Nokia 2005 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

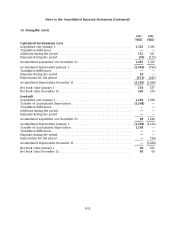

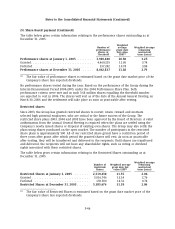

24. Share-based payment (Continued)

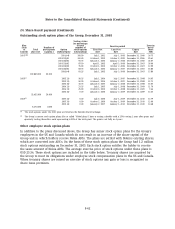

Outstanding stock option plans of the Group, December 31, 2005

Vesting status

(as percentage

Plan of total Exercise

Exercise period

(Year Number of number of price/

of Total participants Option stock options First Vest Last Vest Expiry share

launch) plan size (approx.) (Sub)category outstanding) date date date EUR

2001(1)(2) 2001A+B 100.00 July 1, 2002 July 1, 2005 December 31, 2006 36.75

2001C3Q/01 100.00 October 1, 2002 October 3, 2005 December 31, 2006 20.61

2001C4Q/01 93.75 January 1, 2003 January 2, 2006 December 31, 2006 26.67

2001C1Q/02 87.50 April 1, 2003 April 3, 2006 December 31, 2007 26.06

2001C3Q/02 75.00 October 1, 2003 October 2, 2006 December 31, 2007 12.99

2001C4Q/02 68.75 January 1, 2004 January 2, 2007 December 31, 2007 16.86

2002A+B 81.25 July 1, 2003 July 3, 2006 December 31, 2007 17.89

102,869,000 30,000

2003(2) 2003 2Q 56.25 July 1, 2004 July 2, 2007 December 31, 2008 14.95

2003 3Q 50.00 October 1, 2004 October 1, 2007 December 31, 2008 12.71

2003 4Q 43.75 January 3, 2005 January 2, 2008 December 31, 2008 15.05

2004 2Q 31.25 July 1, 2005 July 1, 2008 December 31, 2009 11.79

2004 3Q 25.00 October 3, 2005 October 1, 2008 December 31, 2009 9.44

2004 4Q 0.00 January 2, 2006 January 2, 2009 December 31, 2009 12.35

33,452,000 20,000

2005(2) 2005 2Q 0.00 July 3, 2006 July 1, 2009 December 31, 2010 12.79

2005 3Q 0.00 October 2, 2006 October 1, 2009 December 31, 2010 13.09

2005 4Q 0.00 January 2, 2007 January 1, 2010 December 31, 2010 14.48

8,174,000 4,000

(1) The stock options under the 2001 plan are listed on the Helsinki Stock Exchange.

(2) The Group’s current stock option plans (the so called ‘‘Global plans’’) have a vesting schedule with a 25% vesting 1 year after grant, and

quarterly vesting thereafter, each representing 6.25% of the total grant. The grants vest fully in 4 years.

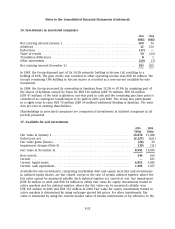

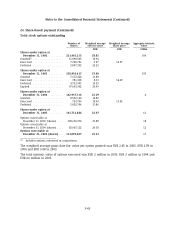

Other employee stock option plans

In addition to the plans discussed above, the Group has minor stock option plans for the Group’s

employees in the US and Canada which do not result in an increase of the share capital of the

Group and in which holders receive Nokia ADSs. The plans are settled with Nokia’s existing shares,

which are converted into ADS’s. On the basis of these stock option plans the Group had 1.2 million

stock options outstanding on December 31, 2005. Each stock option entitles the holder to receive

the same amount of Nokia ADSs. The average exercise price of stock options under these plans is

USD 25.36. These stock options are included in the table below. Treasury shares are acquired by

the Group to meet its obligations under employee stock compensation plans in the US and Canada.

When treasury shares are issued on exercise of stock options any gain or loss is recognized in

share issue premium.

F-42