Nokia 2005 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

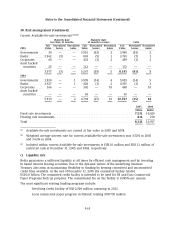

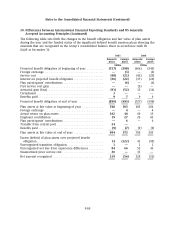

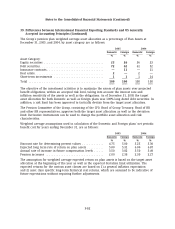

39. Differences between International Financial Reporting Standards and US Generally

Accepted Accounting Principles (Continued)

for as a capital lease until the potential obligation lapses with the zoning change expected in 2006.

Once the potential obligation lapses and continuing involvement ceases, the transaction can be

accounted for as a sale and the corresponding gain can be realized. Until that time, the amount of

the asset will remain on the US GAAP balance sheet and rental payments are recorded as a

reduction of the principal amount of the obligation and as interest expense.

The US GAAP sale and leaseback adjustment reflects the reversal of the gain on sale of the

property and rental expense recorded under IFRS net of interest expense recorded under US GAAP.

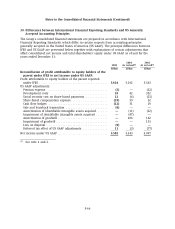

Acquisition purchase price

Under IFRS, when the consideration paid in a business combination includes shares of the

acquirer, the purchase price of the acquired business is determined on the date at which the

shares are exchanged.

Under US GAAP, the measurement date for shares of the acquirer is the date the acquisition is

announced or, if the number of shares is uncertain on such date, the first day on which both the

number of acquirer shares and the amount of other consideration becomes fixed. The average

share price for a reasonable period before and after the measurement date is then used to value

the shares.

The US GAAP acquisition purchase price adjustment reflects the different measurement dates used

under IFRS and US GAAP in the valuation of shares issued in connection with a business

combination.

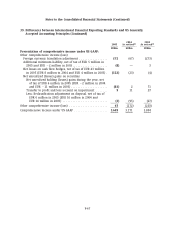

Amortization and impairment of identifiable intangible assets acquired

Under IFRS, prior to April 1, 2004, unpatented technology acquired was not separately recognized

upon acquisition as an identifiable intangible asset but was included within goodwill.

Under US GAAP, any unpatented technology acquired in a business combination is recorded as an

identifiable intangible asset with an associated deferred tax liability. The intangible asset is

amortized over its estimated useful life.

The adjustment to US GAAP net income and shareholders’ equity relates to the amortization and

accumulated amortization, respectively, recorded under IFRS related to Amber Networks’

intangible asset.

During 2004 the carrying value of Amber Network unpatented technology was impaired since

Nokia no longer developed nor used the technology acquired and its carrying amount was deemed

not recoverable through estimated future cash flows. The total impact on net income in 2004

amounted to EUR 58 million of which the impairment recognized under US GAAP was

EUR 47 million.

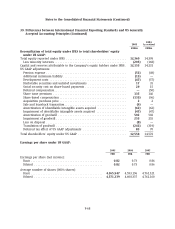

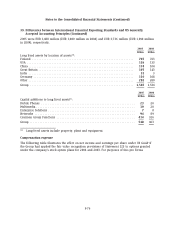

The net carrying amount of other intangible assets under US GAAP is EUR 425 million in 2005

(EUR 419 million in 2004) and consists of capitalized development costs of EUR 213 million

(EUR 210 million) and acquired patents, trademarks and licenses of EUR 212 million

(EUR 209 million). The Group does not have any indefinite lived intangible assets. Amortization

F-72