital of the company

by issuing new shares, stock options or convertible bonds in one or more issues. The increase of

the share capital through issuance of new shares, subscription of shares pursuant to stock options

and conversion of convertible bonds into shares, may amount to a maximum of EUR 48,540,000 in

total. As a result of share issuance, subscription of shares pursuant to stock options and conversion

of convertible bonds into shares an aggregate maximum of 809,000,000 new shares with a par

value of EUR 0.06 may be issued. The authorization is proposed to be effective until March 30,

2007, or in the event that the new Companies Act has been approved by the time of the Annual

General Meeting, and enters into force latest on March 30, 2007, this authorization is proposed to

be effective until June 30, 2007.

Other authorizations

At the Annual General Meeting held on March 25, 2004, Nokia shareholders authorized the Board of

Directors to repurchase a maximum of 230 million Nokia shares. In 2005 Nokia repurchased

54 million Nokia shares on the basis of this authorization.

At the Annual General Meeting held on April 7, 2005, Nokia shareholders authorized the Board of

Directors to repurchase a maximum of 443,200,000 Nokia shares, representing less than 10% of the

share capital and the total voting rights, and to resolve on the disposal of a maximum of

443,200,000 Nokia shares. In 2005, a total of 261,010,000 Nokia shares were repurchased under

this buy-back authorization, as a result of which the unused authorization amounted to

182,190,000 shares on December 31, 2005. No shares were disposed of in 2005 under the

respective authorization. The shares may be repurchased under the buy-back authorization in

order to carry out the company’s stock repurchase plan. In addition, the shares may be

repurchased in order to develop the capital structure of the company, to finance or carry out

acquisitions or other arrangements, to settle the company’s equity-based incentive plans, to be

transferred for other purposes, or to be cancelled. The authorization to dispose of the shares may

be carried out pursuant to terms determined by the Board in connection with acquisitions or in

other arrangements or for incentive purposes to selected members of the personnel. The Board

may resolve to dispose the shares in another proportion than that of the shareholders’

pre-emptive rights to the company’s shares, provided that from the company’s perspective

important financial grounds exist for such disposal. These authorizations are effective until

April 7, 2006.

F-40