Nokia 2005 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

38. Risk management (Continued)

b) Credit risk

Structured Finance Credit Risk

Network operators in some markets sometimes require their suppliers to arrange or provide term

financing in relation to infrastructure projects. Nokia has maintained a financing policy aimed at

close cooperation with banks, financial institutions and Export Credit Agencies to support selected

customers in their financing of infrastructure investments. Nokia actively mitigates, market

conditions permitting, this exposure by arrangements with these institutions and investors.

Credit risks related to customer financing are systematically analyzed, monitored and managed by

Nokia’s Customer Finance organization, reporting to the Chief Financial Officer. Credit risks are

approved and monitored by Nokia’s Credit Committee along principles defined in the Company’s

credit policy and according to the credit approval process. The Credit Committee consists of the

CFO, Group Controller, Head of Group Treasury and Head of Nokia Customer Finance.

At the end of December 31, 2005, our long-term loans to customers and other third parties totaled

EUR 63 million (no outstanding loans in 2004), while there was nil financial guarantees given on

behalf of third parties (EUR 3 million in 2004). In addition, we had financing commitments totaling

EUR 13 million, which does not, however, increase total outstanding and committed credit risk

from EUR 63 million, as it is available only provided that outstanding loan EUR 56 million is

repaid. Total structured financing (outstanding and committed) stood at EUR 63 million

(EUR 59 million in 2004).

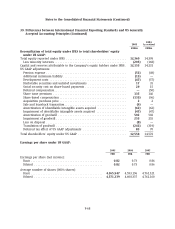

The term structured financing portfolio at December 31, 2005 was:

Financing

Outstanding commitments Total

EURm EURm EURm

Total Portfolio ........................................ 63 13 63

The term structured financing portfolio at December 31, 2005 mainly consists of outstanding and

committed customer financing to a network operator.

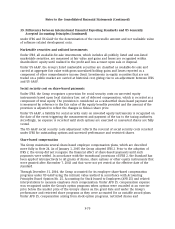

Financial credit risk

Financial instruments contain an element of risk of the counterparties being unable to meet their

obligations. This risk is measured and monitored by the Treasury function. The Group minimizes

financial credit risk by limiting its counterparties to a sufficient number of major banks and

financial institutions, as well as through entering into netting arrangements, which gives the

Company the right to offset in the case that the counterparty would not be able to fulfill the

obligations.

Direct credit risk represents the risk of loss resulting from counterparty default in relation to

on-balance sheet products. The fixed income and money market investment decisions are based on

strict creditworthiness criteria. The outstanding investments are also constantly monitored by the

Treasury. Nokia does not expect the counterparties to default given their high credit quality.

F-62