Nokia 2005 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

39. Differences between International Financial Reporting Standards and US Generally

Accepted Accounting Principles (Continued)

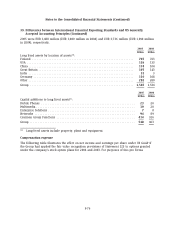

Estimated future benefits payments, which reflect expected future service, as appropriate, are

expected to be paid as follows:

Domestic Foreign

Pension Pension

Benefits Benefits

EURm EURm

2006 ............................................................. 9 9

2007 ............................................................. 13 9

2008 ............................................................. 15 10

2009 ............................................................. 16 10

2010 ............................................................. 18 10

2011–2015 ........................................................ 105 62

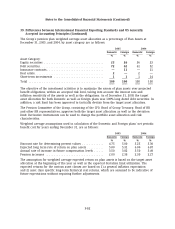

Reclassification of foreign currency translation

Net foreign exchange gains/(losses) of EUR (161) million, EUR (54) million and EUR 182 million are

included in the determination of net income under US GAAP of which EUR 418 million, EUR (345)

million and EUR (717) million are included in cost of sales for the year ended December 31, 2005,

2004, and 2003, respectively. EUR (568) million, EUR 283 million and EUR 867 million of the net

foreign exchange gains/(losses) are included in the determination of net sales in 2005, 2004 and

2003, respectively.

Reclassification to financial income and expense

Under IFRS, certain net gains of EUR 0 million, EUR 137 million, EUR 65 million in 2005, 2004 and

2003, respectively, have been classified as other operating income in 2005 and 2004, and as a

reduction of cost of sales in 2003. These gains resulted from instruments held for operating

purposes that were considered to be non-hedging derivatives under US GAAP and are classified as

financial income and expense.

Included within the EUR 137 million net gain recognized in 2004 is EUR 160 million, representing

the premium return under a multi-line, multi-year insurance program, see Note 8. Under US GAAP,

this gain represents the settlement of a call option on the counter party’s interest in an

unconsolidated reinsurance subsidiary.

Reclassification of bank and cash

Under US GAAP, bank overdrafts of EUR 46 million and EUR 21 million in 2005 and 2004,

respectively, for which there is a legal right of offset are excluded from short-term borrowings and

included within bank and cash, which has been reflected in total US GAAP assets of

EUR 22,661 million and EUR 22,921 million, respectively.

Reclassification of treasury stock retirement

Under IFRS, the accounting treatment for treasury stock retirement involves an increase in the

share premium account corresponding to the reduction in share capital for the nominal value of

treasury stock retired. Treasury stock is reduced by the acquisition cost of retired treasury stock

with a corresponding reduction in retained earnings.

F-83