Nokia 2005 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

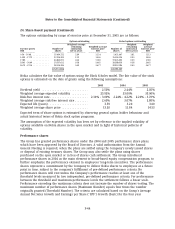

23. The shares of the Parent Company (Continued)

The Board of Directors will propose to the Annual General Meeting convening on March 30, 2006

that the Board of Directors be authorized to repurchase a maximum of 405 million Nokia shares

by using unrestricted shareholders’ equity. Further, the Board of Directors will propose that the

Annual General Meeting authorize the Board of Directors to resolve to dispose a maximum of

405 million Nokia shares. These authorizations are proposed to be effective until March 30, 2007,

or in the event that the new Companies Act has been approved by the time of the Annual General

Meeting, and enters into force latest on March 30, 2007, these authorizations are proposed to be

effective until June 30, 2007.

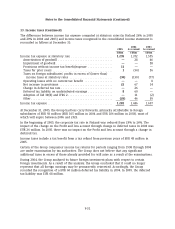

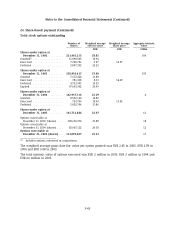

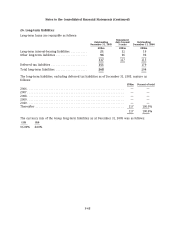

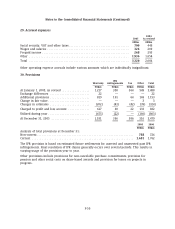

24. Share-based payment

The Group has several equity based incentive programs for employees, in which management also

participates. The programs include performance share plans, stock option plans and restricted

share plans.

The equity-based incentive grants are generally forfeited, if the employment relationship with the

Group terminates, and they are conditional upon the fulfillment of the performance and such

other conditions, as determined in the relevant plan rules.

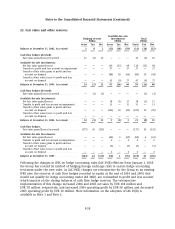

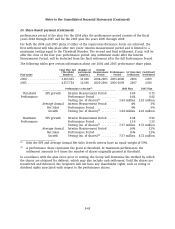

Stock options

The Group’s outstanding stock option plans currently include the so called ‘‘Global plans’’ launched

in 2001, 2003 and 2005. These plans have been approved by the Annual General Meeting in the

year of the launch of the plan.

Under these plans, each stock option entitles the holder to subscribe for one new Nokia share with

a par value of EUR 0.06 each. In the 2001 stock option plan the stock options are transferable and

the stock options under the 2003 and 2005 plans are non-transferable by the participants. All of

the stock options have a quarterly staggered vesting schedule, as specified in the table below. The

exercise prices are determined at the time of the grant, on a quarterly basis equalling the trade

volume weighted average price of the Nokia share on the Helsinki Stock Exchange during the

trading days of the first whole week of the second month (i.e. February, May, August or

November) of the respective calendar quarter, when the sub-category of the stock option is

denominated.

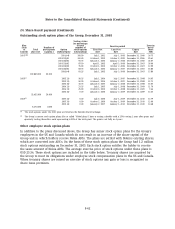

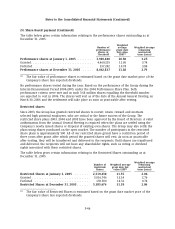

The exercises based on the stock options issued under the 2001, 2003 and 2005 stock option plans

are settled with newly issued shares which will entitle the holder to a dividend for the financial

year in which the subscription occurs. Other shareholder rights commence on the date on which

the shares subscribed for are registered with the Finnish Trade Register.

Pursuant to the stock options issued, an aggregate maximum number of 144,495,187 new shares

were authorized for subscription representing EUR 8,669,711 of the share capital and

approximately 3% of the total number of votes on December 31, 2005. During 2005 the exercise of

125,240 options resulted in the issuance of 125,240 new shares and an increase of the share

capital of the Group by EUR 7,514.40.

There were no other stock options or convertible bonds outstanding as of December 31, 2005,

which upon exercise would result in an increase of the share capital of the parent company.

F-41