Nokia 2005 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227

|

|

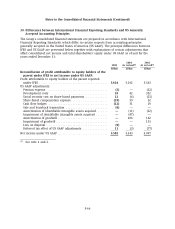

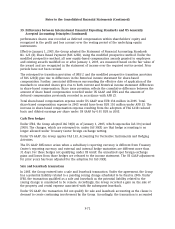

Notes to the Consolidated Financial Statements (Continued)

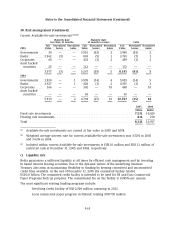

38. Risk management (Continued)

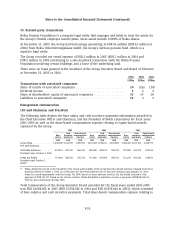

Current Available-for-sale investments(1)(2)(3)

Maturity date Maturity date

less than 12 months 12 months or more Total

Fair Unrealized Unrealized Fair Unrealized Unrealized Fair Unrealized Unrealized

2005 Value Losses Gains Value Losses Gains Value Losses Gains

Governments . . . 30 — — 3,919 (32) 2 3,949 (32) 2

Banks ......... 2,962 (3) — 803 (5) 1 3,765 (7) 1

Corporates ..... 60 — — 433 (1) 2 459 (1) 2

Asset backed

securities .... 25 — — 112 — — 172 — —

3,077 (3) — 5,267 (38) 5 8,345 (41) 5

2004

Governments . . . 1,820 — 1 3,999 (14) 4 5,819 (14) 5

Banks ......... 3,927 — 1 428 (1) 2 4,355 (1) 3

Corporates ..... 166 — — 302 — 10 468 — 10

Asset backed

securities .... — — — 65 — — 65 — —

5,913 — 2 4,794 (15) 16 10,707 (15) 18

2005 2004

EURm EURm

Fixed rate investments ................................................ 7,531 10,429

Floating rate investments .............................................. 814 278

Total .............................................................. 8,345 10,707

(1) Available-for-sale investments are carried at fair value in 2005 and 2004.

(2) Weighted average interest rate for current available-for-sale investments was 3.52% in 2005

and 3.63% in 2004.

(3) Included within current Available-for-sale investments is EUR 10 million and EUR 11 million of

restricted cash at December 31, 2005 and 2004, respectively.

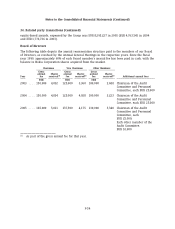

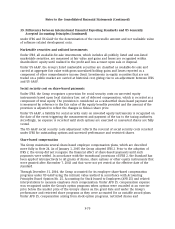

c) Liquidity risk

Nokia guarantees a sufficient liquidity at all times by efficient cash management and by investing

in liquid interest bearing securities. Due to the dynamic nature of the underlying business

Treasury also aims at maintaining flexibility in funding by keeping committed and uncommitted

credit lines available. At the end of December 31, 2005 the committed facility totaled

USD 2.0 billion. The committed credit facility is intended to be used for US and Euro Commercial

Paper Programs back up purposes. The commitment fee on the facility is 0.045% per annum.

The most significant existing funding programs include:

Revolving Credit Facility of USD 2,000 million, maturing in 2012

Local commercial paper program in Finland, totaling EUR 750 million

F-63