MoneyGram 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

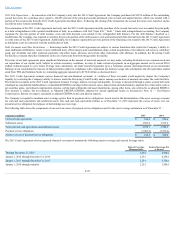

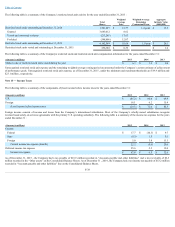

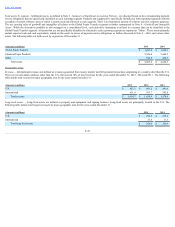

The following table is a summary of the significant amounts reclassified out of each component of "Accumulated other comprehensive loss" during the years

ended December 31 :

(Amounts in millions) 2015

2014

2013 Statement of Operations Location

Change in unrealized gains on securities classified as available-for-

sale, before tax $ (1.4)

$ (5.7)

$ (5.7) "Investment revenue"

Tax (benefit) expense, net —

(0.2)

1.6

Total, net of tax $ (1.4)

$ (5.9)

$ (4.1)

Pension and Postretirement Benefits adjustments:

Amortization of prior service credits $ (0.6)

$ (0.6)

$ (0.6) "Compensation and benefits"

Amortization of net actuarial losses 8.7

7.2

8.1 "Compensation and benefits"

Settlement charges 14.0

—

— "Compensation and benefits"

Total before tax 22.1

6.6

7.5

Tax benefit, net (8.2)

(2.5)

(2.7)

Total, net of tax $ 13.9

$ 4.1

$ 4.8

Total reclassified for the period, net of tax $ 12.5

$ (1.8)

$ 0.7

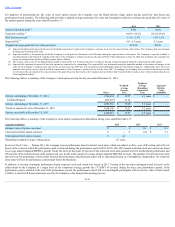

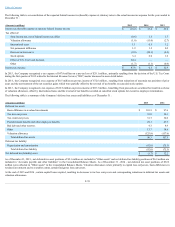

Note 12 — Stock-Based Compensation

The MoneyGram International, Inc. 2005 Omnibus Incentive Plan (“2005 Plan”) provides for the granting of equity-based compensation awards, including stock

options, stock appreciation rights, restricted stock units and restricted stock awards (collectively, “share-based awards”) to officers, employees and directors. In

May 2015, the Company's stockholders approved an amendment and restatement of the 2005 Plan increasing the aggregate number of shares that may be issued

from 12,925,000 to 15,425,000 shares. As of December 31, 2015 , the Company has remaining authorization to issue future grants of up to 7,373,664 shares.

The calculated fair value of share-based awards is recognized as compensation cost using the straight-line method over the vesting or service period in the

Company’s financial statements. Stock-based compensation is recognized only for those options, restricted stock units and stock appreciation rights expected to

vest, with forfeitures estimated at the date of grant and evaluated and adjusted periodically to reflect the Company’s historical experience and future expectations.

Any change in the forfeiture assumption will be accounted for as a change in estimate, with the cumulative effect of the change on periods previously reported

being reflected in the financial statements of the period in which the change is made.

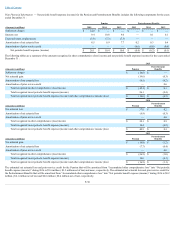

The following table is a summary of stock-based compensation expense for the years ended December 31 :

(Amounts in millions) 2015

2014

2013

Expense recognized related to stock options $ 4.6

$ 6.2

$ 6.7

Expense recognized related to restricted stock units 15.0

(0.8)

4.5

Stock-based compensation expense $ 19.6

$ 5.4

$ 11.2

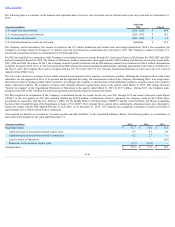

StockOptions —Option awards are granted with an exercise price equal to the closing market price of the Company’s common stock on the date of grant. All

outstanding stock options contain certain forfeiture and non-compete provisions.

There were no options granted in 2015 . All options granted in 2014 , 2013 and 2012 have a term of 10 years . Prior to the fourth quarter of 2011 , options issued

were either time based, vesting over a four -year period, or performance based, vesting over a five -year period. All options issued after the fourth quarter of 2011

are time-based, with options granted in the fourth quarter of 2011 through the first part of 2014 vesting over a four -year period, and the remaining options granted

in 2014 vesting over a three -year period, in an equal number of shares each year.

F-35