Nokia 2005 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227

|

|

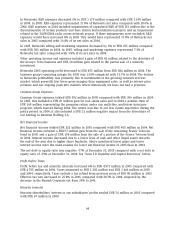

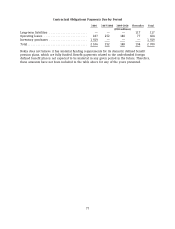

Enterprise Solutions

The following table sets forth selective line items and the percentage of net sales that they

represent for the Enterprise Solutions business group for the fiscal years 2004 and 2003.

Year ended Year ended

December 31, December 31, Percentage

2004 Percentage of 2003 Percentage of Increase/

As revised Net Sales As revised Net Sales (decrease)

(EUR millions, except percentage data)

Net sales .................. 839 100.0% 540 100.0% 55%

Cost of sales ................ (475) (56.6)% (288) (53.3)% 65%

Gross profit ................ 364 43.4% 252 46.7% 44%

Research and development

expenses ................. (304) (36.2)% (239) (44.3)% 27%

Selling, general and

administrative expenses .... (264) (31.5)% (153) (28.3)% 73%

Amortization of goodwill ..... (6) (0.7)% (3) (0.6)% 100%

Operating loss .............. (210) (25.0)% (143) (26.5)% 47%

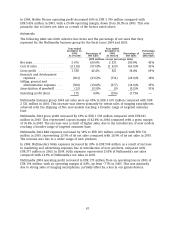

Enterprise Solutions business group 2004 net sales grew 55% to EUR 839 million compared with

EUR 540 million in 2003 primarily as a result of increased sales of business-focused mobile

devices.

In Enterprise Solutions gross profit increased by 44% to EUR 364 million due to higher sales,

compared with EUR 252 million in 2003. This represented a gross margin of 43.4% in 2004

compared with a gross margin of 46.7% in 2003.

In Enterprise Solutions R&D expenses increased by 27% to EUR 304 million due to wider range of

new products compared with 2003 (EUR 239 million) representing 36.2% of its net sales (44.3% of

its net sales compared with 2003).

In 2004, Enterprise Solutions SG&A expenses increased by 73% to EUR 264 million as a result of

increase in marketing and advertising expenses due to introduction of new products, compared

with EUR 153 million in 2003. In 2004 SG&A expenses represented 31.5% of Enterprise Solutions

net sales (28.3% of Enterprise Solutions net sales compared with 2003).

Enterprise Solutions operating loss increased 47% to EUR 210 million in 2004 compared with a

loss of EUR 143 million in 2003, with an operating margin of -25.0%, compared with an operating

margin of -26.5% in 2003. The operating loss was in line with our expectations.

68