Nokia 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 20-F 2005

Table of contents

-

Page 1

Form 20-F 2005 -

Page 2

The device on the cover is a Nokia 6131. -

Page 3

..., Finland (Address of principal executive offices) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered American Depositary Shares Shares, par value EUR 0.06 (1) New York Stock Exchange New York Stock Exchange(1) Not for trading... -

Page 4

... ...FINANCIAL INFORMATION ...Consolidated Statements and Other Financial Information ...Significant Changes ...THE OFFER AND LISTING ...Offer and Listing Details ...Plan of Distribution ...Markets ...Selling Shareholders ...Dilution ...Expenses of the Issue ...ADDITIONAL INFORMATION ...Share Capital... -

Page 5

...PART II DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES ...MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS ...CONTROLS AND PROCEDURES ...AUDIT COMMITTEE FINANCIAL EXPERT ...CODE OF ETHICS ...PRINCIPAL ACCOUNTANT FEES AND SERVICES ...EXEMPTIONS FROM THE LISTING STANDARDS... -

Page 6

... generally delivers these consolidated financial statements to record holders of American Depositary Receipts, or ADRs, evidencing American Depositary Shares, or ADSs. One ADS represents one share. We also furnish the Depositary with quarterly reports containing unaudited financial information... -

Page 7

... to ensure the quality, safety, security and timely delivery of our products and solutions; • inventory management risks resulting from shifts in market demand; • our ability to source quality components without interruption and at acceptable prices; • our success in collaboration arrangements... -

Page 8

... currency, and the US dollar, the Chinese yuan, the UK pound sterling and the Japanese yen; • the management of our customer financing exposure; • our ability to recruit, retain and develop appropriately skilled employees; and • the impact of changes in government policies, laws or regulations... -

Page 9

... annual report on Form 20-F. Financial data at December 31, 2001 and 2002, and December 31, 2003, as revised, and for each of the years in the two-year period ended December 31, 2002 have been derived from Nokia's previously published audited consolidated financial statements not included in this... -

Page 10

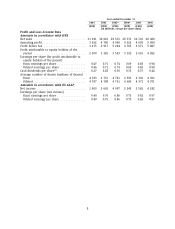

2001 (EUR) Year ended December 31, 2002 2003* 2004* 2005 (EUR) (EUR) (EUR) (EUR) (in millions, except per share data) 2005 (USD) Profit and Loss Account Data Amounts in accordance with IFRS Net sales ...Operating profit ...Profit before tax ...Profit attributable to equity holders of the parent ... -

Page 11

... equity holders of the parent ...Minority interests ...Long-term interest-bearing liabilities ...Other long-term liabilities ...Borrowings due within one year ...Other current liabilities ...Net interest-bearing debt ...Share capital ...Amounts in accordance with US GAAP Total assets ...Shareholders... -

Page 12

... Companies Act, but also to the rules of the stock exchanges on which the repurchases take place. The Board of Directors of Nokia has been regularly authorized by our shareholders in the Annual General Meetings to repurchase Nokia's own shares: 225 million shares in 2001, 220 million shares in 2002... -

Page 13

Federal Reserve Bank of New York (the ''noon buying rate'') on the respective dividend payment dates. EUR per share USD per ADS EUR millions (in total) 2001 2002 2003 2004 2005 (1) ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... -

Page 14

... use mobile devices. Second, while participants in the mobile communications industry once provided complete products and solutions, industry players are increasingly providing specific hardware and software layers for products and solutions. As a result of these changes, new market segments within... -

Page 15

... portfolio. For Nokia, a competitive mobile device product portfolio means a broad and balanced offering of commercially appealing mobile devices with attractive features, functionality and design for all major consumer segments and price points supported by the Nokia brand, quality and competitive... -

Page 16

... our profitability, may be materially adversely affected if we do not successfully manage price erosion and are not able to manage costs related to our products and operations. Price erosion is a characteristic of the mobile communications industry, and the products and solutions offered by... -

Page 17

... product portfolios, price, operational and manufacturing efficiency, technical performance, product features, quality, customer support and brand recognition. We are facing increased competition from both our traditional competitors in the mobile communications industry as well as a number of new... -

Page 18

... on our sales, our results of operations and reputation, and the value of the Nokia brand. We depend on a limited number of suppliers for the timely delivery of components and for their compliance with our supplier requirements, such as our and our customers' product quality, safety, security and... -

Page 19

... foresee or prevent; the technologies, products or solutions supplied by the companies that work with us do not meet the required quality, safety, security and other standards or customer needs; our own quality controls fail; or the financial condition of the companies that work with us deteriorates... -

Page 20

...to renew or finalize such arrangements with acceptable commercial terms may result in costly and time-consuming litigation, and any adverse result in any such litigation may lead to restrictions on our ability to sell certain products or solutions, and could result in payments that potentially would... -

Page 21

..., the number of our customers may diminish due to operator consolidation. This will increase our reliance on fewer larger customers, which may negatively impact our bargaining position, sales and profitability. Our sales derived from, and assets located in, emerging market countries may be... -

Page 22

... consolidated financial statements included in Item 18 of this annual report on Form 20-F for a more detailed discussion of issues relating to customer financing, trade credits and related commercial credit risk. Allegations of health risks from the electromagnetic fields generated by base stations... -

Page 23

... imposed on our products, environmental, product safety and security and other regulations that adversely affect the export, import, pricing or costs of our products and solutions, as well as new services related to our products, could adversely affect our net sales and results of operations. The... -

Page 24

...customers and suppliers, potential litigation involving ourselves or our industry, and announcements concerning the success of new products and services, as well as general market volatility. See ''Item 9.A Offer and Listing Details'' for information regarding the trading price history of our shares... -

Page 25

... INFORMATION ON THE COMPANY 4.A History and Development of the Company Nokia is the world's largest manufacturer of mobile devices and a leader in mobile network equipment, solutions and services. We also provide equipment, solutions and services for corporate customers. For 2005, Nokia's net sales... -

Page 26

... our consolidated financial statements included in Item 18 of this annual report on Form 20-F. Nokia maintains listings on four major securities exchanges. The principal trading markets for the shares are the New York Stock Exchange, in the form of American Depositary Shares, and the Helsinki Stock... -

Page 27

.... We believe that replacement sales will be driven by camera phones, 3G/WCDMA devices, smartphones, continued penetration of color displays, music features, mobile multimedia services and general aesthetic trends. According to our estimates the global 3G/WCDMA market totaled 44 million units in 2005... -

Page 28

... such as downloading music to become more prevalent, while mobile TV is expected to become available in select markets and to reach mass market by 2008. In the longer term, the use of mobile devices for close range communication with and sending of content to home televisions, entertainment systems... -

Page 29

...are carried mainly by the three mobile device business groups, with the balance included in Common Group Expenses. Customer and Market Operations is responsible for marketing, sales, sourcing, manufacturing and logistics for mobile devices from Mobile Phones, Multimedia and Enterprise Solutions. The... -

Page 30

.... In voice-centric and mainstream mobile phones, we believe that design, brand, ease of use and price are our customers' most important considerations. Increasingly, our product portfolio includes new features and functionality designed to appeal to the mass market, such as megapixel cameras, music... -

Page 31

...operators are mainly in the United States, China, India, Indonesia, Australia, Brazil and some other Latin American markets. In 2005, we continued to expand our CDMA portfolio. Products introduced include the Nokia 6265 slide design phone with a 2-megapixel camera and Bluetooth connectivity, and the... -

Page 32

... and marketing accessory products and car communications solutions. Highlights include: • During the third quarter of 2005 we started shipping the Nokia N90, featuring Carl Zeiss optics for video and still imaging, and the Nokia N70, a small device with a 2-megapixel camera. • Upcoming products... -

Page 33

...began shipping in December 2005. Enterprise Solutions business group comprises four main units: Mobile Devices; Mobility Solutions; Security and Mobile Connectivity; and Sales, Marketing and Services. The Mobile Devices unit produces mobile devices specifically designed for business use. Our product... -

Page 34

... and Value Added Resellers, or VARs, that integrate Nokia gateways with Checkpoint software for customers. Nokia also provides end user and reseller support for these security products. The Sales, Marketing and Services unit is responsible for sales to corporate customers, the management of... -

Page 35

... managed services deals. The company announced plans to open a services-focused Nokia Global Networks Solutions Center in Chennai, India during the first half of 2006. Other developments in 2005 included the announcement of a joint venture with China Putian to focus on R&D, as well as manufacturing... -

Page 36

...group. For example, Enterprise Solutions manages sales of our security and mobile connectivity products and Nokia Business Center to certain resellers or systems integrators who contribute value, such as consulting services or additional software, before distribution. Networks' sales channels mainly... -

Page 37

... competence and competitive advantage. Our Customer and Market Operations horizontal group currently operates nine mobile device manufacturing plants in eight countries. Our Mexican and Brazilian plants primarily supply the North and South American markets. Three European plants, located in Finland... -

Page 38

... Networks business group operated five production plants, three in Finland and two in China. During 2005, Nokia announced that it intends to establish a high-end base station controller manufacturing unit in Chennai, India, with production expected to commence in 2006. In line with our strategy to... -

Page 39

... end-user services. Further, we focus on creating open hardware and software architecture, which results in research and development costs being spread among industry players. Our business groups improve R&D efficiency and speed time to market by often basing their products on the same technologies... -

Page 40

...the Nokia Research Center Cambridge. Competition Mobile Devices Mobile phone market participants compete mainly on the basis of the breadth and depth of their product portfolios, price, operational and manufacturing efficiency, technical performance, product features, quality, customer support, and... -

Page 41

... companies in the development of GSM/GPRS/EDGE/WCDMA technologies, and that we hold a strong patent position in this field. Nokia is a holder of numerous essential patents for various mobile communications standards. An essential patent covers a feature or function that is incorporated into an open... -

Page 42

...to develop or otherwise acquire these complex technologies as required by the market, with full rights needed to use in our business, or to successfully commercialize such technologies as new advanced products and solutions that meet customer demand, or fail to do so on a timely basis, this may have... -

Page 43

... of new technological or legal requirements could impact products, wireless services and solutions, manufacturing or distribution processes, and could affect the timing of product introductions, the cost of production, and the commercial success of products. Our net sales and results of... -

Page 44

... life balance: health & safety, flexible working hours, telecommuting opportunities, leave and benefits. 4.C Organizational Structure The following is a list of Nokia's significant subsidiaries as of December 31, 2005. Country of Incorporation Nokia Ownership Interest Nokia Voting Interest Company... -

Page 45

..., Plants and Equipment At December 31, 2005, Nokia operated 14 manufacturing facilities in eight countries around the world. None of these facilities is subject to a material encumbrance. The following is a list of their location, use and capacity. Productive Capacity, Net (m2)(1) Country Location... -

Page 46

... equipment, solutions and services for corporate customers. Nokia is organized in four business groups: Mobile Phones, Multimedia, Enterprise Solutions and Networks. There are also two horizontal groups that support the mobile device business groups: Customer and Market Operations and Technology... -

Page 47

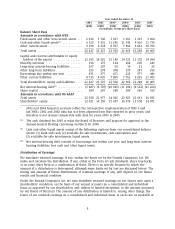

.... Net Sales and Operating Profit by Business Group 2005 Operating Profit/(Loss) Year ended December 31, 2004, As revised* Net Operating Sales Profit/(Loss) (EUR millions) 2003, As revised* Net Operating Sales Profit/(Loss) Net Sales Mobile Phones ...Multimedia ...Enterprise Solutions ...Networks... -

Page 48

... Solutions business group. Our principal customers are mobile network operators, distributors, independent retailers and corporate customers. Our product portfolio covers all major user segments and price points from entry-level to mid-range and high-end devices offering voice, data, multimedia... -

Page 49

... CDMA technology, resulted in our volumes and market share declining compared to 2004. However, we closed the year with sequential and year on year market share gains in the fourth quarter, thanks to improvements in our clamshell and CDMA product offerings. Nokia's device ASP (average selling price... -

Page 50

... by secure mobile voice, data and business applications. With our Enterprise Solutions business group we intend to capture profitable segments of the enterprise market by offering products and services designed to help enterprises improve their performance by extending their use of mobility with... -

Page 51

.... We believe that replacement sales will be driven by camera phones, 3G/WCDMA devices, smartphones, continued penetration of color displays, music features, mobile multimedia services and general aesthetic trends. According to our estimates the global 3G/WCDMA market totaled 44 million units in 2005... -

Page 52

....2 Total ... Networks' sales and profitability are also affected by the product mix. The share of 3G/WCDMA projects increased from about 17% in 2004 to about 20% in 2005 while the average gross margin in 3G/WCDMA projects improved close to our average group margin of Networks. Service related sales... -

Page 53

... 5 635 Total ... Networks sales are also impacted by price developments. Like our mobile devices business, the products and solutions offered by our Networks business are subject to price erosion over time, largely as a result of technology maturation and competitive pressures in the markets where... -

Page 54

... results of operations, financial position, or cash flows in 2006. Telsim settlement As previously agreed with Telsim and the Turkish Savings and Deposit Insurance Fund (TMSF), which currently controls and manages Telsim's assets, Nokia will receive a settlement payment upon completion of the sale... -

Page 55

... than half of Nokia's profit before tax has been generated in Finland. See also Note 13 to our consolidated financial statements for a further discussion of our income taxes. Seasonality Our device sales are somewhat affected by seasonality. Historically, the first quarter of the year was the lowest... -

Page 56

...agreed customer inventories at the date of the price adjustment. An immaterial part of the revenue from products sold through distribution channels is recognized when the reseller or distributor sells the product to the end user. Networks' revenue and cost of sales from contracts involving solutions... -

Page 57

... collections. See also Note 38(b) to our consolidated financial statements for a further discussion of long-term loans to customers and other parties. Allowances for doubtful accounts We maintain allowances for doubtful accounts for estimated losses resulting from the subsequent inability of our... -

Page 58

... development of new technologies is between two to five years. During the development stage, management must estimate the commercial and technical feasibility of these projects as well as their expected useful lives. Should a product fail to substantiate its estimated feasibility or life cycle, we... -

Page 59

... the cash inflows and outflows. Management determines discount rates to be used based on the risk inherent in the related activity's current business model and industry comparisons. Terminal values are based on the expected life of products and forecasted life cycle and forecasted cash flows over... -

Page 60

... to the consolidated financial statements and include, among others, the dividend yield, expected volatility and expected life of the options. The expected life of options is estimated by observing general option holder behavior and actual historical terms of Nokia stock option programs, whereas the... -

Page 61

...Year ended December 31, Percentage of 2004 Percentage of Net Sales As revised Net Sales (EUR millions, except percentage data) Percentage Increase/ (decrease) Net sales ...Cost of sales ...Gross profit ...Research and development expenses ...Selling and marketing expenses Administrative and general... -

Page 62

...would have represented 11.1% of Nokia net sales in 2005 compared with 12.5% of Nokia net sales in 2004. Selling and marketing expenses increased in Mobile Phones, Multimedia and Enterprise Solutions due to increased marketing spend in the device business groups and decreased spending in Networks. In... -

Page 63

...Year ended December 31, Percentage of 2004 Percentage of Net Sales As revised Net Sales (EUR millions, except percentage data) Percentage Increase/ (decrease) Net sales ...Cost of sales ...Gross profit ...Research and development expenses ...Selling and marketing expenses Administrative and general... -

Page 64

...Year ended December 31, Percentage of 2004 Percentage of Net Sales As revised Net Sales (EUR millions, except percentage data) Percentage Increase/ (decrease) Net sales ...Cost of sales ...Gross profit ...Research and development expenses ...Selling and marketing expenses Administrative and general... -

Page 65

...Year ended December 31, Percentage of 2004 Percentage of Net Sales As revised Net Sales (EUR millions, except percentage data) Percentage Increase/ (decrease) Net sales ...Cost of Sales ...Gross profit ...Research and development expenses ...Selling and marketing expenses Administrative and general... -

Page 66

... investments in the growing network services market, which generally has lower gross margins than equipment sales, as well as intense price pressure and our ongoing push into markets where historically we have not had a presence. Common Group Expenses Common Group expenses totaled EUR 392 million in... -

Page 67

... Year ended December 31, Percentage of 2003 Percentage of Net Sales As revised Net Sales (EUR millions, except percentage data) Percentage Increase/ (decrease) Net sales ...Cost of sales ...Gross profit ...Research and development expenses ...Selling, general and administrative expenses ...Customer... -

Page 68

... profit in Networks and Multimedia. Our operating margin was 14.7% in 2004 compared with 16.8% in 2003. Results by Segments Mobile Phones The following table sets forth selective line items and the percentage of net sales that they represent for the Mobile Phones business group for the fiscal years... -

Page 69

... profit (loss) ... Multimedia business group 2004 net sales were up 45% to EUR 3 676 million compared with EUR 2 531 million in 2003. This increase was driven primarily by robust sales of imaging smartphones, achieved with the shipping of five new models reaching a broader range of targeted customer... -

Page 70

... 65% 44% 27% 73% 100% 47% Operating loss ... Enterprise Solutions business group 2004 net sales grew 55% to EUR 839 million compared with EUR 540 million in 2003 primarily as a result of increased sales of business-focused mobile devices. In Enterprise Solutions gross profit increased by 44% to EUR... -

Page 71

..., by ceasing some ongoing research and development projects, resulting in a reduction of the number of R&D employees. Networks did this to bring sharper focus and lower cost to research and development, and to position Networks for long-term profitability. If the impairments and write-offs... -

Page 72

...issued by France Telecom. As a result, the company booked a total net gain of EUR 106 million. The bonds had been classified as available-for-sale investments and fair valued through shareholders' equity. Profit Before Taxes Profit before tax and minority interests decreased 11% to EUR 4 705 million... -

Page 73

..., executive officer or 5% shareholder. There are no material transactions with enterprises controlling, controlled by or under common control with Nokia or associates of Nokia. See Note 34 to our consolidated financial statements included in Item 18 of this annual report on Form 20-F. Exchange... -

Page 74

...US GAAP that affect our net profit or loss, as well as our shareholders' equity, relate to the treatment of capitalization and impairment of development costs, pension costs, provision for social security costs on share-based payments, share-based compensation expense, identifiable intangible assets... -

Page 75

... resulted from an increased number of share buybacks. The change in 2004 resulted from both our continued good profitability and the improvements in our cash and other liquid assets position reflecting the increased amount of share buy-backs. The total dividends per share were EUR 0.37 for the year... -

Page 76

... loan of EUR 56 million is repaid. The guarantees of EUR 3 million outstanding in 2004 were released. See Notes 9 and 38(b) to our consolidated financial statements included in Item 18 of this annual report on Form 20-F for additional information relating to our committed and outstanding customer... -

Page 77

...financial statements included in Item 18 of this annual report on Form 20-F for further information regarding commitments and contingencies. 5.C Research and Development, Patents and Licenses Success in the mobile communications industry requires continuous introduction of new products and solutions... -

Page 78

...20 882 people in research and development, representing approximately 36% of Nokia's total workforce. Research and development expenses of Mobile Phones as a percentage of its net sales were 6.0% in 2005 compared with 6.5% in 2004 and 4.9% in 2003. In Multimedia, research and development expenses as... -

Page 79

... ...Operating leases ...Inventory purchases ...Total ... - 187 1 919 2 106 - 252 - 252 - 148 - 148 117 77 - 194 117 664 1 919 2 700 Nokia does not believe it has material funding requirements for its domestic defined benefit pension plans, which are fully funded. Benefit payments related to the... -

Page 80

... of Technology). President and CEO, Chairman of the Group Executive Board of Nokia Corporation 1992-1999, President of Nokia Mobile Phones 1990-1992, Senior Vice President, Finance of Nokia 1986-1989. Holder of various managerial positions at Citibank within corporate banking 1978-1985. Member of... -

Page 81

... AT&T 1997-2000, General Manager for the AT&T Online Services Group 1996, President and CEO of AT&T Network Systems International 1991-1995. Various managerial positions in AT&T, including network operations, strategic planning and sales 1977-1991. Member of the Board of Directors of VF Corporation... -

Page 82

... Director, with mergers and acquisitions advisory responsibilities, at Enskilda M&A, Enskilda Securities (London) 1986-1992. Corporate strategy consultant at the Boston Consulting Group (London) 1979-1986. Board member of IKANO Holdings S.A. Edouard Michelin, b. 1963 Managing Partner and CEO... -

Page 83

... be elected as a new member of the Board of Directors for the next one-year term. Keijo Suila, 60, acted as President and CEO of Finnair Oyj, the major Finnish aviation company, from 1999 until his retirement in 2005. Prior to this, Mr. Suila held various senior executive positions, including ¨ Oy... -

Page 84

...Vice President and General Manager of Mobile Phones • Kai Oist and member of the Group Executive Board effective October 1, 2005. The current members of our Group Executive Board are set forth below. Chairman Jorma Ollila, b. 1950 Chairman and CEO of Nokia Corporation. Group Executive Board member... -

Page 85

...2001-2004, Vice President of Sales for Nokia Mobile Phones in Europe and Africa 1998-2001. Simon Beresford-Wylie, b. 1958 Executive Vice President and General Manager of Networks. Group Executive Board member since February 1, 2005. Joined Nokia 1998. Bachelor of Arts (Economic Geography and History... -

Page 86

Olli-Pekka Kallasvuo, b. 1953 President and COO. President and CEO as from June 1, 2006. Group Executive Board member since 1990. With Nokia 1980-81, rejoined 1982. LL.M. (University of Helsinki). Executive Vice President and General Manager of Mobile Phones 2004-2005, Executive Vice President, CFO... -

Page 87

... Vice President & Head of Customer Finance of Nokia Corporation 2001-2003, Managing Director of Telecom & Media Group of Barclays 2001, Head of Global Project Finance and other various positions at Bank of America Securities 1985-2001. Member of the Board of Trustees of International House- New York... -

Page 88

... Management of Mobile Phones 2004-2005, Senior Vice President, Mobile Phones Business Unit of Nokia Mobile Phones 2002-2003, Vice President, TDMA/GSM 1900 Product Line of Nokia Mobile Phones 1999-2002, Vice President, TDMA Product Line 1997-1999, various technical and managerial positions in Nokia... -

Page 89

... President, Technology Platforms, and a member of the Group Executive Board will resign from the Group Executive Board as of April 1, 2006. He will also resign from Nokia. Niklas Savander has been appointed as Executive Vice President, Technology Platforms and a member of the Group Executive Board... -

Page 90

...Board of Directors, as resolved by the Annual General Meetings in the respective years. Since the fiscal year 1999, approximately 60% of each Board member's annual fee has been paid in cash, with the balance in Nokia Corporation shares acquired from the market. Compensation of the Board of Directors... -

Page 91

... position. As from June 1, 2006, Mr. Ollila will no longer be a Nokia employee and his service contract will terminate as of that date without any severance or other payments by Nokia. Thereafter, he will no longer be eligible for incentives, bonuses, stock options or other equity grants from Nokia... -

Page 92

... the company's actual performance to pre-established targets for net sales, operating profit and net working capital measures. Certain executives may also have objectives related to market share, quality, technology innovation, new product revenue, or other objectives of key strategic importance... -

Page 93

... the ''Summary Compensation Table 2005'' on page 94. Long-term equity-based incentives • Long-term equity-based incentive awards in the form of stock options, performance shares and restricted shares are used to align the executives' interests with shareholders' interests, reward performance, and... -

Page 94

... The following tables summarize the aggregate cash compensation paid and the long-term equitybased incentives granted to the members of the Group Executive Board, including Jorma Ollila, Chairman and CEO, for the year 2005. It also shows the long-term equity-based incentives granted in the aggregate... -

Page 95

Long-term equity-based incentives granted in 2005(1) Group Executive Board Other employees Total Total number of participants Performance Shares at Threshold(2) (number) ...Stock Options (number) ...Restricted Shares (number) ...(1) 241 000 1 121 000 508 000 4 228 000 7 431 000 2 509 000 4 469 ... -

Page 96

...Stock Options number Fair Value at grant(5) EUR Restricted Shares number Fair Value at grant(5) EUR Name and Principal Position in 2005 Year Jorma Ollila Chairman and CEO ¨ (7) Pekka Ala-Pietila Until October 1, 2005, President of Nokia Corporation and Head of Customer and Market Operations Olli... -

Page 97

... Executive Board The members the Group Executive Board in 2005 participate in the local retirement programs applicable to employees in the country where they reside. Executives in Finland participate in the Finnish TEL pension system, which provides for a retirement benefit based on years of service... -

Page 98

... service contract, which has been terminated, see ''-Summary Compensation Table 2005'' on page 94. Equity-based compensation programs General Nokia has today three global stock option plans outstanding, two performance share plans and three restricted share plans. After using broad-based employee... -

Page 99

... global stock option plans have been approved by the Annual General Meetings in the year when the plan was launched, i.e. in 2001, 2003 and 2005. Each stock option entitles the holder to subscribe for one new Nokia share with a par value of EUR 0.06. Under the 2001 stock option plan the stock... -

Page 100

...were a total of approximately 1 000 participants. For more information of these plans, see Note 24 ''Share-based payment'' to the consolidated financial statements included in Item 18 of this annual report on Form 20-F. Equity-based compensation program 2006 Nokia's Equity Program 2006 The Board of... -

Page 101

... to equity-based compensation programs we also provide our executives and employees with cash incentive payments through our comprehensive cash incentive plans. These performance-based cash incentives include individual, team and project/program incentive payments as well as the Nokia Connecting... -

Page 102

... in the New York Stock Exchange's corporate governance listing standards, as amended in ¨ was determined to be November 2004. In addition to the Chairman, Bengt Holmstrom non-independent due to a family relationship with an executive officer of a Nokia supplier of whose consolidated gross revenues... -

Page 103

... a company Code of Conduct which is equally applicable to all of our employees, directors and management and is accessible at our website, www.nokia.com. As well, we have a Code of Ethics for the Principal Executive Officers and the Senior Financial Officers. For more information about our Code of... -

Page 104

... is granted through an authorization to the Board of Directors, not earlier than one year in advance of the delivery of the shares. The NYSE listing standards require that equity compensation plans be approved by a company's shareholders. Nokia's corporate governance practices also comply with the... -

Page 105

... activity and geographical location as follows: 2005 2004 2003 Mobile Phones ...Multimedia(2) ...Enterprise Solutions(2) ...Networks ...Customer and Market Operations(3) Technology Platforms(3) ...Nokia Ventures Organization(4) ...Common Group Functions ...Finland ...Other European countries Middle... -

Page 106

... long-term equity incentives of the members of our Group Executive Board, in relation to the company's outstanding share capital and total voting rights as of December 31, 2005. Group Executive Board, ownership of shares and equity-based incentives, December 31, 2005 Stock Options Performance Shares... -

Page 107

... Total ...(1) The number of shares includes not only shares acquired as compensation for services rendered as a member of the Board of Directors, but also shares acquired by any other means. For Mr. Ollila's holdings of long-term equity-based incentives, see ''Stock option ownership of the Group... -

Page 108

... of our stock option plans, including information regarding the expiration date of the options under these plans, please see the table ''Outstanding stock option plans of the Group, December 31, 2005'' in Note 24 to the consolidated financial statements in Item 18 of this annual report on Form 20... -

Page 109

...the Group Executive Board, December 31, 2005 Total realisable value of Stock Options, December 31, 2005 Number of Stock Options(1) EUR(2) Exercisable Unexercisable Exercisable(3) Unexercisable Stock Option category Exercise price per share EUR Jorma Ollila 2001 2001 2002 2003 2004 2005 2001 2001... -

Page 110

...249 290 Number of stock options equals the number of underlying shares represented by the option entitlement. The realizable value of the stock options is based on the difference between the exercise price of the options and the closing market price of Nokia shares on the Helsinki Stock Exchange as... -

Page 111

... 17 13 Number equals the number of underlying shares represented by the option entitlement. For Dr. Neuvo the realisable value of the stock options is based on the difference between the exercise price of the options and the closing market price of Nokia shares on the Helsinki Stock Exchange as of... -

Page 112

... our executive officers participate, please see Note 24 ''Share-based payment'' to the consolidated financial statements in Item 18 of this annual report on Form 20-F. Performance Shares Plan name(1) Performance Shares at Threshold(2) number Performance Shares at Maximum(2) number Value December... -

Page 113

... Date for the 2004 plan is October 1, 2007, and for the 2005 plan October 1, 2008. Value is based on the closing market price of the Nokia share on the Helsinki Stock Exchange as of December 30, 2005 of EUR 15.45. ¨ resigned as member of the Group Executive Board as of October 1, 2005, and Pekka... -

Page 114

... results. In addition, Nokia may set trading restrictions based on participation in projects. We update our insider trading policy from time to time and monitor our insiders' compliance with the policy on a regular basis. Nokia's Insider Policy is in line with the Helsinki Stock Exchange Guidelines... -

Page 115

...Nokia by any director, executive officer or 5% shareholder. There are no material transactions with enterprises controlling, controlled by or under common control with Nokia or associates of Nokia. See Note 34 to our consolidated financial statements included in Item 18 of this annual report on Form... -

Page 116

... and Turkish Savings and Deposit Insurance Fund (TMSF), which currently controls and manages Telsim's assets. In December 2005, the Turkish government completed an auction of Telsim's assets to Vodafone. Nokia's settlement payment will be 7.5% of the purchase price, which is expected to be received... -

Page 117

...certain technology. The license provided for a fixed royalty payment through 2001 and most favored licensee treatment from 2002 through 2006. The patents being licensed were subject to litigation by other manufacturers. In March 2003, IDT settled patent litigation with Ericsson and Sony-Ericsson and... -

Page 118

... and results of operations. ITEM 9. THE OFFER AND LISTING 9.A Offer and Listing Details Our capital consists of shares traded on the Helsinki Stock Exchange under the symbol ''NOK1V.'' American Depositary Shares, or ADSs, each representing one of our shares are traded on the New York Stock Exchange... -

Page 119

... Not applicable. 9.C Markets The principal trading markets for the shares are the New York Stock Exchange, in the form of ADSs, and the Helsinki Stock Exchange, in the form of shares. In addition, the shares are listed on the Frankfurt and Stockholm stock exchanges. 9.D Selling Shareholders Not... -

Page 120

... the manufacture and marketing of telecommunications systems and equipment, mobile phones, consumer electronics and industrial electronic products. We also may engage in other industrial and commercial operations, as well as securities trading and other investment activities. Director's Voting... -

Page 121

... bonds issued by the company if so requested by the holder. Under the Finnish Securities Market Act of 1989, as amended, a shareholder whose holding exceeds two-thirds of the total voting rights in a company shall, within one month, offer to purchase the remaining shares of the company, as well as... -

Page 122

...of the current income tax convention between the United States and Finland, signed September 21, 1989, referred to as the Treaty, and that are entitled to the benefits of the Treaty under the ''Limitation on Benefits'' provisions contained in the Treaty, are referred to as ''US Holders.'' Beneficial... -

Page 123

... by the US Holder (in the case of shares), regardless of whether the payment is in fact converted into US dollars. Generally, any gain or loss resulting from currency exchange rate fluctuations during the period between the time such payment is received and the date the dividend payment is converted... -

Page 124

...(if applicable) and address in the country of residence. US and Finnish Tax on Sale or Other Disposition A US Holder generally will recognize taxable capital gain or loss on the sale or other disposition of ADSs in an amount equal to the difference between the US dollar value of the amount realized... -

Page 125

... on stock exchange transfers. Otherwise, the transfer tax would be payable at the rate of 1.6% of the transfer value of the security traded. Finnish Inheritance and Gift Taxes A transfer of an underlying share by gift or by reason of the death of a US Holder and the transfer of an ADS are not... -

Page 126

... of non-US status (generally on IRS Form W-8BEN) in connection with payments received in the United States or through certain US-related financial intermediaries. Backup withholding is not an additional tax. Amounts withheld as backup withholding may be credited against a Holder's US federal income... -

Page 127

... in its Treasury activities. Business Groups have detailed Standard Operating Procedures supplementing the Treasury Policy in financial risk management related issues. Market risk Foreign exchange risk Nokia operates globally and is thus exposed to foreign exchange risk arising from various currency... -

Page 128

... in the Group consolidation. Nokia uses, from time to time, foreign exchange contracts and foreign currency denominated loans to hedge its equity exposure arising from foreign net investments. Interest rate risk The Group is exposed to interest rate risk either through market value fluctuations of... -

Page 129

... to the listed equity holdings, Nokia invests in private equity through Nokia Venture Funds. The fair value of these available-for-sale equity investments at December 31, 2005 was USD 177 million (USD 142 million in 2004). Nokia is exposed to equity price risk on social security costs relating to... -

Page 130

... 303A.02 of the New York Stock Exchange's Listed Company Manual. ITEM 16B. CODE OF ETHICS We have adopted a code of ethics that applies to our Chief Executive Officer, President, Chief Financial Officer and Corporate Controller. This code of ethics is posted on our website, www.nokia.com, and may be... -

Page 131

... standards; internal control matters and services in anticipation of the company's compliance with Section 404 of the Sarbanes-Oxley Act of 2002; advice and assistance in connection with local statutory accounting requirements; due diligence related to acquisitions; employee benefit plan audits and... -

Page 132

the Policy set out the audit, audit-related, including internal control, tax and other services that have received the general pre-approval of the Audit Committee, which services are subject to annual review by the Audit Committee. All other audit, audit-related, including internal control, tax and ... -

Page 133

... Nokia shares by Nokia Corporation and its affiliates during 2005. (c) Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (d) Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs Period (a) Total Number of Shares Purchased (b) Average Price... -

Page 134

... Articles of Association of Nokia Corporation. Form of Executive Contract. See Note 31 to our consolidated financial statements included in Item 18 of this annual report on Form 20-F for information on how earnings per share information was calculated. List of significant subsidiaries. Certification... -

Page 135

... of exchanges and the basic transmission equipment that together form the basis for network services. Digital: A signaling technique in which a signal is encoded into digits for transmission. Dual Transfer Mode (DTM): A transfer mode in which a mobile station is simultaneously in dedicated mode and... -

Page 136

... product. Firewall Gateways: Network points that act as an entrance to another network. GPRS (General Packet Radio Services): for second generation GSM networks. A service that provides packet switched data, primarily GSM (Global System for Mobile Communications): A digital system for mobile... -

Page 137

... radio access technologies. NFC (Near Field Communication): A technology that enables users to exchange information between devices located near to each other. OMA (Open Mobile Alliance): An organization that acts as a mobile industry standards forum aiming at interoperable mobile services across... -

Page 138

... of conveying signals from one point to one or more other points. VAR (Value Added Reseller): A reseller that adds something to a product, thus creating a complete customer solution which it then sells under its own name. VoIP (Voice over Internet Protocol): Use of the Internet protocol to carry and... -

Page 139

...2005 and 2004, and the related consolidated statements of profit and loss, changes in shareholders' equity and cash flows for each of the three years in the period ended December 31, 2005. These financial statements are the responsibility of the Company's management. Our responsibility is to express... -

Page 140

... and Subsidiaries Consolidated Profit and Loss Accounts Financial year ended December 31 2005 2004 2003 As revised As revised EURm EURm EURm Notes Net sales ...Cost of sales ...Gross profit ...Research and development expenses ...Selling and marketing expenses Administrative and general expenses... -

Page 141

... 2004 As revised EURm EURm Notes ASSETS Non-current assets Capitalized development costs ...Goodwill ...Other intangible assets ...Property, plant and equipment ...Investments in associated companies . Available-for-sale investments ...Deferred tax assets ...Long-term loans receivable ...Other non... -

Page 142

... Acquisition of Group companies ...Purchase of current available-for-sale investments, liquid assets ...Purchase of non-current available-for-sale investments . . Purchase of shares in associated companies ...Additions to capitalized development costs ...Long-term loans made to customers ...Proceeds... -

Page 143

... and Subsidiaries Consolidated Cash Flow Statements (Continued) Financial year ended December 31 2004 2003 2005 As revised As revised EURm EURm EURm Notes Cash flow from financing activities Proceeds from stock option exercises ...Purchase of treasury shares ...Proceeds from long-term borrowings... -

Page 144

Nokia Corporation and Subsidiaries Consolidated Statements of Changes in Shareholders' Equity Fair value Share and Before Number of Share issue Treasury Translation other Retained minority Minority shares capital premium shares differences reserves earnings interests interests (000's) Group, EURm ... -

Page 145

... compensation is shown net of deferred compensation recorded related to social security costs on share-based payments. Dividends declared per share were EUR 0.37 for 2005 (EUR 0.33 for 2004 and EUR 0.30 for 2003), subject to shareholders' approval. See Notes to Consolidated Financial Statements... -

Page 146

... Consolidated Financial Statements 1. Accounting principles Basis of presentation The consolidated financial statements of Nokia Corporation (''Nokia'' or ''the Group''), a Finnish limited liability company with domicile in Helsinki, are prepared in accordance with International Financial Reporting... -

Page 147

... over which it has control of their operating and financial policies. The Group's share of profits and losses of associated companies (generally 20% to 50% voting rights or over which the Group has significant influence) is included in the consolidated profit and loss account in accordance with the... -

Page 148

.... Differences resulting from the translation of profit and loss account items at the average rate and the balance sheet items at the closing rate are treated as an adjustment affecting consolidated shareholders' equity. On the disposal of all or part of a foreign Group company by sale, liquidation... -

Page 149

... in the time value for options, or options strategies, are recognized within other operating income or expenses. Accumulated fair value changes from qualifying hedges are released from shareholders' equity into the profit and loss account as adjustments to sales and cost of sales, in the period... -

Page 150

... equity. Accumulated fair value changes from qualifying hedges are released from shareholders' equity into the profit and loss account only if the legal entity in the given country is sold, liquidated, repays its share capital or is abandoned. Revenue recognition Sales from the majority of the Group... -

Page 151

... based upon relative fair values. All the Group's material revenue streams are recorded according to the above policies. Shipping and handling costs The costs of shipping and distributing products are included in cost of sales. Research and development Research and development costs are expensed as... -

Page 152

... profit/loss. Leases The Group has entered into various operating leases, the payments under which are treated as rentals and charged to the profit and loss account on a straight-line basis over the lease terms. Inventories Inventories are stated at the lower of cost or net realizable value. Cost... -

Page 153

... cash flows. Interest income on loans to customers is accrued monthly on the principal outstanding at the market rate on the date of financing and is included in other operating income. Income taxes Current taxes are based on the results of the Group companies and are calculated according to local... -

Page 154

... profit and loss account over the service period. When stock options are exercised, the proceeds received net of any transaction costs are credited to share capital (nominal value) and share premium. Dividends Dividends proposed by the Board of Directors are not recorded in the financial statements... -

Page 155

... early stage of a long-term project, new technology, changes in the project scope, changes in costs, changes in timing, changes in customers' plans, realization of penalties, and other corresponding factors. Customer financing The Group has provided a limited amount of customer financing and agreed... -

Page 156

... future economic benefits and certain criteria, including commercial and technical feasibility, have been met. Should a product fail to substantiate its estimated feasibility or life cycle, material development costs may be required to be written off in future periods. Valuation of long-lived and... -

Page 157

... in equity securities which are subject to equity market volatility. Changes in assumptions may materially affect the pension obligation and future expense. Share-based compensation The Group has various types of equity settled share-based compensation schemes for employees. Fair value of stock... -

Page 158

... primary business segments: Mobile Phones; Multimedia; Enterprise Solutions; and Networks. Nokia's reportable segments represent the strategic business units that offer different products and services for which monthly financial information is provided to the Board. Mobile Phones connects people by... -

Page 159

... customer represents 10% or more of Group revenues. Total Common Mobile Enterprise reportable Group Phones Multimedia Solutions Networks segments Functions Eliminations Group EURm EURm EURm EURm EURm EURm EURm EURm 2005 Profit and Loss Information Net sales to external customers ...20,811 Net sales... -

Page 160

...Consolidated Financial Statements (Continued) 3. Segment information (Continued) Total Common Mobile Enterprise reportable Group Phones Multimedia Solutions Networks segments Functions Eliminations Group EURm EURm EURm EURm EURm EURm EURm EURm 2004, As revised Profit and Loss Information Net sales... -

Page 161

...Consolidated Financial Statements (Continued) 3. Segment information (Continued) Total Common Mobile Enterprise reportable Group Phones Multimedia Solutions Networks segments Functions Eliminations Group EURm EURm EURm EURm EURm EURm EURm EURm 2003, As revised Profit and Loss Information Net sales... -

Page 162

Notes to the Consolidated Financial Statements (Continued) 3. Segment information (Continued) 2005 EURm 2004 As revised EURm 2003 As revised EURm Net sales to external customers by geographic area by location of customer Finland ...China ...USA ...Great Britain ...India ...Germany ...Other ... ...... -

Page 163

... profit and loss account ... Share based compensation expense includes pension and other social costs of EUR 9 million in 2005 (EUR 2 million in 2004 and EUR 0 million in 2003) based upon the related employee benefit charge recognized during the year. The net of tax share-based compensation expense... -

Page 164

.... The amounts recognized in the profit and loss account are as follows: 2005 EURm 2004 EURm 2003 EURm Current service cost ...Interest cost ...Expected return on plan assets ...Net actuarial losses recognized in year Past service cost gain (-) loss (+) ...Transfer from central pool ...Curtailment... -

Page 165

... to the Consolidated Financial Statements (Continued) 6. Pensions (Continued) Movements in prepaid pension costs recognized in the balance sheet are as follows: 2005 EURm 2004 EURm Prepaid pension costs at beginning of year ...Net income (expense) recognized in the profit and loss Contributions... -

Page 166

... personnel expenses and other costs in connection with the restructuring taken in light of general downturn in market conditions, of which EUR 15 million was paid during 2003. 9. Impairment Mobile Phones EURm Enterprise Solutions EURm Common Group Functions EURm 2005 Multimedia EURm Networks EURm... -

Page 167

...the Amber platform technology, using a discount rate of 15%. The impairment was a result of significant declines in the market outlook for products under development. During 2005 the Group's investment in certain equity securities suffered a permanent decline in fair value resulting in an impairment... -

Page 168

Notes to the Consolidated Financial Statements (Continued) 12. Financial income and expenses 2005 EURm 2004 EURm 2003 EURm Income from available-for-sale investments Dividend income ...Interest income ...Other financial income ...Foreign exchange gains and losses ...Interest expense ...Other ... -

Page 169

...million. In 2005, there was no impact on the Profit and loss account through a change in deferred tax. Income taxes include a tax benefit from a tax refund from previous years of EUR 48 million in 2005. Certain of the Group companies' income tax returns for periods ranging from 1998 through 2004 are... -

Page 170

Notes to the Consolidated Financial Statements (Continued) 14. Intangible assets 2005 EURm 2004 EURm Capitalized development costs Acquisition cost January 1 ...Translation differences... 31 ...Net book value January 1 ...Net book value December 31 ...Goodwill Acquisition cost January 1 ...Transfer... -

Page 171

... Consolidated Financial Statements (Continued) 14. Intangible assets (Continued) 2005 EURm 2004 EURm Other intangible assets Acquisition cost January...book value January 1 ...Net book value December 31 ...15. Property, plant and equipment 2005 EURm 2004 EURm Land and water areas Acquisition cost... -

Page 172

Notes to the Consolidated Financial Statements (Continued) 15. Property, plant and equipment (Continued) 2005 EURm 2004 EURm Machinery and equipment Acquisition cost January 1 . . Translation differences ...Additions during the period . Disposals during the period . ... ... ... ... ... ... ... ... -

Page 173

... was EUR 165 million in 2005 and EUR 115 million in 2004. Fair value for equity investments traded in active markets is determined by using exchange quoted bid prices. For other investments, fair value is estimated by using the current market value of similar instruments or by reference to the F-35 -

Page 174

... part of the available-for-sale investments portfolio is classified as non-current. See Note 38 for details of these investments. 18. Long-term loans receivable Long-term loans receivable, consisting of loans made to suppliers and to customers principally to support their financing of network... -

Page 175

...to the Consolidated Financial Statements (Continued) 21. Valuation and qualifying accounts Balance at beginning of year EURm Charged to cost and expenses EURm Balance at end of year EURm Allowances on assets to which they apply: Deductions EURm (1) 2005 Allowance for doubtful accounts ...Excess... -

Page 176

Notes to the Consolidated Financial Statements (Continued) 22. Fair value and other reserves Hedging reserve EURm Gross Tax Net Balance at December 31, 2002, As revised ...Cash flow hedges (Revised): Fair value gains/(losses) in period ...Available-for-sale Investments: Net fair value gains/(losses... -

Page 177

... by the Group companies with an aggregate par value of EUR 15,690,676.98 representing approximately 5.9% of the share capital and the total voting rights. Authorizations Authorization to increase the share capital The Board of Directors had been authorized by Nokia shareholders at the Annual General... -

Page 178

... to the Consolidated Financial Statements (Continued) 23. The shares of the Parent Company (Continued) one year from the resolution of the Annual General Meeting. The increase of the share capital may consist of one or more issues offering a maximum of 886,000,000 new shares with a par value of EUR... -

Page 179

... plans currently include the so called ''Global plans'' launched in 2001, 2003 and 2005. These plans have been approved by the Annual General Meeting in the year of the launch of the plan. Under these plans, each stock option entitles the holder to subscribe for one new Nokia share with a par value... -

Page 180

Notes to the Consolidated Financial Statements (Continued) 24. Share-based payment (Continued) Outstanding stock option plans of the Group, December 31, 2005 Vesting status (as percentage of total number of stock options outstanding) 100.00 100.00 93.75 87.50 75.00 68.75 81.25 56.25 50.00 43.75 31.... -

Page 181

Notes to the Consolidated Financial Statements (Continued) 24. Share-based payment (Continued) Total stock options outstanding Number of shares Weighted average exercise price EUR Weighted average share price EUR Aggregate intrinsic value EURm Shares under option at December 31, 2002 . Granted(1) ... -

Page 182

... using the Company's newly issued shares or disposal of existing treasury shares. The Group may also settle the plans using shares purchased on the open market or in lieu of shares cash settlement. The Group introduced performance shares in 2004 as the main element to broad-based equity compensation... -

Page 183

... the four year performance period. Any settlement made after the Interim Measurement Period, will be deducted from the final settlement after the full Performance Period. The following tables give certain information about our 2004 and 2005 performance share plans. Total Plan Size Number of Interim... -

Page 184

... the Board of Directors. A valid authorization from the Annual General Meeting is required when the plans are settled using the Company's newly issued shares or disposal of existing own shares. The Group may also settle the plans using shares purchased on the open market. The number of participants... -

Page 185

Notes to the Consolidated Financial Statements (Continued) 24. Share-based payment (Continued) No Restricted Shares vested during the year. Other equity plans for employees The Group also sponsors other immaterial equity plans for employees. Total compensation cost related to unvested awards As of ... -

Page 186

... to the Consolidated Financial Statements (Continued) 26. Long-term liabilities Long-term loans are repayable as follows: Outstanding December 31, 2005 EURm Repayment date beyond 5 years EURm Outstanding December 31, 2004 EURm Long-term interest-bearing liabilities ...Other long-term liabilities... -

Page 187

Notes to the Consolidated Financial Statements (Continued) 27. Deferred taxes 2005 EURm 2004 EURm Deferred tax assets: Intercompany profit in inventory Tax losses carried forward ...Warranty provision ...Other provisions ...Fair value gains/losses ...Untaxed reserves ...Other temporary differences... -

Page 188

... Final resolution of IPR claims generally occurs over several periods. This results in varying usage of the provision year to year. Other provisions include provisions for non-cancelable purchase commitments, provision for pension and other social costs on share-based awards and provision for losses... -

Page 189

... the Consolidated Financial Statements (Continued) 31. Earnings per share 2005 2004 As revised 2003 As revised Numerator/EURm Basic/Diluted: Profit attributable to equity holders of the parent ...Denominator/1000 shares Basic: Weighted average shares ...Effect of dilutive securities: stock options... -

Page 190

... infrastructure equipment and services and to fund working capital. The Group has been named as defendant along with certain of its senior executives in a class action complaint in the United States relating to certain public statements about its product portfolio and related financial projections... -

Page 191

Notes to the Consolidated Financial Statements (Continued) 34. Related party transactions Nokia Pension Foundation is a separate legal entity that manages and holds in trust the assets for the Group's Finnish employee benefit plans; these assets include 0.009% of Nokia shares. At December 31, 2005,... -

Page 192

... to the members of our Board of Directors, as resolved by the Annual General Meetings in the respective years. Since the fiscal year 1999, approximately 60% of each Board member's annual fee has been paid in cash, with the balance in Nokia Corporation shares acquired from the market. Chairman Gross... -

Page 193

Notes to the Consolidated Financial Statements (Continued) 34. Related party transactions (Continued) The following table depicts the total annual remuneration paid to the members of our Board of Directors, as resolved by the Annual General Meetings in the respective years. Gross annual fee* 2005 ... -

Page 194

... number of shares received as part of gross annual fee for that year is presented in the ''Shares received'' column on the table on page F-54. (6) (7) * Retirement benefits of certain Group Executive Board Members Jorma Ollila and Olli-Pekka Kallasvuo can as part of their service contract retire... -

Page 195

...interest-free short-term borrowings ...Change in net working capital ...Non-cash investing activities Acquisition of: Current available-for-sale investments in settlement of customer loan ...Company acquisitions ...Total ...36. Subsequent events (unaudited) Changes in the Nokia Group Executive Board... -

Page 196

...Savings and Deposit Insurance Fund (TMSF), which currently controls and manages Telsim's assets, the Group will receive a settlement payment upon completion of the sale of Telsim's assets for losses the Group incurred in 2001. The Group's share of the announced purchase price expected to be received... -

Page 197

... in close co-operation with the business groups. There is a strong focus in Nokia on creating shareholder value. The Treasury function supports this aim by minimizing the adverse effects caused by fluctuations in the financial markets on the profitability of the underlying businesses and by managing... -

Page 198

... Consolidated Financial Statements (Continued) 38. Risk management (Continued) Nokia has Treasury Centers in Geneva, Singapore/Beijing and New York/Sao Paolo, and a Corporate Treasury unit in Espoo. This international organization enables Nokia to provide the Group companies with financial services... -

Page 199

... to the listed equity holdings, Nokia invests in private equity through Nokia Venture Funds. The fair value of these available-for-sale equity investments at December 31, 2005 was USD 177 million (USD 142 million in 2004). Nokia is exposed to equity price risk on social security costs relating to... -

Page 200

...in the Company's credit policy and according to the credit approval process. The Credit Committee consists of the CFO, Group Controller, Head of Group Treasury and Head of Nokia Customer Finance. At the end of December 31, 2005, our long-term loans to customers and other third parties totaled EUR 63... -

Page 201

... to the Consolidated Financial Statements (Continued) 38. Risk management (Continued) Current Available-for-sale investments(1)(2)(3) Maturity date Maturity date less than 12 months 12 months or more Fair Unrealized Unrealized Fair Unrealized Unrealized Value Losses Gains Value Losses Gains Total... -

Page 202

... Consolidated Financial Statements (Continued) 38. Risk management (Continued) Euro Commercial Paper (ECP) program, totaling USD 500 million US Commercial Paper (USCP) program, totaling USD 500 million None of the above programs have been used to a significant degree in 2005. Nokia's international... -

Page 203

... to the Consolidated Financial Statements (Continued) 38. Risk management (Continued) Fair values of derivatives The net fair values of derivative financial instruments at the balance sheet date were: 2005 EURm 2004 EURm Derivatives with positive fair value(1): Forward foreign exchange contracts... -

Page 204

...profit attributable to equity holders of the parent under IFRS to net income under US GAAP: Profit attributable to equity holders of the parent reported under IFRS ...US GAAP adjustments: Pension expense ...Development costs ...Social security cost on share-based payments ...Share-based compensation... -

Page 205

...4 million in 2003) Net unrealized (losses) gains on securities: Net unrealized holding (losses) gains during the year, net of tax of EUR 6 million in 2005 (EUR ‫מ‬2 million in 2004 and EUR ‫מ‬11 million in 2003) ...Transfer to profit and loss account on impairment ...Less: Reclassification... -

Page 206

... to the Company's equity holders under IFRS . US GAAP adjustments: Pension expense ...Additional minimum liability ...Development costs ...Marketable securities and unlisted investments ...Social security cost on share-based payments ...Deferred compensation ...Share issue premium ...Share-based... -

Page 207

...'s net selling price and value in use. Value in use is the present value of estimated discounted future cash flows expected to arise from the continuing use of an asset and from its disposal at the end of its useful life. Under US GAAP, the unamortized capitalized costs of a software product are... -

Page 208

... are recognized within shareholders' equity until realized in the profit and loss account upon sale or disposal. Under US GAAP, the Group's listed marketable securities are classified as available-for-sale and carried at aggregate fair value with gross unrealized holding gains and losses reported as... -

Page 209

... Consolidated Financial Statements (Continued) 39. Differences between International Financial Reporting Standards and US Generally Accepted Accounting Principles (Continued) performance shares was recorded as deferred compensation within shareholders' equity and recognized in the profit and loss... -

Page 210

... or, if the number of shares is uncertain on such date, the first day on which both the number of acquirer shares and the amount of other consideration becomes fixed. The average share price for a reasonable period before and after the measurement date is then used to value the shares. The US GAAP... -

Page 211

Notes to the Consolidated Financial Statements (Continued) 39. Differences between International Financial Reporting Standards and US Generally Accepted Accounting Principles (Continued) expense under US GAAP of other intangible assets as of December 31, 2005, is expected to be as follows: EURm ... -

Page 212

...between International Financial Reporting Standards and US Generally Accepted Accounting Principles (Continued) The Group recorded no goodwill impairments during 2005 and 2004. Below is a roll forward of US GAAP goodwill during 2005 and 2004: Mobile Phones EURm Enterprise Solutions EURm Common Group... -

Page 213

... events could delay our successful delivery of products and solutions that meet our and our customers' quality, safety, security and other requirements, or otherwise adversely affect our sales and our results of operations. Segment information The accounting policies of the segments are the same as... -

Page 214

... property, plant and equipment. Compensation expense The following table illustrates the effect on net income and earnings per share under US GAAP if the Group had applied the fair value recognition provisions of Statement 123 to options granted under the company's stock option plans for 2004... -

Page 215

Notes to the Consolidated Financial Statements (Continued) 39. Differences between International Financial Reporting Standards and US Generally Accepted Accounting Principles (Continued) disclosure, the value of the options is estimated using a Black-Scholes option-pricing formula and amortized to ... -

Page 216

... 2004 EURm Current assets: Intercompany profit in inventory Warranty provision ...Other provisions ...Tax losses carried forward ...Other ...Non-current assets: Tax losses carried forward . . Warranty provision ...Other provisions ...Untaxed reserves ...Fair value gains/losses ...Other temporary... -

Page 217

...the Consolidated Financial Statements (Continued) 39. Differences between International Financial Reporting Standards and US Generally Accepted Accounting Principles (Continued) Pension expense For its single-employer defined benefit pension schemes, net periodic pension cost included in the Group... -

Page 218

... and US Generally Accepted Accounting Principles (Continued) The following table sets forth the changes in the benefit obligation and fair value of plan assets during the year and the funded status of the significant defined benefit pension plans showing the amounts that are recognized in the Group... -

Page 219

... International Financial Reporting Standards and US Generally Accepted Accounting Principles (Continued) 2005 Domestic Foreign plans plans EURm 2004 Domestic Foreign plans plans EURm Amounts recognized in the statement of financial positions consist of: Prepaid benefit cost ...Accrued benefit... -

Page 220

Notes to the Consolidated Financial Statements (Continued) 39. Differences between International Financial Reporting Standards and US Generally Accepted Accounting Principles (Continued) The Group's pension plan weighted average asset allocation as a percentage of Plan Assets at December 31, 2005, ... -

Page 221

Notes to the Consolidated Financial Statements (Continued) 39. Differences between International Financial Reporting Standards and US Generally Accepted Accounting Principles (Continued) Estimated future benefits payments, which reflect expected future service, as appropriate, are expected to be ... -

Page 222

... or the date that the EU-member country adopts a law to implement the Directive. The Group has adopted FSP 143-1 and the statement did not have a material impact on the Group's financial statements. New accounting pronouncements under US GAAP In November 2005, The FASB issued Staff Position No. (FSP... -

Page 223

(This page has been left blank intentionally.) -

Page 224

(This page has been left blank intentionally.) -

Page 225

(This page has been left blank intentionally.) -

Page 226

... the undersigned to sign this annual report on its behalf. NOKIA CORPORATION By: /s/ MAIJA TORKKO Name: Maija Torkko Title: Senior Vice President, Corporate Controller Ëš HLBERG /s/ KAARINA STA By: Ëš Name: Kaarina Stahlberg Title: Vice President, Assistant General Counsel March 2, 2006 -

Page 227

Copyright © 2006. Nokia Corporation. All rights reserved. Nokia and Nokia Connecting People are registered trademarks of Nokia Corporation.