Nokia 2005 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

included production lines, test equipment and computer hardware used primarily in research and

development as well as office and manufacturing facilities. We expect the amount of our capital

expenditures during 2006 to be higher than 2005 and to be funded from our cash flow from

operations.

Structured Finance

Structured Finance includes customer financing and other third party financing. Network

operators in some markets sometimes require their suppliers, including us, to arrange or provide

long-term financing as a condition to obtaining or bidding on infrastructure projects. Customer

financing continues to be requested by some operators in some markets. Extended payment terms

may continue to result in a material aggregate amount of trade credits, but the associated risk is

mitigated by the fact that the portfolio relates to a variety of customers. See ‘‘Item 3.D Risk

Factors—Customer financing to network operators can be a competitive requirement and could

adversely and materially affect our sales, results of operations, balance sheet and cash flow.’’

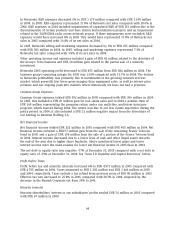

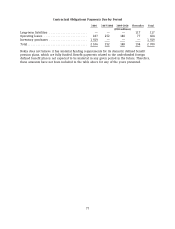

The following table sets forth Nokia’s total structured finance, outstanding and committed, for the

years indicated.

Structured Finance

At December 31,

2005 2004 2003

(EUR millions)

Financing commitments ............................................. 13 56 490

Outstanding long-term loans (net of allowances and write-offs) ............. 63 — 354

Outstanding financial guarantees and securities pledged ................... — 3 33

Total ............................................................ 63 59 877

In 2005, our total structured financing, outstanding and committed, increased to EUR 63 million

from EUR 59 million in 2004 and primarily consisted of the funding of the EUR 56 million 2004

financing commitment to a network operator. The committed financing in 2005 of an additional

EUR 13 million to this network operator will expire in 2008. This commitment does not increase

our total and outstanding credit risk from EUR 63 million, as it is available only if the outstanding

loan of EUR 56 million is repaid. The guarantees of EUR 3 million outstanding in 2004 were

released.

See Notes 9 and 38(b) to our consolidated financial statements included in Item 18 of this annual

report on Form 20-F for additional information relating to our committed and outstanding

customer financing.

In 2004, we reduced our total customer financing, outstanding and committed, by EUR 818 million

(or 93%) compared to 2003. Our outstanding loans decreased mainly due to the fact that the

customer financing to Huchison 3G UK Ltd in the United Kingdom, which amounted to EUR 653

million, was prepaid and released. The total committed customer financing to the TNL PCS S.A.

(Telemar) in Brazil, which amounted to EUR 191 million, was sold off and released. In addition,

the reduction was achieved through release of outstanding guarantees as well as arrangements

with banks, financial institutions and Export Credit Agencies, and mutual agreement with the

borrower.

In 2003, our outstanding loans decreased by EUR 1 127 million mainly due to the fact that the

MobilCom loan was exchanged for subordinated convertible perpetual bonds of France Telecom.

These bonds were treated as available-for-sale investments and were sold during 2004 and 2005.

74