Nokia 2005 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

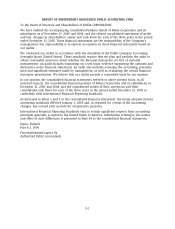

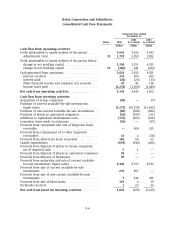

Nokia Corporation and Subsidiaries

Consolidated Statements of Changes in Shareholders’ Equity

Fair

value

Share and Before

Number of Share issue Treasury Translation other Retained minority Minority

shares capital premium shares differences reserves earnings interests interests Total

(000’s)

Group, EURm

Balance at January 1, 2003 ....... 4,786,762 287 2,225 (20) 135 (7) 11,661 14,281 173 14,454

Impact of implementing IAS 39(R) . . (21) 21

Revised balance at January 1, 2003 .4,786,762 287 2,225 (20) 135 (28) 11,682 14,281 173 14,454

Tax benefit on stock options

exercised ................ 13 13 13

Translation differences ......... (375) (375) (33) (408)

Net investment hedge gains ..... 155 155 155

Cash flow hedges, net of tax(1) .... 10 10 10

Available-for-sale investments, net

of tax .................. 98 98 98

Other increase, net ........... 40 40 8 48

Profit(1) ................... 3,543 3,543 54 3,597

Total recognized income and

expense .................. — 13 — (220) 108 3,583 3,484 29 3,513

Share issue related to acquisitions . 1,225 18 18 18

Stock options exercised ........ 7,160 1 22 23 23

Stock options exercised related to

acquisitions .............. (6) (6) (6)

Share-based compensation(1)(2) .... 41 41 41

Acquisition of treasury shares .... (95,339) (1,363) (1,363) (1,363)

Reissuance of treasury shares .... 460 10 10 10

Dividend .................. (1,340) (1,340) (38) (1,378)

Total of other equity movements .. 1 75 (1,353) — — (1,340) (2,617) (38) (2,655)

Revised balance at December 31,

2003 .................... 4,700,268 288 2,313 (1,373) (85) 80 13,925 15,148 164 15,312

Translation differences ......... (119) (119) (16) (135)

Net investment hedge gains ..... 78 78 78

Cash flow hedges, net of tax(1) .... (1) (1) (1)

Available-for-sale investments, net

of tax .................. (66) (66) (66)

Other decrease, net ........... (1) (1) (5) (6)

Profit(1) ................... 3,192 3,192 67 3,259

Total recognized income and

expense .................. — — — (41) (67) 3,191 3,083 46 3,129

Stock options exercised ........ 5 — — —

Stock options exercised related to

acquisitions .............. (8) (8) (8)

Share-based compensation(1)(2) .... 53 53 53

Acquisition of treasury shares .... (214,120) (2,661) (2,661) (2,661)

Reissuance of treasury shares .... 788 14 14 14

Cancellation of treasury shares .... (8) 8 1,998 (1,998) — —

Dividend .................. (1,398) (1,398) (42) (1,440)

Total of other equity movements .. (8) 53 (649) — — (3,396) (4,000) (42) (4,042)

Revised balance at December 31,

2004 .................... 4,486,941 280 2,366 (2,022) (126) 13 13,720 14,231 168 14,399

(1) 2003 and 2004 financial statements have been revised to reflect the retrospective implementation of IFRS 2 and IAS 39(R). See Note 2.

F-6