Nokia 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Nokia estimates that the replacement market will represent over 60% of industry volumes in

2006, compared with approximately 60% in 2005. We believe that replacement sales will be

driven by camera phones, 3G/WCDMA devices, smartphones, continued penetration of color

displays, music features, mobile multimedia services and general aesthetic trends. According to our

estimates the global 3G/WCDMA market totaled 44 million units in 2005 and we believe that it will

at least double in 2006. We believe that the global mobile subscriber base reached approximately

2.2 billion at the end of 2005, and we estimate that this figure will reach 3 billion during 2008.

Our target is to continue to lower our mobile device R&D expenses/net sales ratio to 8% by the

end of 2006, while simultaneously ensuring that the most compelling products are brought to

market at the right time.

Infrastructure

Our Networks business group drives our infrastructure net sales by providing network

infrastructure, communications and networks service platforms, as well as professional services to

operators and service providers. Nokia’s Enterprise Solutions business group also provides a

variety of interoperable corporate infrastructure products, as discussed in the last paragraph of

this section. A number of factors affect the sales and profitability of our infrastructure business,

some of which are to a certain extent outside of our control.

Networks’ net sales depend on the mobile infrastructure market driven by network operator

investments. In low penetration markets, the principal factor influencing operator investments is

the growth in mobile usage and the growth in number of subscribers. This growth in turn leads

to increased demand for mobile network infrastructure as operators seek to build networks and

launch commercial services to meet coverage and capacity requirements. In low penetration

markets, where most networks currently use 2G technology, competition among suppliers is

driven by price, the ability to provide networks and services designed for low total cost of

ownership, and the ability to roll-out and support mobile networks. Investments by network

operators in low penetration markets may also depend on regulatory developments, such as the

availability, number and cost of telecommunications licenses. 3G/WCDMA deployment plans may

also have an impact on the size and speed of operators’ 2G investments.

In more developed markets, operator investments are driven primarily by the decision to expand

the capacity of existing networks or upgrade them in order to incorporate new technologies, such

as 3G/WCDMA, and next generation core. The demand for and commercial acceptance of such new

technologies is largely dependent upon the attractiveness of related services, the pricing of 3G

mobile devices, and the further maturity of 3G technologies as well as local regulation. In 3G,

vendors compete on the basis of price, track record of network implementations, and which future

technologies they plan to offer and when.

In 2005, according to our estimates, the value of the mobile infrastructure market increased

approximately 10% from 2004, while in 2004 it increased by approximately 14% from 2003 in

euro terms. Subscriber growth combined with increased voice usage in some markets has been

the main driver for the 2005 market growth. Investments in 3G also contributed positively to

market growth in Western Europe, Asia-Pacific and the US.

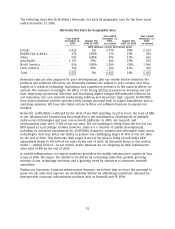

The following chart sets forth the global mobile infrastructure market size by geographic area,

based on Nokia’s estimates, for the three years ended December 31, 2005. Nokia’s estimate of the

value of the mobile infrastructure market includes sales of mobile infrastructure equipment and

related services for all cellular standards.

49