Nokia 2005 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the end of the preceding financial year pursuant to the annual accounts as approved by our

shareholders. Subject to exceptions relating to the right of minority shareholders to request

otherwise, the distribution may not exceed the amount proposed by the Board of Directors. The

Finnish Companies Act of 1978, which provides for distribution of earnings, is currently subject to

a major reform expected to become effective in the latter part of 2006.

Share Buy-backs

Under the Finnish Companies Act, Nokia Corporation may repurchase its own shares pursuant to

either a shareholders’ resolution or an authorization to the Board of Directors approved by the

company’s shareholders. Such authorizations to the Board of Directors are effective for a maximum

of one year. The undertaking of share buy-backs is subject not only to the regulations in the

Finnish Companies Act, but also to the rules of the stock exchanges on which the repurchases take

place. The Board of Directors of Nokia has been regularly authorized by our shareholders in the

Annual General Meetings to repurchase Nokia’s own shares: 225 million shares in 2001,

220 million shares in 2002, 225 million shares in 2003, 230 million shares in 2004 and

443.2 million shares in 2005. The amount authorized each year has been at or slightly under the

maximum limit provided by the Finnish Companies Act. The upper limit for share repurchases

was increased from 5% to 10% in 2005.

On January 26, 2006, we announced that the Board of Directors will propose that the Annual

General Meeting, convening on March 30, 2006, approve a new authorization to repurchase a

maximum of 405 million shares corresponding to nearly 10% of Nokia’s share capital and total

voting rights.

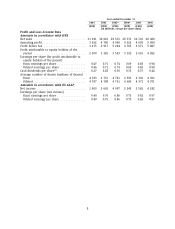

The table below sets forth actual share buy-backs by the Group in respect of each fiscal year

indicated.

EUR millions

Number of shares (in total)

2001 ..................................... 995 000 21

2002 ..................................... 900 000 17

2003 ..................................... 95 338 500 1 363

2004 ..................................... 214 119 700 2 661

2005 ..................................... 315 010 000 4 265

For more information about share buy-backs during 2005, see ‘‘Item 16E. Purchases of Equity

Securities by the Issuer and Affiliated Purchasers.’’

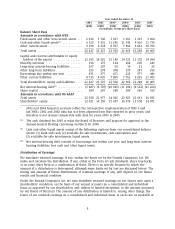

Dividends

The Board of Directors will propose for approval at the Annual General Meeting convening on

March 30, 2006 a dividend of EUR 0.37 per share in respect of 2005.

The table below sets forth the amounts of total cash dividends per share and per ADS paid in

respect of each fiscal year indicated. For the purposes of showing the US dollar amounts per ADS

for 2001-2005, the dividend per share amounts have been translated into US dollars at the noon

buying rate in New York City for cable transfers in euro as certified for customs purposes by the

10