Nokia 2005 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

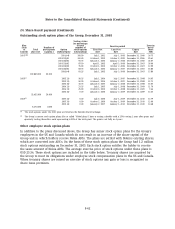

Notes to the Consolidated Financial Statements (Continued)

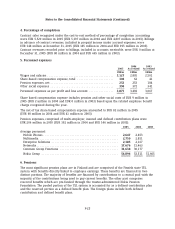

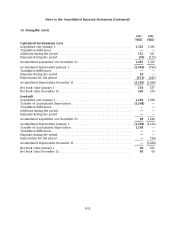

16. Investments in associated companies

2005 2004

EURm EURm

Net carrying amount January 1 ........................................... 200 76

Additions ............................................................ 12 150

Deductions ........................................................... (17) —

Share of results ....................................................... 10 (26)

Translation differences .................................................. 81

Other movements ...................................................... (20) (1)

Net carrying amount December 31 ........................................ 193 200

In 2005, the Group disposed part of its 36.2% minority holding in Aircom Ltd. resulting to a

holding of 10%. The gain on the sale recorded in other operating income was EUR 18 million. The

Group’s remaining 10% holding in Aircom shares is recorded as a non-current available-for-sale

investment.

In 2004, the Group increased its ownership in Symbian from 32.2% to 47.9% by acquiring part of

the shares of Symbian owned by Psion for EUR 102 million (GBP 70 million). EUR 68 million

(GBP 47 million) of the total acquisition cost was paid in cash and the remaining purchase price is

considered as contingent consideration to be paid in 2005 and 2006. The Group also participated

in a rights issue to raise EUR 73 million (GBP 50 million) additional funding to Symbian. The issue

was pro rata to existing shareholders.

Shareholdings in associated companies are comprised of investments in unlisted companies in all

periods presented.

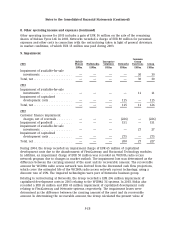

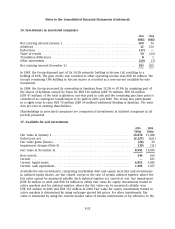

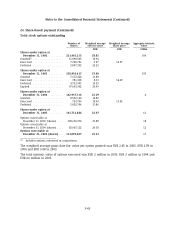

17. Available-for-sale investments

2005 2004

EURm EURm

Fair value at January 1 ............................................... 10,876 11,088

Deductions, net ..................................................... (2,227) (221)

Fair value gains (losses) .............................................. (28) 20

Impairment charges (Note 9) .......................................... (30) (11)

Fair value at December 31 ............................................ 8,591 10,876

Non-current ........................................................ 246 169

Current ........................................................... —255

Current, liquid assets ................................................ 6,852 9,085

Current, cash equivalents ............................................. 1,493 1,367

Available-for-sale investments, comprising marketable debt and equity securities and investments

in unlisted equity shares, are fair valued, except in the case of certain unlisted equities, where the

fair value cannot be measured reliably. Such unlisted equities are carried at cost, less impairment

(EUR 82 million in 2005 and EUR 54 million in 2004). Fair value for equity investments traded in

active markets and for unlisted equities, where the fair value can be measured reliably, was

EUR 165 million in 2005 and EUR 115 million in 2004. Fair value for equity investments traded in

active markets is determined by using exchange quoted bid prices. For other investments, fair

value is estimated by using the current market value of similar instruments or by reference to the

F-35