MoneyGram 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

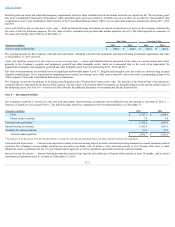

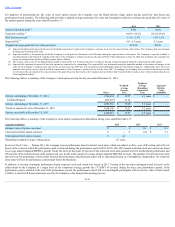

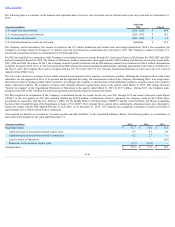

The following tables are a summary of the benefit obligation and plan assets, changes to the benefit obligation and plan assets, and the funded status of the Pension

and Postretirement Benefits as of and for the years ended December 31 :

Pension

Postretirement Benefits

(Amounts in millions) 2015

2014

2015

2014

Change in benefit obligation:

Benefit obligation at the beginning of the year $ 266.0

$ 233.6

$ 1.3

$ 1.4

Settlement impact (14.0)

—

—

—

Interest cost 9.4

10.8

—

0.1

Actuarial (gain) loss (25.9)

36.4

(0.2)

0.2

Benefits paid (32.3)

(14.8)

(0.1)

(0.4)

Benefit obligation at the end of the year $ 203.2

$ 266.0

$ 1.0

$ 1.3

Pension

Postretirement Benefits

(Amounts in millions) 2015

2014

2015

2014

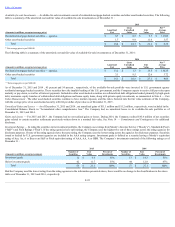

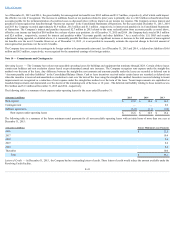

Change in plan assets:

Fair value of plan assets at the beginning of the year $ 141.6

$ 136.6

$ —

$ —

Settlement impact (14.0)

—

—

—

Actual return on plan assets (0.4)

6.9

—

—

Employer contributions 13.0

12.9

0.1

0.4

Benefits paid (32.3)

(14.8)

(0.1)

(0.4)

Fair value of plan assets at the end of the year $ 107.9

$ 141.6

$ —

$ —

Unfunded status at the end of the year $ 95.3

$ 124.4

$ 1.0

$ 1.3

The unfunded status of the Pension decreased by $29.1 million as the Pension benefit obligation decreased $62.8 million and the fair value of the Pension Plan

assets decreased $33.7 million during the year. The unfunded status of the Pension Plan was $24.6 million and $41.9 million at December 31, 2015 and 2014 ,

respectively, and the unfunded status of the SERPs was $70.7 million and $82.5 million at December 31, 2015 and 2014 , respectively.

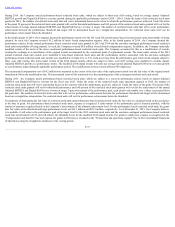

In January 2015, the Company announced a voluntary pension buyout whereby eligible deferred vested participants could elect to receive a lump-sum settlement of

their remaining pension benefit. In June 2015, the Company paid out $31.3 million of Pension Plan assets to participants electing the settlement with a

corresponding decrease in the Pension Plan liability. As a result, the Company recognized settlement charges for the Pension Plan of $14.0 million for the year

ended December 31 , 2015 . Additionally, the Company recognized a reduction in the projected benefit obligation for the Pension Plan of $51.0 million for the year

ended December 31 , 2015 due to the settlement and changes in the actuarial assumptions used to estimate the Pension Plan projected benefit obligation. Also, in

October 2015, the Society of Actuaries issued updated mortality tables. The Company adopted the updated mortality tables on its measurement date which

decreased the Pension benefit obligation.

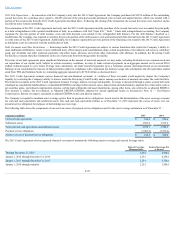

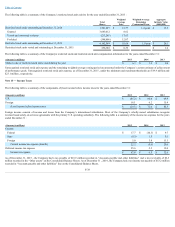

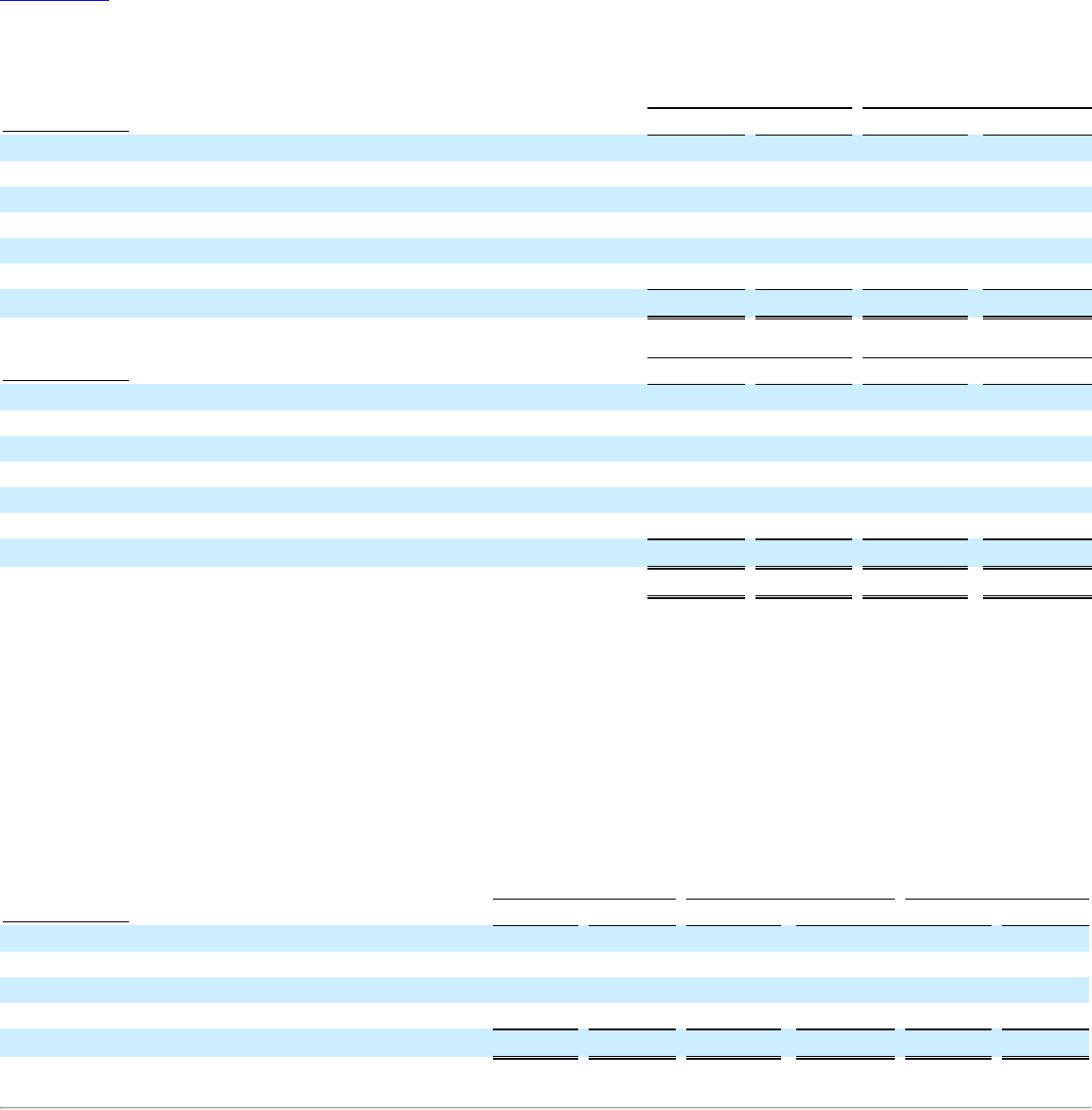

The following table summarizes the components recognized in the Consolidated Balance Sheets relating to the Pension and Postretirement Benefits as of

December 31 :

Pension

Postretirement Benefits

Total

(Amounts in millions) 2015

2014

2015

2014

2015

2014

Pension and other postretirement benefits liability $ 95.3

$ 124.4

$ 1.0

$ 1.3

$ 96.3

$ 125.7

Accumulated other comprehensive loss:

Net actuarial loss, net of tax $ 46.0

$ 72.7

$ 0.8

$ 1.1

$ 46.8

$ 73.8

Prior service cost (credit), net of tax 0.2

0.1

(0.7)

(1.0)

(0.5)

(0.9)

Total $ 46.2

$ 72.8

$ 0.1

$ 0.1

$ 46.3

$ 72.9

F-31