Nokia 2005 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

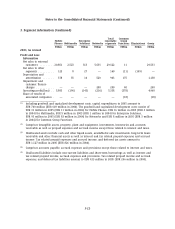

1. Accounting principles (Continued)

Warranty provisions

The Group provides for the estimated cost of product warranties at the time revenue is recognized.

The Group’s warranty provision is established based upon best estimates of the amounts necessary

to settle future and existing claims on products sold as of the balance sheet date. As new products

incorporating complex technologies are continuously introduced, and as local laws, regulations

and practices may change, changes in these estimates could result in additional allowances or

changes to recorded allowances being required in future periods.

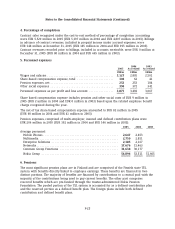

Provision for intellectual property rights, or IPR, infringements

The Group provides for the estimated future settlements related to asserted and unasserted IPR

infringements based on the probable outcome of each infringement. IPR infringement claims can

last for varying periods of time, resulting in irregular movements in the IPR infringement

provision. The ultimate outcome or actual cost of settling an individual infringement may

materially vary from estimates.

Legal contingencies

Legal proceedings covering a wide range of matters are pending or threatened in various

jurisdictions against the Group. Provisions are recorded for pending litigation when it is

determined that an unfavorable outcome is probable and the amount of loss can be reasonably

estimated. Due to the inherent uncertain nature of litigation, the ultimate outcome or actual cost

of settlement may materially vary from estimates.

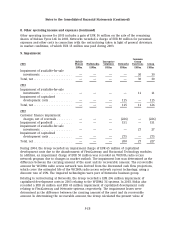

Capitalized development costs

The Group capitalizes certain development costs when it is probable that a development project

will generate future economic benefits and certain criteria, including commercial and technical

feasibility, have been met. Should a product fail to substantiate its estimated feasibility or life

cycle, material development costs may be required to be written off in future periods.

Valuation of long-lived and intangible assets and goodwill

The Group assesses the carrying value of identifiable intangible assets, long-lived assets and

goodwill annually, or more frequently if events or changes in circumstances indicate that such

carrying value may not be recoverable. Factors that trigger an impairment review include

underperformance relative to historical or projected future results, significant changes in the

manner of the use of the acquired assets or the strategy for the overall business and significant

negative industry or economic trends. The most significant variables in determining cash flows are

discount rates, terminal values, the number of years on which to base the cash flow projections,

as well as the assumptions and estimates used to determine the cash inflows and outflows.

Amounts estimated could differ materially from what will actually occur in the future.

Fair value of derivatives and other financial instruments

The fair value of financial instruments that are not traded in an active market (for example,

unlisted equities, currency options and embedded derivatives) are determined using valuation

techniques. The Group uses judgment to select an appropriate valuation methodology as well as

underlying assumptions based on existing market practice and conditions. Changes in these

assumptions may cause the Group to recognize impairments or losses in future periods.

F-18