Nokia 2005 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Subsequent Events

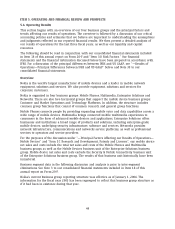

Preliminary Agreement with SANYO

On February 14, 2006, Nokia and SANYO Electric Co., Ltd announced a preliminary agreement with

intent to form a new global company comprised of their respective CDMA mobile phone

businesses—separate from the parent companies. The relevant assets from both companies will be

contributed or made available for the new entity. Final agreements are expected to be signed in

the second quarter of 2006, with the new business expected to commence operations in the third

quarter of 2006, provided that the due diligence has been completed and all necessary regulatory

approvals obtained.

Considering the preliminary structure, the new entity is expected to be treated as an associated

company for accounting purposes, and therefore upon formation Nokia’s share of the revenues

and expenses and assets and liabilities of the entity will be shown as single line item in the

consolidated profit and loss, balance sheet and financial statements of the Group. The historical

Nokia CDMA business has represented less than 5% of our net sales, operating profit and total

assets. Additional information regarding the impact of this transaction on us will become available

once agreements with SANYO Electric Co., Ltd are finalized.

Acquisition of Intellisync

In February 2006, Nokia acquired 100% of the outstanding common shares of Intellisync

Corporation for cash consideration of approximately EUR 368 million. Intellisync delivers wireless

email and other applications over an array of devices and application platforms across carrier

networks. Intellisync will be integrated into the Enterprise Solutions business group, and its results

of operations will be included in our consolidated financial statements as from the acquisition

date.

Other than the cash consideration paid and corresponding intangible assets recognized, principally

goodwill, the acquisition is not expected to have a material effect on our results of operations,

financial position, or cash flows in 2006.

Telsim settlement

As previously agreed with Telsim and the Turkish Savings and Deposit Insurance Fund (TMSF),

which currently controls and manages Telsim’s assets, Nokia will receive a settlement payment

upon completion of the sale of Telsim’s assets for losses Nokia incurred in 2001. Our share of the

announced purchase price expected to be received during the first half of 2006 is 7.5% of the

purchase price, or USD 341 million (EUR 285 million) and is subject to negotiations.

Certain Other Factors

United States Dollar

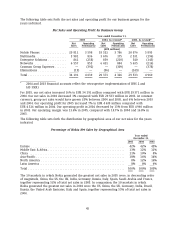

In 2005 the US dollar was weaker on average than in 2004, even though the US dollar trend

reversed and the US dollar appreciated against the euro by 12.6% (when measured year-end rate

compared to the year-end rate for the previous year). When measured by the average rate used to

record transactions in foreign currency for accounting purposes for the year compared with the

corresponding rate for the previous year, the US dollar depreciated against the euro by 1.7% in

2005. The weaker US dollar on average had a slight negative impact on our net sales expressed in

euros because somewhat more than 50% of our net sales are generated in US dollars and

currencies closely following the US dollar. However, the average depreciation of the US dollar also

contributed to a lower average product cost as more than 50% of the components we use are

sourced in US dollars. To mitigate the impact of changes in exchange rates on net sales as well as

52